A growing personal finance debate centers around whether or not individuals should have a mortgage when they retire. A surprising number of retirees maintain a mortgage — 4 in 10 in 2007 — but is this good financial management?

debt

How To Fight Back Against Debt Collector Ninjas

Debt collectors, like vampires, have certain rules they must follow. For example, both are vulnerable to sunlight and garlic, but only vampires glitter when they’re playing baseball.

Credit Unions Dive Into The Student Loan Market

Private loans are the worst type of student debt, but the best place to get them may be your local credit union. Like most credit union products, their loans are usually a better deal with more favorable terms than similar loans from bigger banks.

Arbitration May Be Dead, But Courts Offer Imperfect Alternative

Last month, the Minnesota Attorney General brought an oppressive arbitration regime to its knees. Nation Arbitration Forum handled over 200,000 arbitrations per year. But many of those cases will end up in the 50 states’ district courts, where consumers may fare no better.

The Five Universal Financial Truths

Saving can be boiled down to a few universal financial truths. The sooner you know and internalize them, the sooner you can start enjoying a responsible, sustainable lifestyle.

Lender Makes Borrowers Pledge Their Souls

Mirosiichenko said his company would not employ debt collectors to get its money back if people refused to repay, and promised no physical violence. Signatories only have to give their first name and do not show any documents. “If they don’t give it back, what can you do? They won’t have a soul, that’s all.”

"Chase Hiked My Minimum Payment To 5 Percent!"

Chase just notified Greg that they’re more than doubling his minimum payment requirement. Because he and his wife are carrying such a large balance due to a promotional balance transfer offer a few years ago, this pushes their monthly payment to nearly $1,000.

Study Of Credit Unions Indicates CARD Act Will Benefit Consumers

Two Harvard doctoral students in economics compared how credit unions and banks operated their credit card divisions, and concluded that the recent CARD act “is likely to bring about moderate, and even positive, changes,” as banks begin to emulate parts of the fairer business model of credit unions. Specifically, they say, all the doom and gloom from the banking industry about how consumers will get shafted by the new rules is mostly fearmongering.

NY Attorney General Shuts Down Abusive Debt Collection Operation, Puts Owner's Rap Career On Hold

The New York Attorney General shut down a network of debt collection agencies today that were run by convicted felon Tobias Boyland, who along with his colleagues impersonated police officers, threatened debtors with arrest, and told them they were being sued in civil court. Boyland is also an author and a musician, and he has an awesome website, bagsofmoney.us, which—warning—launches into a street-friendly rap song as soon as it loads.

Credit Card Companies Are Warming Up To Reduced Payoff Deals

If you’ve fallen into a debt pit and can’t make your credit card payments, and now you’re watching them steadily mount with penalties, fees, and steep interest rates, consider negotiating a lower payment. The New York Times reports that while most card companies won’t admit it officially, they know when they’ve got a customer who can’t pay, and they’re much more willing to settle for a lower amount than they were a year ago.

Should I Reduce My 401k And Put The Money Toward Credit Card Debt?

Given the state of the economy today, is it better for me to reduce my 401k to a minimum and use the extra funds to pay off my credit card debt? This is a good time to put money into the markets, based on my admittedly limited understanding, but with interest rates going through the roof (my personal Chase card went from 12.99 to 23.99), I would like to kick down my cc debt (now at around $6,000) faster. I’m currently only putting 6% in my 401k, and I’m fairly young (35). Have you advice for me?

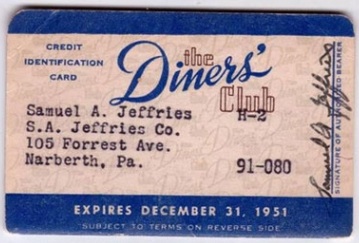

A Visual History Of Credit Cards From 1951-Today

Credit cards weren’t always the adorable little pocket debt machines that they are today. They weren’t even plastic until AmEx decided to class things up in 1959. Travel back to the good old days when credit cards were a “ticket for anyone to spend freely and decide when was best to pay it back” with this revealing photo set from Slate.

Are You A Deadbeat? Suddenly You're Attractive To Card Companies Again

“Revolvers”—customers who keep a revolving balance on their credit cards—used to be the cash crop for credit card companies. But now more and more of them are turning into expensive charge-offs, and the new CARD act is going to make it harder to acquire those riskier customers anyway. As a result, card companies are beginning to look more closely at the customer who was most hated back in the credit-orgy years: the deadbeat.

Which Parts Of The Country Are Carrying The Most Credit Card Debt?

Forbes wanted to know which states had the highest average balances per household in May, so they took the total amount of debt in 50 major metropolitan areas, divided that by the number of households, then divided that by the median household income for that area for May. Here are some of their results.

../../../..//2009/05/22/there-is-apparently-serious-concern/

There is apparently serious concern that the United States will eventually lose its AAA credit rating. [Bloomberg] (Photo:donbuciak)