With so many people facing foreclosure these days, it’s a good idea to educate yourself about the types of scams that take advantage of folks who are having trouble paying their bills. Even if you are doing ok, perhaps you can help someone else by recognizing a scam.

mortgages

Where Do I Turn For Help With My Mortgage?

Reader Mike is in a “challenging mortgage situation” and wants to know where he should turn for help.

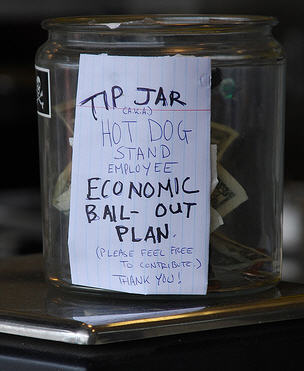

Stock Market Pleased By New Phase Of Bailout

Today the Federal Reserve announced the creation of a new special purpose entity that will buy consumer and business debt. Under the new plan, the Treasury will provide $20 billion dollars in of credit protection (from the Troubled Asset Relief Program) — and will absorb most of the losses, should they occur.

Citibank Teaches Us How To Destroy A $244 Billion Banking Institution

Only two short years ago, Citibank was worth $244 billion. Now, after its stock lost half of its value in just the past week, the bank is estimated to be worth $20.5 billion. What happened? The New York Times attempted to answer that question Saturday, and it pointed the finger at the usual suspects — conflicts of interest between those who were supposed to manage risk — and those who stood to benefit from making risky bets.

Fannie, Freddie Announce New Loan Mod Plans For Borrowers 90+ Days Overdue

The Federal Housing Finance Agency announced plans for allowing Fannie and Freddie to modify more of their loans. The mods will lower interest rates or lengthen the repayment schedule with the goal of bringing payments below 38% of household income. To qualify, borrowers must:

Fannie And Freddie To Announce More Sweeping Loan Modifications

Fannie Mae and Freddie Mac are expected to announce today plans for accelerating and expanding mortgage loan modifications for distressed homeowners. The new guidelines will apply to specific kinds of past due loans and try to bring their debt to income ratio down to 38%. Washington will also prod other big banks to do the same. “It could apply to a broad range of borrowers,” reports WSJ. Expect the full details at a 2pm eastern Federal Housing Finance Agency press conference.

Catch My Robert Allen Piece On On The Money Tonight

“When is the best time to get out there and make a lot of money? NOW!” says the real-estate investment speaker in a dim ballroom in a hotel just off a New Jersey highway. Body odor musky baby powder and farts mingle and hang in the air. I’m in a dim ballroom that’s been converted into a nexus of financial success. A tall man in his 40’s or beyond, with square shoulder, combed thinning blond hair, lords over the group of about 35 on a Tuesday afternoon. In a condescending tone a practiced manner of over-enunciating every syllable, he’s here to disseminate the secrets of real-estate pros. Working undercover for CNBC’s On The Money, I’m eager to learn…

Chase To Fix 400,000 Option-ARM Mortgages

Chase will turn 400,000 high-interest option-ARM mortgages into lower-cost fixed ones, the bank announced this Friday. Foreclosure processes on the loans will be stopped for 90 days while the procedure gets set up. Banks mainly have latitude to adjust the mortgages they themselves own. The complexities of modifying a loan that may have been sold and repackaged into a security are intricate. For one, hedge funds have threatened to sue banks if they modify the loans underlying their bonds. So hooray for the lucky 400,000. Only a few more million to go. If you’re a homeowner facing foreclosure and you’re unable to get your lender to work with you, try contacting the HOPE NOW hotline at 1-888-995-HOPE for free advice from a home preservation counselor.

Treasury, FDIC Considering Plan To Guarantee Millions Of Mortgages

The Washington Post says that the Treasury Department and the FDIC are considering a plan to guarantee millions of mortgages. According to the WaPo, the plan under consideration would encourage lenders to reduce borrowers monthly payments based on the homeowner’s ability to pay. To attract lenders into the program, the government would guarantee to repay the lender for a portion of its loss if the borrower defaulted on the reconfigured loan.

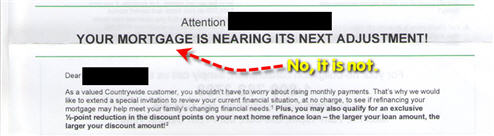

Countrywide To Fixed Rate Customer: Your Mortgage Is About To Adjust!

Countrywide either doesn’t know, or doesn’t care that reader Graham has a fixed rate mortgage, because they keep sending him “notices” that his mortgage is about to “adjust.”

Consumerist Attends Robert Allen's Get Rich Quick In Real Estate Seminar

I wanted to find out what Robert Allen’s “get-rich-quick in real estate with no money down” promise was all about, so when I saw a full page ad in the Daily Post advertising one of his free seminars recently, I went and checked it out. I’ll give you a full run-down later, but here’s the quick and dirty, and what I can tell about how the darn thing seems to function.

../../../..//2008/10/22/the-wall-street-journal-says-1/

The Wall Street Journal says that the troubled California real estate market may be healing, but not without considerable pain. [WSJ]

Despite Subprime Implosion, Robert Allen's Troops Still Pitch "Get Rich Quick In Real Estate With No Money Down"

Robert Allen promises to make you millions teaching you how to buy real estate with no money down. Unsurprisingly, Ripoffreport is littered with complaints about his company and those that use his name. Here’s the story they tell:

Bank of America CEO Explains How He Beat Wall Street

Is the new financial capital of our country located in Charlotte, NC? 60 Minutes traveled down south to talk to CEO Ken Lewis about his bank, its recent purchase of Merrill Lynch, whether or not the bank bailout is “socialism” and the economic crisis in general.

The Bailout Bill Helps Renters Keep Their Homes

Great news for renters facing eviction due to foreclosure: any mortgage owner seeking assistance under Congress’ mammoth bailout bill is required to let paying renters stay in their homes.

Chicago Sheriff Halts Foreclosure Evictions, Won't Toss Innocent Renters

Cook County Sheriff Tom Dart said he understood he was flouting the law in refusing to have deputies carry out the rising number of eviction requests, but mortgage holders must be accountable.

Consumer Spending Will Shrink For The First Time In Nearly Twenty Years

Consumer spending, the engine that powers our economy, is probably going to shrink for the first time in nearly two decades, says the NYT — a move that will “all but guarantee” that the current economic crisis will deepen.

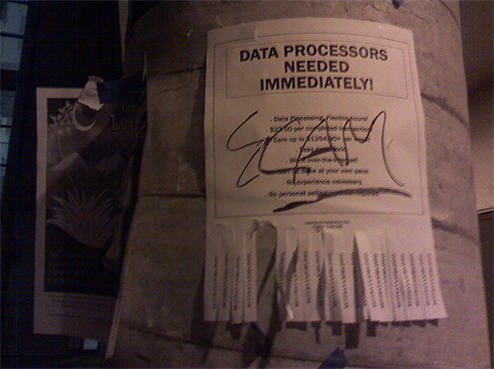

5 Scams To Watch Out For During A Recession

The LA Times says that recessions are boom times for scammers looking to take advantage of desperate people. They’ve listed 5 common scams that do well in a poor economy. They include bankrupcy scams, foreclosure scams, and fake home-based businesses.