USAA just pulled a huge mindf#@k on Travis and his wife, and now he wants to talk to someone high enough up the chain to find out what went wrong and how to prevent it from happening again. His wife “went online yesterday to check on some transactions and discovered her IRA balance was $0. Six hours prior to that, her balance was $14,000.” When she tried to find out what had happened, the first CSR she spoke with told her she had no IRA account, and the second CSR told her to refresh her browser. Yeah, you know how these newfangled browswers are always wiping out retirement accounts.

savings

'Rudder' Provides Your Daily Financial Status Via Email

Rudder is a new personal finance service that differs from the dozens of other ones now available in two key ways: it presents a simplified overview of your available funds, which it calls “What’s Left,” and it delivers it (along with bill reminders and balance notifications) to your email inbox instead of requiring you to visit a website. Think of it as a highly customized “Very Short List” or “Daily Candy,” only the topic is always your current financial health.

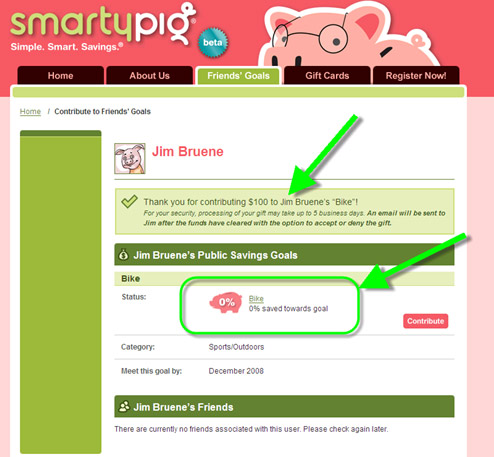

Save For Specific Goals With SmartyPig.com

“Saving up.” It’s nearly an alien concept in this “buy with debt” world, but into that breach steps SmartyPig. The site lets you set and save for specific goals in their online savings accounts at a competitive 3.9% APY savings rate. There’s all sorts of built-in graphs and widgets to track your progress, but then you can make it social, if you like, by making a page where your goals public and having friends and family or other random people on the net (export to Facebook, etc) track and root for your progress, or even contribute to your goal.

BoA's "Keep The Change" Program: Worth It?

What do you think of Bank of America’s “Keep The Change” program? How it works is every purchase you make with your BoA debit card you make gets rounded up to the next dollar. The difference between that and the actual price gets moved from your checking to your savings account. The idea is to help people save. Good idea, but there’s some potential downsides I can see:

Give The Gift Of College For Your Next Birthday Party

Thanks to state-sponsored 529 plans, friends and family can finally contribute to college savings funds without drowning under long forms and boring paperwork.

Looking For Great Deals? Try The Local Pawn Shop

Pawn shops are becoming an unlikely source of great deals thanks to the ongoing non-recession thing, according to CBS. Where else can you turn pop’s old watch into last month’s overdue rent check? We always see pawn shops as a half-step up from dumpster diving, a semi-acceptable sad-land where each abandoned item comes with a free story and a frown.

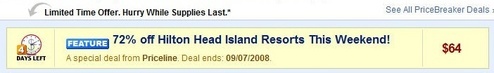

Priceline Encourages Deal-Seekers To Vacation Under Tropical Storm Hanna

Priceline won’t let deal-hating weathermen keep you from the amazing savings churned up by Tropical Storm Hanna. Rooms in Hilton Head are now going for the low, low price of $64 per night, but act fast because the deal is only valid while Hanna pummels the dream destination’s shores with 70 mph winds!

4 Unusual Ways To Save Money

BusinessWeek has put together one of those accursed slideshows of 25 ways to save money, and while a lot of them are things you’ve heard before (use credit cards wisely! buy generic or used!), there are a few less common tips that you might not have considered. Here are four that caught our attention.

Watch Out For These 5 Overdraft Traps

Banks need your money. They’re not doing too well on their own, and you’re not screwing up enough to generate the fees they need to make their shareholders happy. That’s why they’ve set up sneaky ways to maximize your every mistake—or in some cases, ways to change the rules so that you make new mistakes where you didn’t before—in order to penalize you. Here are five things SmartMoney says to watch out for.

6 Unpleasant Truths About Personal Finance

Ready for some tough love about how to improve your financial situation? Jeffrey Strain, the man behind SavingAdvice.com, has put together a list of six “awful truths” about personal finance for TheStreet.com. The reason they’re “awful,” he writes, is that “these truths mean that the each person must take more responsibility and make hard decisions that they would rather leave to others.”

Coinstar Calls Cashing In Change 'Recycling'

Douglas writes, “Coinstar wants you to ‘recycle’ your coins in their machines, and save the environment! Minus their 8.9% fee of course.” They even have a little wizard on their website that estimates how many parts of the environment—water, energy consumption, and geological waste—you save by putting those coins back into circulation, instead of hoarding them like the polar bear murderer you are. They don’t provide any source for these estimates, though, and we’re not convinced you’re doing anything “green” other than lining Coinstar’s pockets.

Walmart's "Buy 2 And Save" Old Spice Deodorant Deal Stinks

Quick, what’s 2 x 2? Did you get 4.32? No? Then you should be able resist Walmart’s “Buy 2 And Save” Old Spice “special.”

7 Ways To Save On Groceries Without Using Coupons

Are you a coupon clipper? No? Lots of people like saving money, but don’t really buy the sort of products that have coupons, or don’t have time to waste searching and clipping. These tips are for you.

3 Ways To Spend Less While Shopping

Shopping is a war and you are outgunned. Stores attack your desire for self-restraint with armies of psychologists, marketers, and “brand gurus.” Defend yourself from overspending with three easy and effective tips from Alpha Consumer…

Morning Deals

- Girl Talk: Girls Talk’s new album “Feed The Animals.” Pay what you want to pay.

- MGM Grand: $69/night + $25 Restaurant Credit

- Amazon: “The Complete Led Zeppelin” MP3 Album download for $9.99. 165 tracks.

Highlights From Dealhack

- Endless.com: Save up to 40% or More off Shoes & Handbags

- TiVo.com: New Savings: TiVo HD DVR now $180 Shipped

- Amazon: Canon SD850 IS 8MP Digital Camera $230 Shipped

Save Money by Taking a State Tax Holiday

In an effort to spur retail sales, many states offer sales-tax holidays each summer — periods of time where sales tax is temporarily suspended on certain products. This year the slumping economy has some states enhancing their efforts by extending the holiday dates and broadening the list of eligible products. Smart Money lists each state sponsoring a sales-tax holiday as well as the applicable dates and details of each offer. It also suggests a few helpful hints for making the most of a sales-tax holiday as follows:

The Basics Of Insurance, Taxes, And 401(k)s For First-Time Employees

If you’re entering the work force for the first time (although this probably pertains to lots of older employees too), all the details of insurance, taxes, and 401(k)s can be daunting/boring/confusing. Ron Lieber at the New York Times has pared away the extraneous bits and created a “primer for young people starting their first job,” including helpful advice like why it’s important to get health insurance, how to fill out your W-4, and why it’s good to take advantage of the built-in “raise” that comes from a company-matching 401(k). Sure, this is all basic stuff, but that’s the point. Ya gotta start somewhere.