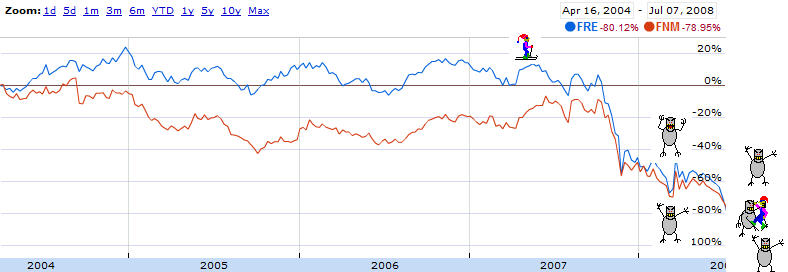

Oh dear, all that talk about Freddie and Fannie being “adequately capitalized” was utter bullshit and the government has now announced plans to place the failed government sponsored enterprises into conservatorship. That means the fate of the housing market and the global economy rest squarely on the shoulders of U.S. taxpayers.

mortgages

Help! Chase Suddenly Wants Me To Buy Tons Of Flood Insurance!

Reader Nate and his wife recently bought their dream home, which they admit is more modest than most people’s dream homes, for $60,000. During closing, they wrote in their offer “that if the home was found to be in a flood plane we withdrew our offer,” but were happy to find out that the house was, in fact, not in a flood plain. That is, until Chase, decided that their house was in a flood plain after all and is requiring $185,000 in flood insurance.

FBI Saw Mortgage Crisis Coming, Didn't Stop It

The LA Times says that FBI agents told reporters that low interest rates and “soaring home values, [were] starting to attract shady operators and billions in losses were possible.” According to the report, Chris Swecker, the FBI official in charge of criminal investigations, told reporters that the FBI thought it was going to prevent a crisis similar to the S&L debacle.

Homeowners Sue Countrywide!

Who isn’t suing Countrywide lately? Phuong Cat Le from the Seattle Post-Intelligencer says that a group of homeowners are now suing Countrywide, alleging that the lender steered them toward high-risk loans without disclosing the inherent risks.

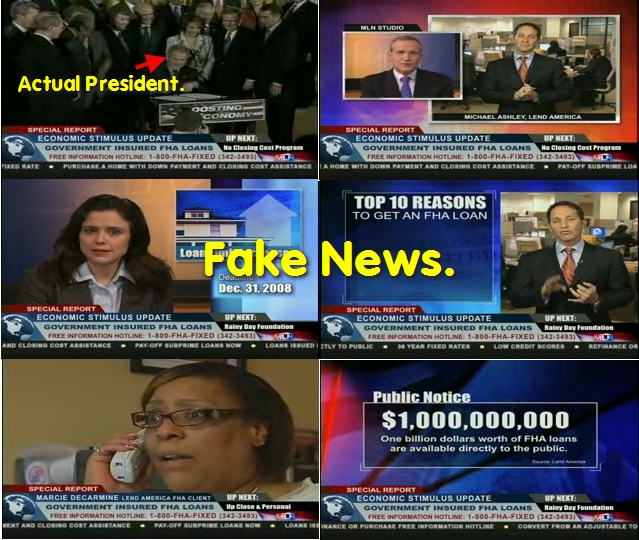

Don't Fall For Mortgage Infomercials Masquerading As "News Networks"

Reader Brian says he saw the above pictured infomercial on CNBC this Sunday, and is wondering how they get away with such a “blatant attempt to take advantage of those same mortgage consumers who where hoodwinked in the first place.”

Not Good: Fannie Mae Loses $2.3 Billion

Fannie Mae is the nation’s largest mortgage finance company and it’s just not doing too well, says the AP. Increasing losses from foreclosures are wiping out Fannie’s revenue.

