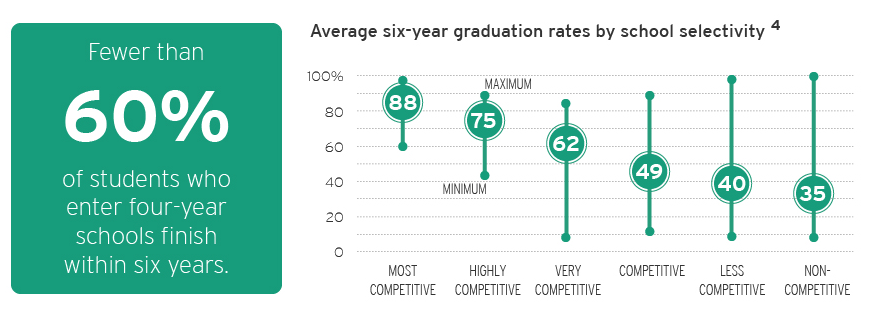

There’s no doubt that the average college graduate earns more than the average worker with only a high school diploma, but a new report shows that it may not always make financial sense to invest in a degree. [More]

student loans

Loan Co-Signers Should Not Be On The Hook With The IRS If The Debt Is Forgiven

We’ve written numerous stories over the years about parents who co-signed student loans for their children and then were stuck with the payments when their child passed away or could not find employment. Sometimes lenders will choose to forgive that debt, but even then some are making a mistake that could continue to hurt the co-signer at tax time. [More]

Report: Student Debtors Under 30 Are Shying Away From Buying Homes, Cars

If life were a 1950s sitcom, college graduates would zoom out of school, get a job, buy a house, buy a car and get married. But these days, student loans are just one of many reason debtors under 30 are staying far away from the housing and auto markets. That, and life isn’t a sitcom. A new report from the Federal Reserve Bank of New York shows that this age group could be a drag on the economy by the very fact that they aren’t participating in it. [More]

The CFPB Answers Your Student Loan Questions, Part 3: Defaulting And Loan Forgiveness

In the second set of questions and answers about student loans, the Consumer Financial Protection Bureau’s Student Loan Ombudsman Rohit Chopra made a few mentions of the various service-specific loan forgiveness programs out there. Here, he gets into more detail and responds to questions about the one topic no one ever hopes to face: default. [More]

The CFPB Answers Your Student Loan Questions, Part 2: Repaying, Consolidating, Refinancing

Earlier today, Rohit Chopra, Student Loan Ombudsman for the Consumer Financial Protection Bureau, responded to questions from readers about applying for schools and comparing financial aid packages. In this second part, he deals with the many issues involved with repaying your student loans. [More]

The CFPB Answers Your Student Loan Questions, Part 1: For Prospective Students

A little while back, we asked Consumerist readers to send in their student loan-related questions to Rohit Chopra, the Consumer Financial Protection Bureau’s Student Loan Ombudsman. Today, we’re bringing you his answers in three parts, each dealing with a different aspect of the topic. Since it’s about time for next year’s freshman class to decide on schools and financial aid packages, we’re starting with answers for prospective students. [More]

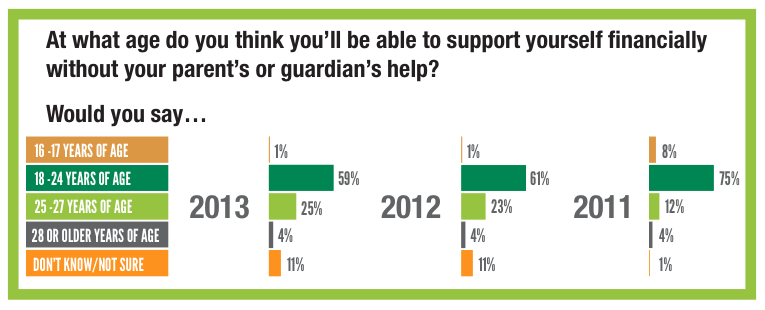

Number Of Teens Expecting To Depend On Parents Into Adulthood Has Doubled Since 2011

