If you’ve walked Canal St. in lower Manhattan’s Chinatown, you’ve probably passed by the modest headquarters of Abacus Federal Savings, a family run community bank that has served New York City’s Chinese immigrant population for more than three decades. It’s more than a mile away — and a world apart — from the more famous banks on Wall Street whose reckless behaviors during the housing bubble led to trillions of dollars in economic loss, the failure of financial institutions nationwide, an unprecedented federal bailout of the banking and auto industries, and continued fraud by big banks in a rush to foreclose on large numbers of homes as quickly as possible. [More]

too big to fail

Only One Bank Was Indicted For Mortgage Fraud Tied To The 2008 Collapse — And It Was Innocent

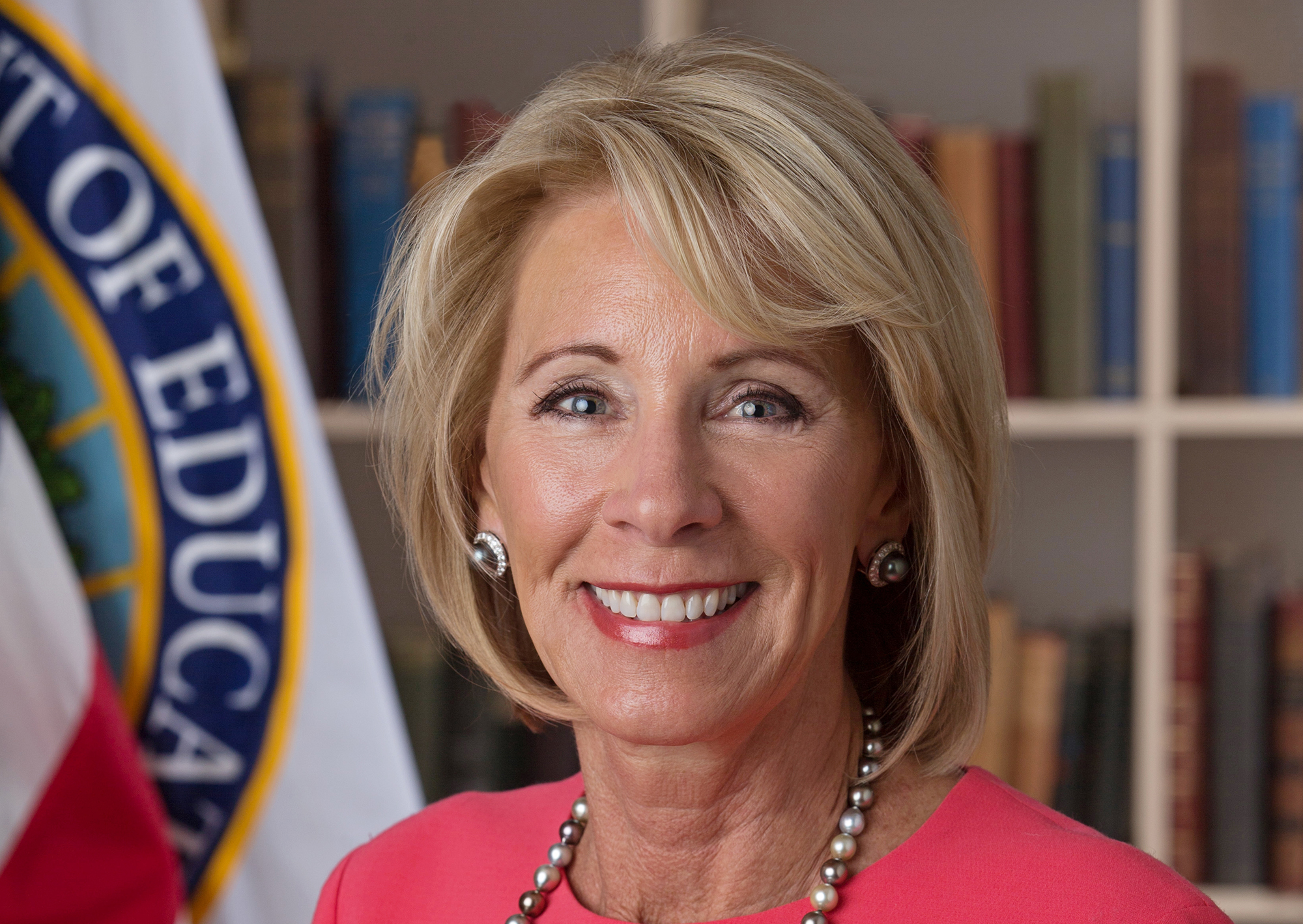

Education Secretary DeVos To Give All Student Loan Accounts To One Company; Strip Away More Protections

Education Secretary Betsy DeVos has made another sweeping change to the student loan system that consumer advocates claim favors student loan collectors over the American people repaying those loans. [More]

Federal Judge: Government Didn’t Prove MetLife Is ‘Too Big To Fail’

How can a financial company become a threat to the entire economy? If its failure would be catastrophic for the economy and the financial system, it’s considered “too big to fail.” That concept was formalized as part of the Dodd-Frank financial legislation of 2010, and the government has special requirements for institutions considered too big to fail. Today, a federal court ruling was unsealed where a judge ruled that the government didn’t sufficiently prove that one such company, MetLife, really fit the requirements. [More]

