While we were concentrating on other things (Snuggie testing, for example), there has apparently been something of a backlash going on against NPR’s Planet Money podcast for its rude treatment of Congressional Oversight Panel Chair Elizabeth Warren. NPR’s Adam Davidson has since expressed regret that he talked over Ms. Warren in a rude way — but despite the mea culpa, a series of links about the issue has popped up in our inbox more than a week later.

debt

Got Debt So Bad It's Defaulted? 3 Ways To Deal

Getting into debt is easy. Winding up in default is easier yet; all you have to do is not pay your bills for several months! So how do you deal when the lender doesn’t want to wait around for you any longer and has moved on to more drastic action? Here’s three ways, only two of which are advisable.

Five Money Lessons For New Grads That Everyone Should Follow

New graduates are about to walk smack into the Great Recession, and they need every bit of financial advice they can get. The Wall Street Journal has five excellent money tips that should apply not just to new graduates, but to everyone.

Big Shocker: Students Are Abusing Credit Cards

Sallie Mae‘s 2009 study of credit card use shows that students just love binging on plastic. Kids these days have more than four cards on average, and most of them carry a balance pushing $3,000. Many don’t tell their parents, and almost a fifth graduate with more than $7,000 of debt. This is how meltdowns start…

What Are You Going To Use Your Tax Refund For This Year? 28% Say "To Pay Off Debt"

The comparison shopping website PriceGrabber.com just completed its “what are you going to do with your tax refund?” survey for the second year in a row, and not surprisingly there are some notable differences between last April and now. The biggest change is among those who plan to spend the money: it was 44.0% in 2008, but only 29.2% this year.

Stephen Colbert Supports Payday Lending, So You Probably Should Too

Chicago Democrat Luis Gutierrez introduced a bill last month that supposedly reforms out of control payday lending, where interest rates can exceed 300%, but actually gives payday lenders the freedom to charge annual interest rates that can exceed, um, 300%. It doesn’t sound like much of a reform, and in fact Gutierrez has been heavily funded by the payday lending lobby. But luckily for you and me, Stephen Colbert explains why this is all a good thing.

"Iceland Is No Longer A Country, It's A Hedge Fund"

Vanity Fair’s April cover story is on Iceland’s banking massacre — detailing how the the tiny, well-to-do country committed “one of the single greatest acts of madness in financial history.”

Best Buy Taking Over Circuit City Credit Cards

“Good news about your credit card account,” proclaims the letter Wilman recently received from Chase. Starting in May, you’ll be able to use that Circuit City card to make purchases at Best Buy. We think this is more like “mixed feelings” news, but on the plus side you won’t have an otherwise good credit card account closed (assuming you care about your FICO score). See the Chase letter below.

10 Self-Lies That Screw You Into Debt

10 lies we tell ourselves that get us into and keep us stuck in credit card debt:

Suze Orman Says Build Up Emergency Cash As Much As Possible

In Suze Orman‘s most recent book, “2009 Action Plan,” she urges people with credit card debt to pay off their balances as quickly as possible using the high interest first method. “The fact that you pay just the minimum is a huge warning signal to your credit card company,” she writes, “that you may already be on shaky ground.” Now she’s changed her mind and says you should just pay the monthly minimum and put the rest of your money toward building an emergency cash stash. Based on the way credit card companies have been behaving, we think she has a point.

High Credit Limits Encourage Consumers To Spend More

The more credulous you are, either because you’re new to the whole line-of-credit experience or because you’re uneducated, the more likely you are to mistake a high line of credit for an indication of your future earnings potential. You can see how this can lead to bad things, as noted by the researchers who studied this unfortunate problem earlier this decade. Luckily, the savvier you get about credit cards, the less influence your credit limit has on you, which is yet another great reason to make financial literacy education mandatory.

Three Tips To Keep The Recession From Depressing Your Relationship

Money can ruin relationships, but by talking honestly about finances with your significant other, you just might emerge from this depressing recession as a couple. Even if your finances are deteriorating, there are a few ways to keep your money problems from rotting your relationship.