In what could be an indicator of either a massive drop in teens’ financial prospects or the fact that teens today are getting more realistic about their financial futures, a new survey shows that the percentage of teenagers who expect to remain dependent on mom and/or dad until at least age 27 has doubled in just the last two years. [More]

13 Attorneys General Voice Support For Federal Bill To Curb Advertising By For-Profit Schools

Earlier this week, Senators Kay Hagan (North Carolina) and Tom Harkin (Iowa) decided to take another go at introducing legislation that would seek to limit the amount of federal money for-profit schools could spend on advertising. At the same time, the Attorneys General from 13 states penned a letter to the chairs and ranking members of key Senate and House voicing their support for the bill. [More]

Send Us Your Questions For The CFPB’s Student Loan Ombudsman

In addition to the masses of consumers currently paying down their student loans, there are millions of Americans who are either about to pick a financial aid package for college or are just being hit with their first post-college loan payments. So we figured it was a good time to take some questions on the subject. [More]

Student Loan Debt Is Creating Generation Of High-Risk Borrowers With Low Credit Scores

Lots of people graduate college with minimal credit histories. Repaying student loans was always a dependable way to build that history. But recent, rampant growth in student loan debt in the U.S. could slow that process for an entire age group. [More]

Kentucky Sues For-Profit College Over Misleading Job-Placement Stats

If you’re comparing college programs and see job-placement rates of anywhere from 80% to 100%, that might sound pretty appealing. But what if the real numbers are not so rosy? [More]

Bankruptcy Finally Ends Father’s 4-Year Struggle To Repay Dead Son’s Student Loan

Back in June, we told you about the California man who had spent years trying to sort out his late son’s student loans, only to keep running into dead ends and and roadblocks. Now, after four years of struggling to figure out how much is owed and to whom, he’s finally getting some relief. [More]

Some For-Profit Colleges Taking “Unlimited Data Plan” Approach To Tuition

A number of recent studies have cast a negative light on the for-profit college industry. A disproportionate number of students are not graduating or unable to find jobs that pay enough to allow them to repay their student loans. With so many people concerned that these schools might be debt traps, some programs are taking a new approach to tuition. [More]

New Bill Would Take Income-Based Student Loan Payments Straight From Your Paycheck

Student Loan debt in the U.S. recently crossed the $1 trillion mark, with a good chunk of that owed to the U.S. government. In an attempt to streamline the whole process, a soon-to-be-introduced bill would replace the current system of debt collection with automatic payroll deductions tied to the borrower’s income. [More]

Sallie Mae The Subject Of Nearly Half Of Student Loan-Related Complaints

The recently released annual report by the Consumer Financial Protection Bureau’s Student Loan Ombudsman looks at the variety and nature of complaints filed with the CFPB’s student loan complaint portal since it launched earlier this year. Not surprisingly to many people with these loans, Sallie Mae’s name comes up in almost half the complaints. [More]

Study: Women Earning Less Than Men Immediately After Graduating College

For anyone who thinks that the pay gap between men and women is something that doesn’t begin until later in their careers, or that this salary disparity is a disappearing relic of a bygone era, a new study claims that within one year of graduating from college, women are only earning 82% of what their male counterparts are making. [More]

Report Shows That College Debt Is On The Rise Again For Recent Graduates

Today in discouraging news: the amount of college debt held by recent graduates is on the rise again. Two-thirds of the class of 2011 nationwide held debt on graduating, and on average those students had about $26,600 to take away with them along with their diplomas. However, those numbers don’t even include most graduates of for-profit colleges, who usually borrow a lot more than other students. [More]

University Of Phoenix Not Exactly Rising From Ashes, To Close 115 Locations

With enrollment and revenue declining, the University of Phoenix announced yesterday that it will close about half of its physical locations around the country in an effort to save $300 million.

The closed locations includes 90 learning centers and 25 campuses, accounting for a total of 13,000 students. This will leave 112 Phoenix locations in 36 states. [More]