Report: $32 Billion In Federal Aid Going To Students At Underperforming For-Profit Colleges

Earlier today, the Senate Committee on Health, Education, Labor, and Pensions (HELP) announced the findings of its two-year investigation into exactly where the $32 billion annual investment in federal student aid is going — and whether students are getting a return on taxpayers’ investment.

According to the report, not only does the for-profit education business rely the most on federal funding, it also has the highest percentage of students leaving with debt and the highest student loan default rates.

HELP found that only 17% of what these colleges spend actually goes to instruction, while 42% of the money goes to marketing, recruiting and profits for the companies. Not-for-profit schools pay less than 1% on average for marketing.

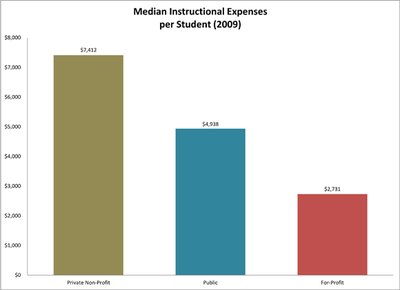

And even though an education at a for-profit college often costs twice what students would pay at a 4-year public college, public colleges spent almost double per-student on instruction. And private, non-profit colleges spent more than 2.5 times as much on average.

And even though an education at a for-profit college often costs twice what students would pay at a 4-year public college, public colleges spent almost double per-student on instruction. And private, non-profit colleges spent more than 2.5 times as much on average.

The report also accuses for-profit schools of being overzealous in its recruiting of students, effectively bullying some under- or unqualified students into enrolling.

From the report:

For the purposes of training their recruiting personnel, ITT used a “pain funnel” intended to educate recruiters how to break a potential student down by criticizing their current life situation. The most severe questions are meant to make the students feel bad about themselves: “What are you willing to change now or have you given up trying to deal with the problem?” After breaking them down, recruiters would then present an education at ITT as the solution to the “pain.”

And while these schools pumped all this time, money and effort into recruiting, on average they only had one career services staffer for every recruiter on the payroll. One of the largest for-profit operators had no career services position whatsoever.

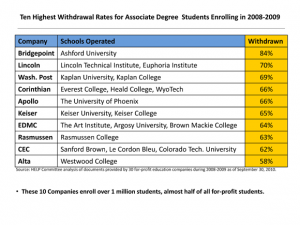

Maybe that’s because an inordinate number of students never complete the programs at for-profit colleges. The HELP report found that, on average, 54% of students who began at a for-profit institution during the 2008-2009 school year withdrew by summer 2010. Nine schools in the study had withdrawal rates of at least 60%, with the highest being 84%.

Maybe that’s because an inordinate number of students never complete the programs at for-profit colleges. The HELP report found that, on average, 54% of students who began at a for-profit institution during the 2008-2009 school year withdrew by summer 2010. Nine schools in the study had withdrawal rates of at least 60%, with the highest being 84%.

Of course, when students exit without a degree, they are still walking away with debt.

And yet, while students are being aggressively recruited to pay too much for a degree from schools that don’t support them in the classroom or in the job hunt, those same colleges are making a tidy profit. In 2009, 16 of the largest for-profit schools raked in a profit of $2.7 billion.

“For-profit colleges are taking advantage of students and taxpayers alike at a financially vulnerable time for many families,” said Pamela Banks, senior policy counsel for Consumers Union. “These institutions promote the opportunity to advance your education and career and then leave students drowning with debt without the degree or experience to become a higher earner. We need to find ways to hold these for-profit colleges accountable and make sure that these expenses aren’t charged to the taxpayer’s tab.”

Senators Kay Hagan (N.C.) and Tom Harkin (Iowa) have already introduced the Protecting Financial Aid for Students and Taxpayers Act, which would require all colleges and universities to pay for advertising, marketing and recruiting with non-taxpayer dollars.

“Schools should be focused on helping students, not their bottom line,” said Banks. “This report underscores the need for Congress to protect students and taxpayers by passing this bill.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.