A family whose son has debilitating cerebral adrenoleukodystrophy got foreclosed on by Chase, just days after they were told their loan modification was approved. [More]

foreclosures

Foreclosure Firm Allegedly Forged Bank Execs' Signatures On Affidavits

A foreclosure firm listed “Bogus Assignee” as the mortgage owner on the documents they submitted to the court to process the foreclosure. That’s one of the many oddities surfacing in the investigation of a Florida foreclosure firm for allegedly using improper documentation to speed up foreclosures. Another is an employee “Linda Green” who signed of on thousands of foreclosure affidavits claiming to be executives from Bank of America, Wells Fargo, U.S. Bank and other lenders. [More]

BofA Forecloses On Man's House, Even Though He Has No Mortgage

Bank of America stole Jason’s house from him, putting it through foreclosure even though he has no mortgage, with them or anyone, and he paid for it in cash. [More]

GMAC Bungled Foreclosure Affidavits In 23 States

GMAC Mortgage is taking the eye-opening step of stopping evictions in 23 states because the affidavits used to support the kickouts contained information the employees didn’t themselves personally know to be true, and they were sometimes signed without a notary present, according to a company statement. [More]

GMAC Halts Evictions In 23 States

GMAC has told brokers and agents to immediately stop evicting homeowners in 23 states. In a memo, the Ally Financial Inc. subsidiary cited “corrective action in connection with some foreclosures” that may need to be taken. Smells like some people got foreclosed on that shouldn’t have, though we’ve been hearing scattered reports about that for a while without the banks doing much, so why drastic action now? Have they uncovered something massive? [More]

Wells Fargo Says It Won't Foreclose For 30 Days, Then Does So Within A Week

A week after Wells Fargo rejected a couple’s loan mod app and said it wouldn’t start foreclosure proceedings any sooner than 30 days later, a guy showed up on their steps. He said he was with an investment firm that had just bought the house at a real estate auction, and if they would leave within 2 weeks, he would give them $1,500. [More]

Man Sets House On Fire, Dies In It, After Losing Home To Homeowners' Association

Feuds between homeowners and homeowners’ associations can get pretty intense, as BoingBoing pointed out twice last week. One feud in Ogden, NC, was so bad that the man’s house was sold by the court to pay for dues and fines levied by the association. The house was sold earlier this summer, reports the Star-News, and last month the man doused everything in gas and set the place on fire. [More]

BofA Tries To Foreclose On Couple With Current Mortgage

Even though they have made every payment in full and on time, Bank of America sent one couple a letter asking them for the deed to their house. [More]

Chase Foreclosing On 90-Year-Old Even Though Son Is Willing To Pay

Chase is proceeding full steam ahead with foreclosing on a 90-year-old woman’s condo even though her son has offered to pay it off. Rather than get the full amount of the mortgage paid in full, they prefer to incur the expenses of a foreclosure and sell it at a loss. [More]

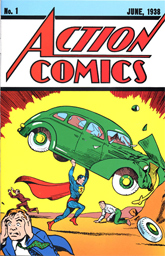

Rare Superman Comic Saves Home From Foreclosure

See through walls, bounce bullets off his chest, save homes from foreclosure, is there anything the man of steel can’t do? [More]

Oops, You Didn't Buy A House, You Bought Its Worthless 2nd Mortgage, And Now It's In Foreclosure

A couple thought they were snagging a $97,606 foreclosure fixer upper at a courthouse sale, only to find out months later they had actually bought its worthless second mortgage. The original was in arrears, and now the house would be sold at another courthouse auction. [More]

Georgia Woman Plans To Win Foreclosed House Back With Cornbread

Many people, facing underemployment and foreclosure on their home, would despair. Not reader Bev. She’s determined to win her house back when it’s sold at auction, and is fighting back with… cornbread. Wait, cornbread? [More]

Man Who Offered To Set Car On Fire Saves Home

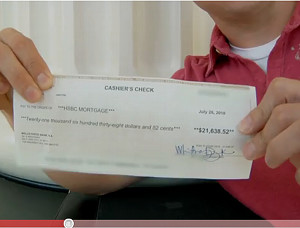

The guy who offered to set his car on fire in exchange for “loanations” (his word–he says he’s going to pay back all donations) managed to raise enough money to prevent the foreclosure sale of his house yesterday. Below is a video of him handing over a check for $21,000. The only problem is, now he’s saying he might not burn the car. [More]

Man Offers To Set Car On Fire To Save Home From HSBC Foreclosure

John admits on his blog that he’s responsible for falling six months behind on his mortgage. But once he got over his divorce and losing his adopted son and started trying to make things right, he ended up in loan modification limbo at HSBC. The bank never moved forward on any modification, and now he has to pay $21,638.02 today if he wants to keep his house. Logically, he’s offering to burn his car and post the video online in return for donations. [More]

1.6 Million Homes Hit With Foreclosure Notices In First Half Of 2010

If you received a foreclosure notice this year, you’re not alone. According to tracking firm RealtyTrac, 1.6 million properties received a foreclosure filing — defined as default notices, auction sale notices and bank repossessions — during the first half of 2010. The good news: that number is down 5% from the previous six months. The bad? It’s up 8% from the first half of last year. And RealtyTrac doesn’t see any relief coming, as a “massive number of distressed properties and underwater loans continues to sit just below the surface.” [More]

"I Bought It From Yahweh" Is Not A Good Defense For Squatting In Foreclosed House

Here’s a tip to anyone looking to squat in a foreclosed home — People probably won’t believe you if you tell them you purchased the property from Yahweh (aka God, aka Big Man in the Sky). It’s a lesson a Montana man learned this week after being convicted of not only illegally living in a home that wasn’t his, but also trying to use it as collateral for a loan. [More]

Rich People: More Likely To Default On Mortgages Than You Are

Are you a fancy person? Then you have a 1 in 7 chance of defaulting on your mortgage, says a new study of data compiled for the New York Times. Those of you with mortgages of less than a million dollars only have a 1 in 12 chance of defaulting, the paper says. [More]

HOA Board Member Says They're Not All Money Grubbing Scumbags

Yesterday we wrote about how in Texas, there’s been a bit of a spree of homeowner’s associations (HOAs) foreclosing on people’s houses over just a few hundred in late dues, then selling the house to themselves and turning it around for a juicy profit. And now, the other side of the story. Robert is an HOA board member in Texas and while his association does sometimes foreclose in order to collect, there’s more to the situation than meets the eye. Here’s his take: [More]