As mentioned here earlier this week, the current foreclosure freezes by Bank of America and others have more than a few people in limbo as they wait to either buy or sell a foreclosed property. To help these folks out, Reuters has put together a list of helpful tips for weathering the freeze. [More]

foreclosures

Bankers: We Wouldn't Hire Unqualified Robo-Signers If You Just Paid Your Mortgage

While a lot of attention has been paid to recent foreclosure freezes and the hordes of unqualified “robo-signers” hired to rubber stamp mortgage documents, the bankers of Wall Street want to remind the homeowners of America — This is all your fault. [More]

Banks Hired "Burger King Kids" To Process Mortgages

JPMorgan & Chase had a cute name, the “Burger King Kids,” for the workers with little no experience or qualifications it hired to process the reams of mortgages it plowed through at the height of the housing bubble. These walk-in hires “barely knew what a mortgage was,” writes the NYT. The newbies Citigroup and GMAC/Ally Bank outsourced the work to sometimes tossed paperwork into the garbage can. [More]

AGs In Every State Open Joint Foreclosure Investigations

On the heels of a massive fraudulent foreclosure document scandal, Attorneys General in all fifty states opened a joint investigation into home foreclosures, pledging to halt any and all wrongful practices at mortgage companies and banks. [More]

Delusional Thieves Caught Stealing Entire Mansions

A ring of confused folk in Georgia are stealing entire million-dollar homes, deeding themselves the property with bogus paperwork and squatting inside. [More]

Robo-Signer Confession: 'I Don't Know The Ins & Outs Of The Loan, I Just Sign Documents'

In spite of their nickname, “robo-signers” — those hired to process the mountain of foreclosure documents during the recent recession — are flesh and blood human beings. And like many human beings, they also know very little about mortgages and foreclosures. [More]

Bank Of America's Foreclosure Freeze Stuck Me In Limbo

The Bank of America foreclosure freeze doesn’t work out so well for those who were about to buy a foreclosed property. Andy finds himself spinning his wheels, having been zapped by the freeze ray just as he was about to close on a house. [More]

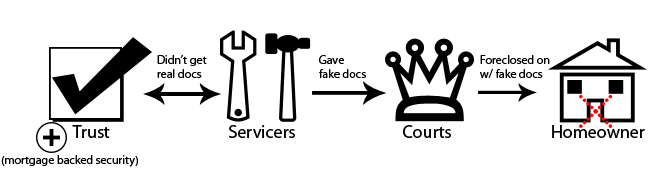

How The Current Foreclosure Fraud Crisis Works

A simplified way to understand how the current foreclosure fraud crisis got started. It all became unwound when a foreclosure mill “robo signer” admitted in a deposition to signing more than 10,000 affidavits in one day, little lies on slips of paper that got people thrown out of their houses. [More]

Bank Sends Scary Person To Break Into Your House

Nancy was sitting at home when someone busted the lock on her door. She was afraid she was being robbed, but it turned out that Chase had mistaken her home for a foreclosure and sent someone to change its locks. It took a visit from police to figure that out. [More]

Bank Of America's 5 Greatest Foreclosure F*#!-Ups

Earlier today, when Bank of America said it was halting foreclosure sales in all 50 states, we decided to take a stroll down memory lane to revisit the wide array of foreclosure disasters that BofA has perpetrated on the homeowning public in just the year or so. [More]

Bank Of America Puts Nationwide Freeze On Foreclosure Sales

Last week, Bank of America announced it was putting a freeze on foreclosures, foreclosure sales and evictions in 23 states. On Friday morning, the bank declared it has ordered a halt to those sales in all 50 states. [More]

White House Says President Won't Sign Bill That Could Make It Harder To Fight Foreclosures

In April, legislation was introduced in the House of Representatives that would require courts to recognize out-of-state notarizations. It got little notice at the time and was deemed dead-on-arrival by some. Then in the last couple weeks, GMAC, JPMorgan Chase and Bank of America announce they are freezing foreclosures in multiple states, in part because of improper notarizations. Suddenly, this bill passes through the Senate without any debate. It was enough to make the White House say “hmmmmm” when it arrived at the Oval Office for the President’s signature. [More]

Should I Worry That My Townhouse Neighbor Has Disappeared?

Grant tells Consumerist that his next-door neighbor disappeared…maybe because of an impending foreclosure, maybe not. No one knows where she has gone. They do know that the house is unoccupied, and Grant worries that the ravages of a Midwestern winter might burst a pipe or cause other damage to the empty home. Why does he care? They’re townhouses, and whatever happens to the house next door could affect him. [More]

Man Caught In Deed-In-Lieu Of Foreclosure Hell

Since he had to get rid of his house and move to take advantage of some new opportunities, Joe has been working for months to get Chase to accept a deed-in-lieu of foreclosure on his condo in Chicago. A deed-in-lieu is when you hand over your house to the bank rather than go through a normal foreclosure process that is lengthy and costly for both parties. He met the requirements and began his descent into hell, full of lost paperwork, unreturned calls, and missed deadlines, despite contacting the executive offices of Chase, Freddie Mac, and Chase Home lending. Finally he catches a break, only to have his hopes snatched away again at the last moment… [More]

Banks Changing Your Locks, Drinking Your Beer

There is a really fun legal gray area when it comes to foreclosed properties. Laws about how to handle the process are different around the country, and reports are popping up about banks cutting the locks off the doors of homes where people are still in residence, gerbils being confiscated — and let’s not forget the hapless Canadian tourists whose delicious beverages went missing after the locks were changed on their vacation rental. [More]

Texas AG Calls For Statewide Foreclosure Freeze

Hot on the heels of foreclosure and eviction freezes by GMAC/Ally, JPMorgan Chase and Bank of America, the Attorney General for the state of Texas has become the latest AG to request that loan servicing companies put a temporary halt to foreclosures. [More]

JPMorgan Chase Suspends 56,000 Foreclosures

JPMorgan became the second major lender after GMAC/Ally Bank to halt pending foreclosures, halting proceedings on 56,000 homes. This follows revelations that “robo-signer” “foreclosure mills” were filing paperwork that would be gracious to call “sloppy,” at the rate of 10,000 a day. [More]

Bank Reverses Erroneous Foreclosure On Family With Very Sick Child

After the Washington Post reported on their plight, a family with a gravely ill child that got foreclosed on a day after they were told their loan modification was approved, the bank investigated and found that they had screwed things up. [More]