In an email to customers, savings site SmartyPig announced it had cut its rate from 1.75% to 1.35% APY. Now it’s no longer the top rate for a nationally available online savings account. Sad day. [More]

smartypig

SmartyPig Slices Interest Rate To 1.75%

SmartyPig just cut the interest rate on its online savings accounts from an ahead of the pack 2.15% to 1.75%, unless you have $50,000 or more in your account. [More]

$150 Bonus For New BBVA Compass Bank Accounts

Savings site Smartypig’s banking partner BBVA Compass Bank is giving away up to $150 in bonus money if you open a new account with them. Of course, there are a few caveats to make sure you’re using the account and not just doing it for the money, like: [More]

Prepare For The Unexpected With A "Stupid Mistakes" Savings Account

One thing that can derail people digging themselves out of debt are the random unexpected setbacks life likes to throw at us to keep us on our toes. The accidental parking ticket, the bike that breaks down, the illness that requires pricey pills. Any of these can be enough to upset even the most carefully orchestrated budgeting and debt payment schedule, unless, you are smart like Ramit Sethi, and set up a “stupid mistakes” sub-savings account. Here’s how it works. [More]

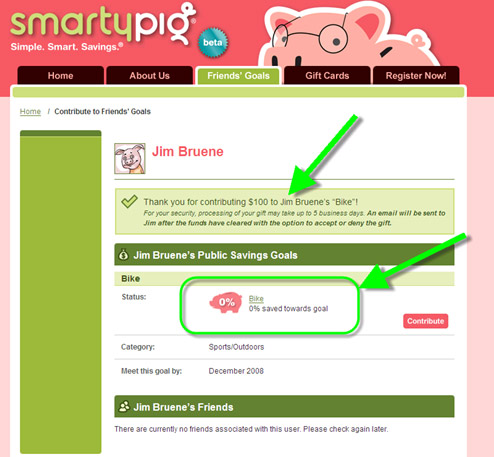

Save For Specific Goals With SmartyPig.com

“Saving up.” It’s nearly an alien concept in this “buy with debt” world, but into that breach steps SmartyPig. The site lets you set and save for specific goals in their online savings accounts at a competitive 3.9% APY savings rate. There’s all sorts of built-in graphs and widgets to track your progress, but then you can make it social, if you like, by making a page where your goals public and having friends and family or other random people on the net (export to Facebook, etc) track and root for your progress, or even contribute to your goal.