"Empathetic" Debt Collectors Want You To Pay The Debts Of The Dead

Who is responsible when dead people owe money? The New York Times says that the law varies but, “generally survivors are not required to pay a dead relative’s bills from their own assets.” That doesn’t mean they’re going to tell you that when they come calling about an unpaid bill.

Internal AmEx Doc On $300 Bribe To Zero Account And Leave Program

Here’s an internal AmEx doc with what customer service reps should say when people call up asking about the $300 to pay off and close your account program, or, as they term it, the “Balance Down Initiative.” The sheet was obtained exclusively by creditcarforum.com. My favorite part is the answer for if people who weren’t chosen to participate ask if they can join. The correct response is, “We apologize, but we can only honor this offer for selected cardmembers. However, if you’re interested in paying down your balance, I can help you with that.” Full doc inside…

AmEx Pays Some $300 To Zero Their Balance And Leave

American Express is so desperate to clean liabilities off its balance sheet that it’s paying some customer $300 if they will pay off their balance in full and close their credit card. The offer is only good if you get a card in the mail from them about it with a 14-digit RSVP code. Thanks for playing, don’t let the door hit your ass on the way out.

Exploding The Myth Of The Bad Credit Card Customer

Too often, when we post about undeserved credit card rate hikes, a few readers will justify the credit card company’s actions by pointing out that the OP is, in pure business terms, a bad customer. If you’re a consumer, this is the worst way to visualize your business relationship with your credit card company. Here’s why.

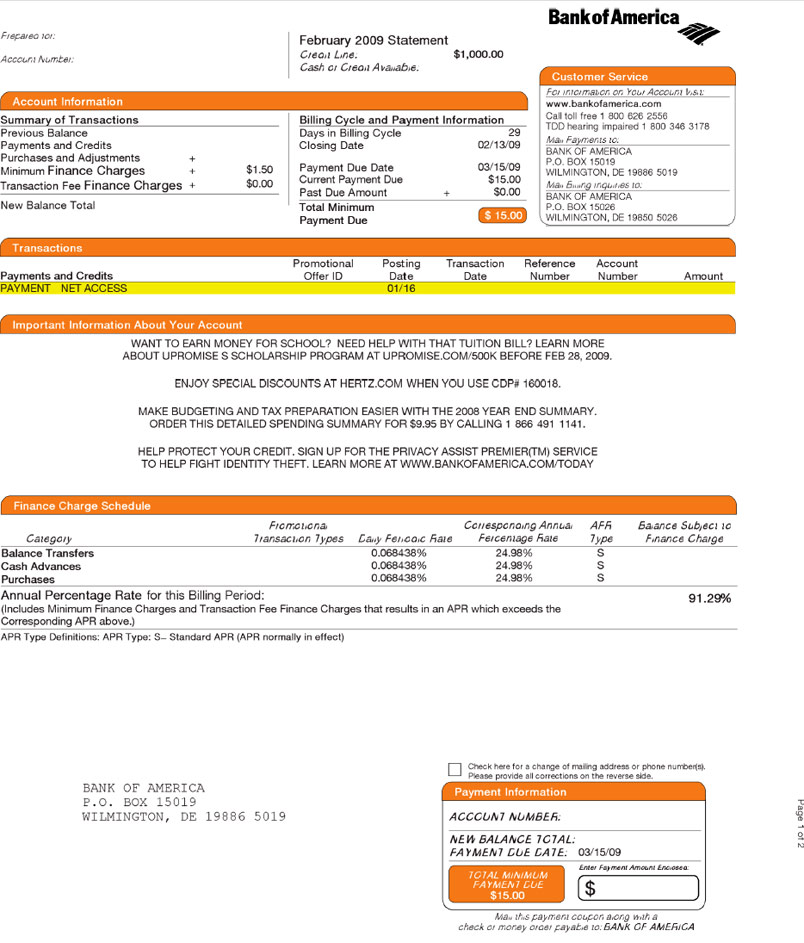

Your APR Is Now 91.29% – Yours Truly, Bank Of America

David’s effective APR on his Bank of America credit card is now 91.29%. It’s not a typo or a scam, it’s math.