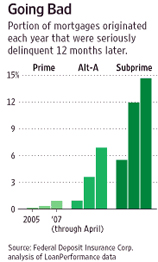

The Only Thing Worse Than '06 Mortgages: '07 Ones

Man, remember those mortgages made in 2006? That was some bad juju. Whooee. But if you thought those were bad, wait till you get a load of the mortgages made in 2007. As the graph shows, people are defaulting on them at an even higher rate than the ’06 ones. How could this be? By 2007 the bubble was popping and lenders could all see that they needed to stop giving making loans to underqualified borrowers, right? That was exactly the problem: “Mortgage originators who profited handsomely from the housing boom “realized the game was completely over” and pushed mortgages out the door,” reports WSJ.

WaMu Tells You To Stop Paying Your Mortgage And Apply For Help, Then Forecloses On You

WaMu, despite all their big talk about helping homeowners avoid foreclosure, is apparently too overwhelmed with a tsunami of defaulted loans to call their customers back, let alone help them stay in their homes. Meet Lori and Mark Pestana. They have a $275,000 fixed rate mortgage with WaMu as their servicer. In August 2007, the Pestanas could not make a payment on their loan. They considered dipping into their retirement savings, but WaMu’s website offered an alternative:

Extreme Makeover Home Edition Leaves Homeowners In Perdition

Some of the winners of ABC’s Extreme Makeover Home Edition (EMHE) got a boobie prize. The Free Money Finance blog has found a few examples of EMHE recipients now in foreclosure, because after the workmen, camera crews, and glitz left, they were left with more house than they can afford. In one case, the town is hosting dinner raffles to help keep the family afloat. Here’s an extreme makeover for you: how about giving the people a house that fits their budget? I guess that doesn’t sell as many Twinkies.

The Subprime Meltdown Will Be Nothing Compared To The Prime Meltdown

James Dimon, the chairman and chief executive of JPMorgan Chase, is not optimistic about the mortgage market. He told investors that he expects the losses mortgages given to people with good or excellent credit to be “terrible.” According to the New York Times, “The first wave of Americans to default on their home mortgages appears to be cresting, but a second, far larger one is quickly building.” How can this be?

Beware The "Fannie Mae" Prize Draw Scam

Scammers love to tap into national trends to put a new face on an old scam, and the “Fannie Mae, Freddie Mac Equity Prize Draw” scam spotted by the Louisville, KY BBB is no exception.

../../../..//2008/07/24/tragic-a-woman-facing-foreclosure/

Tragic: A woman facing foreclosure commits suicide, faxes note to her mortgage company that said “by the time they foreclosed on the house today she’d be dead.” [Boston]

What It Takes To Qualify For A Mortgage In A World With Standards

The party is over. If you want a mortgage you’re going to have to be able to afford it. Oh no! Now what are you going to do? Kiplinger’s has an article that explains how mortgage lending works when there are “standards” involved. How quickly we all forget…

U.S. Treasury Attempts To Save Freddie, Fannie, Avert Apocalypse

This Sunday the Bush administration asked Congress to approve a “rescue package” that would give officials the ability to inject “billions of federal dollars” into Freddie Mac and Fannie Mae. The Federal Reserve also announced that it would make its short-term lending programs available to Freddie and Fannie, said the NYT.

Cattleprod Loan Servicers To Answer Your Loan Modification Requests

If you’re trying to get your mortgage modified or just a question answered but find yourself stymied by your loan servicer’s slow or lack or response, you can write what is termed a qualified written request (QWR) under section 6 of Respa, The Real Estate Settlement Procedures Act. Under federal law, they have to acknowledge the letter within 20 working days and respond in 60. Inside, a template to follow for drafting a QWR…

JPMorgan Chase Accidentally Breaks Into Your House And Steals Everything You Own

Bobo and Joy Dickson bought a house had been headed for foreclosure, but JPMorgan Chase apparently didn’t get the message that the former owners had moved out and the new owners were in residence. So, naturally, they hired a firm to drill the Dickson’s locks and take everything they owned, including their food. Now JPMorgan Chase is “taking it seriously.”

Ex Countrywide Manager Exposes Its Lies

A former regional manager for Countrywide Home Loans, the mega mortgage company whose shady mortgage mill came to epitomize the subprime meltdown, went on The Today Show camera to detail some of the company’s questionable practices. Here’s some of the tricks he warned upper management about during his 6-month stint before he was fired for refusing to give loans to unqualified buyers: