How To Get Out Of Debt

J is in a debt hole and needs help getting out. We’re going to give it to him:

We are pretty smart people who did some pretty stupid things and now we are just trying to get out of debt. We know exactly what to do in the future to manage our spending, savings and credit score. And we both agree that nothing is worth putting on a credit card if we cant go home and transfer money to the card to pay off the balance when we get home. But that doesn’t change the fact that we are currently facing a staggering mound of debt and see no end in sight.

J, you’ve got two choices:

To pay off your debt you will need one, a method, and two, a madness. First, pick a method: Snowball, or Highest-Interest First.

SNOWBALL

SNOWBALL

1. Commit yourself to making the minimum monthly payment on all debts

2. Figure out what extra amount you have in your budget to put towards debt repayment

3. Take your lowest amount bill

4. Pay the minimum plus the extra on that bill until it is paid off

5. After it’s paid off, put all the money you were putting towards that bill to the next lowest bill

6. Repeat until out of debt

HIGHEST INTEREST FIRST

Do the same thing as above, except choose your debt with the highest interest first.

PROS, CONS: Many people find the snowball method to be the more psychologically gratifying. The highest-interest first method will result in you paying off the debt faster and at a lower cost. If you get depressed about your debts and it demotivates you from paying it off, the snowball method might be better to go with if it keeps you on track better.

NOTE: It’s important to make sure you’re current with all your lenders. This means making regular payments and not dodging their letters and calls. They’re not just going to go away like a CD-of-the-month-club, they, or the shady debt collectors they sell your debt to, will keep after you until you pay up or declare bankruptcy. If you don’t have enough to make the minimum payment, try calling and negotiating for a lower one. They’re willing to work with you if your payments are regular and scheduled and lower than if they’re getting no money at all.

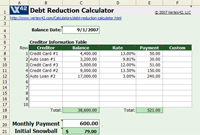

HANDY TOOL: Whichever method you use, this free Excel spreadsheet can help. Just enter your credit cards, their balance, and interest rate. Then enter your required minimum monthly payments and the maximum possible amount you could put towards it, based on your budget. Select which style of repayment you want, such as snowball or highest interest first. The program then spits out an effective payoff strategy. It calculates how much interest and the total you’ll end up paying, and how long it will take to get out of debt.

HANDY TOOL: Whichever method you use, this free Excel spreadsheet can help. Just enter your credit cards, their balance, and interest rate. Then enter your required minimum monthly payments and the maximum possible amount you could put towards it, based on your budget. Select which style of repayment you want, such as snowball or highest interest first. The program then spits out an effective payoff strategy. It calculates how much interest and the total you’ll end up paying, and how long it will take to get out of debt.

THIS IS SPARTA!

The deeper you’re in, the more hardcore you need to be about getting out. This is the “madness” to your “method”. Suffer, cut back, say no. For instance, you can cut up the credit cards and go cash only. Sell extra things around the house and use the money to pay off debts. Sell the car and get a beater, or a bicycle. Take on a second job or work longer hours. Maybe you even have to move back in with your parents while you pay off your debts. Whatever it takes, attack your debt like a hungry wolf. Intensity is the number one difference between those who become truly free and escape debt slavery, and those left staring out the prison bars.

Share your stories about struggling with debt in the comments.

(Photos: samwilkinson.org, kamshots)