How The Federal Government Tries To Keep Financially Troubled Colleges From Failing

Under federal law, colleges that record a student loan default rate of 30% or more for three consecutive years – or 40% in a single year – can lose their access to federal aid. While the rule is meant to weed out bad players and schools that don’t provide students with means for gainful employment, a new report shows that the government often intervenes, propping up schools just before they fail. [More]

How Corporations Got The Same Rights As People (But Don’t Ever Go To Jail)

In every common-sense, everyday way, a corporation is not a person. Corporations don’t date, don’t have families, don’t go catch a movie on Friday night. They also don’t go to jail when they do something criminal. But in the eyes of the law, corporations enjoy many of the same rights — including free speech and religious expression — and protections afforded to individuals. [More]

Public Citizen Calls For Breakup Of Bank Of America

Bank of America poses “a grave threat to U.S. financial stability,” according to watchdog group Public Citizen, which has called for the bank to be broken up. [More]

Report: Fed Concerned Capital One/ING Direct Merger Could Create Another Too-Big-To-Fail Bank

Back in July, Capital One announced a deal to purchase online bank ING Direct USA for around $9 billion. And even though Cap One tried hard to quell ING customers’ screams of “nooooooo,” the folks at the Federal Reserve are reportedly a bit worried that the deal might create another bank so big that its failure would have a disastrous impact on the economy. [More]

Goldman Actually Borrowed From Fed Discount Window 5 Times, Contradicting Bank Claims

Looks like Goldman has been a more frequent visitor to the Federal trough than they’ve been letting on. Despite testifying before Congress that they had only accessed the Federal Reserve’s discount window, which lets banks borrow cash from the government quickly and on favorable terms, just once, Bloomberg reports that recently released data shows they actually took at least five overnight loans from the Fed between September 2008 and 2010. [More]

Fed Chairman Says "Too Big To Fail" Banks Should Have "Living Wills"

Ben Bernanke doesn’t like systemic risk! Shocking, we know. In a speech he gave in Orlando, Florida, the Chairman expressed outrage at the bailouts of too big to fail companies and said shareholders should not be sheltered from losses. [More]

Big Bankers Will Only Pay Themselves $40 Billion In Bonuses

Three top Wall Street financial firms, Morgan Stanley, JP Morgan Chase and Goldman Sachs, plan to cut the bonuses offered to their top executives, as part of an effort to show that they’re willing to cut back on what the White House recently called “obscene” compensation. For 2009, the three banks will award themselves just $39.9 billion, down from $44.7 billion in 2007.

According to Bloomberg, “even with lower amounts allocated in the fourth quarter, the compensation costs are enough to pay each employee at the three firms $336,843, more than six times the U.S. median household income of $50,303 in 2008.”

Why Bank of America's TARP Payback Is Bad News

So, Bank of America is writing a big, fat, $45 billion check to the U.S. to pay back the money we handed the bank under the TARP program. Great news, right? Not so fast. Wall Street bad boy Henry Blodget points out that BofA is paying the money back while taking out ultra-low-interest loans from the government — loans that don’t come with any of the restrictions bundled with TARP funds. [More]

Citibank Teaches Us How To Destroy A $244 Billion Banking Institution

Only two short years ago, Citibank was worth $244 billion. Now, after its stock lost half of its value in just the past week, the bank is estimated to be worth $20.5 billion. What happened? The New York Times attempted to answer that question Saturday, and it pointed the finger at the usual suspects — conflicts of interest between those who were supposed to manage risk — and those who stood to benefit from making risky bets.

"Crazy" Jim Cramer Takes This Opportunity To Gloat

About a year ago, CNBC’s Jim Cramer completely lost his sh*t on CNBC, screaming at Bernanke to lower interest rates before millions of borrowers went into foreclosure. Now, as the “Armageddon” that he was carrying on about is in full swing, Cramer is taking this opportunity to gloat.

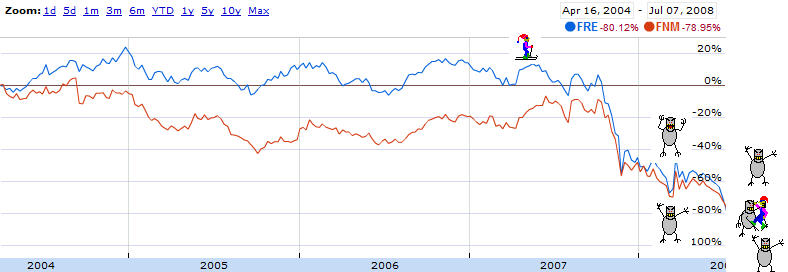

Bush Administration Considering A Takeover Of Freddie And Fanny

Freddie and Fanny lost about half of their value overnight as investors became more certain that the government was going to have to bail out the two GSEs (Government Sponsored Enterprises.) The New York Times says that senior members of the Bush administration are considering a takeover of Freddie and Fannie that would leave their shares “worth little or nothing,” and where taxpayers would pay “any losses on mortgages they own or guarantee.”

Mortgages Of The Apocalypse: Are Freddie And Fannie Going To Collapse?

Freddie Mac and Fannie Mae, the “government sponsored” enterprises that are supposed to bail us out of the current mortgage crisis, may be in danger of collapsing, according to William Poole, the former president of the St. Louis Federal Reserve, who told Bloomberg the companies are already “insolvent.”