Marketplace has the answer to one of the most troubling questions of our time. Why did people who are supposed to be smart buy all this stupid toxic risky debt? Apparently, it’s because they weren’t that smart, and they didn’t understand what they were buying or selling.

mortgages

../../../..//2008/10/03/those-of-you-interested-in/

Those of you interested in watching the bailout bill debate in the House can see it streaming on CSPAN, or read a liveblog on the NYT.

Staying Out Of The Red Is The New Black

All of a sudden, everyone is interested in how their banks, credit cards, credit scores, credit reports, mortgages, and money actually work. Staying out of the red is the new black. Have you found yourself talking more about money matters and strategies with friends, family, co-workers, and even strangers?

The 10 Cities With The Most Crazy Expensive Loans

The Chicago Reporter took a look at some recently released mortgage data with an eye to how many successful refinances there were last year. In addition to concluding that people who most needed a refinance (those with crazy expensive loans) were also the least likely to get one, the Reporter also found that Chicago lead the nation in the total amount of high-cost loans for the fourth year in a row. High-cost loans are loans that are at least 3% above the U.S. Treasury standard.

10 Things To Expect From The New Post-Apocalyptic Economy

Kiplinger’s has put together a list of 10 things that you, fair consumer, can expect from our new post-wall-street-apocalypse economy. Should you be scared? Maybe.

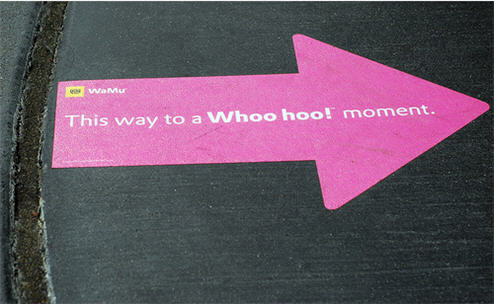

WaMu Says, "Take A Picture It Lasts Longer…"

Reader Steve says this photo was taken at the Austin City Limits Festival on the same day that WaMu was seized by federal regulators — making it not only funny, but extremely accurate.

Now That The Largest Bank Failure In U.S. History Is Over, Is Wachovia Next?

The collapse of Washington Mutual and the FDIC-engineered fire sale to JPMorgan Chase has people worried — about Wachovia. Wachovia’s stock is down 45% for the week, and 27% today as bailout talks stalled in Washington and WaMu held a garage sale at the FDIC.

WaMu Downgraded To Even Junkier Junk, Still Looking For A Life Preserver

The Wall Street Journal is reporting that WaMu is courting several private equity firms about a potential takeover after their debt was downgraded even further into junk status by Standard & Poor’s. Once merely “junk,” WaMu is apparently, “so junky we are not even kidding around about it anymore.”

../../../..//2008/09/18/were-not-the-only/

We’re not the only ones with a credit crunch. HBOS, Britain’s biggest mortgage lender, is going under.

"Crazy" Jim Cramer Takes This Opportunity To Gloat

About a year ago, CNBC’s Jim Cramer completely lost his sh*t on CNBC, screaming at Bernanke to lower interest rates before millions of borrowers went into foreclosure. Now, as the “Armageddon” that he was carrying on about is in full swing, Cramer is taking this opportunity to gloat.

Lehman Brothers Did Business With Mortgage Fraudsters Back In 2000

The Lehman Brothers collapse is shocking! Unless you remember a little story from 8 years ago…

Escape The Rat Race With A Tiny House

It’s not just supermarkets that are shrinking—you can also build yourself a 90-square-foot house to shack up in with your hunched-over spouse and children. You’ll save money! You’ll save the environment! Relatives will never expect to be given free room and board when they come to visit!

Home Mortgage Collector Confessor Responds To Your Comments

In response to some of the comments posted on 12 Confessions Of A Home Mortgage Collector, the confessor has sent in a followup letter to answer your questions, and clarify some of his statements.

12 Confessions Of A Home Mortgage Collector

A former Wells Fargo Home Mortgage home collector has stepped forth from the shadows to tell you what’s really going on. Here’s his confession:

../../../..//2008/09/10/now-that-the-magic-accounting/

Now that the magic accounting party is over, Fannie Mae and Freddie Mac are to be removed from the S&P 500 starting Wednesday. The minimum market cap a company needs to be allowed in the index is 5 billion. Freddie’s market cap is $614 million and Fannie’s $1.04 billion. [AP]

Facing Foreclosure? Buy A Second Home! Wait, What?

ABCNews says that more and more people who are facing foreclosure are just buying cheaper homes and then just walking away from their original mortgage. It only works for people who can afford the down payment on a new home and carry both mortgages until they’re in the new home, but for some people whose payments are about to balloon, it’s the most attractive option out there right now.