The money from a multibillion-dollar federal program to help unemployed and underemployed workers in certain states hold onto their homes failed to reach some of the people who needed the most help, especially in two states hit particularly hard by the recession. [More]

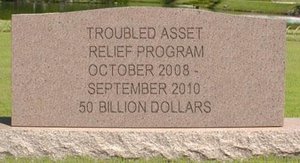

tarp

Watchdog Says Treasury Dept. Once Again Overpaid GM Execs

Under the guidelines for the Troubled Asset Relief Program, which invested billions of taxpayer dollars in bailing out the nation’s banks and carmakers, executive pay is supposed to kept to reasonable levels. In the case of General Motors, it pledged to cap salaries at $500,000; not bad for a company that allowed nearly two dozen people to die rather than fix an ignition switch. But the TARP watchdog says that once again the Treasury Dept. has allowed GM to pay execs more than it agreed to. [More]

Banks Received $814 Million In Federal Incentives For Mortgages That Ended Up In Redefault

According to the latest report from the Special Inspector General for the Troubled Asset Relief Program (or the much-cooler SIGTARP), the nation’s mortgage servicers have received more than $800 million in incentives for making modifications on mortgages that have ultimately resulted in the homeowner redefaulting on the loan. [More]

Report Rips Treasury Dept. For Giving Out Raises To Execs At Bailed-Out Companies

Today, the Special Inspector General for the Troubled Asset Relief Program released her report on 2012 compensation for executives at institutions that received TARP bail-out money, and well… the title — Treasury Continues Approving Excessive Pay for Top Executives at Bailed-Out Companies — is about as on-the-nose as it gets. [More]

Treasury Freezes Compensation For Top AIG, Ally, GM Executives

While a majority of the American corporations that received “exceptional” bailout assistance form the Troubled Asset Relief Program, there are still three businesses — AIG, Ally Financial (you may know it by its pre-bust name of GMAC), and General Motors — remaining. Today, Treasury Dept. announced that the Acting Special Master for TARP Executive Compensation has determined that the top executives at this trio of companies will not get a pay raise in 2012. [More]

Video: Occupy Portlanders Open Credit Union Accounts On Bank Transfer Day

Saturday was the fifth of November, and many remembered to take a stand and shut down their big retail bank accounts, transferring their cash to a new credit union account. Here’s a video out of Occupy Portland covering what happened on Bank Transfer Day. Interviewees talk about why they’re switching to a credit union, and how this is just the beginning. [More]

Video Of People Closing Down Their Accounts At Big Banks

Tomorrow is Bank Transfer Day. By this date, people all across America are shutting down their accounts at large, costly, name-brand banks and transferring their funds to new bank accounts at their local credit union or community bank. Here is an excellent video made in Portland that follows along with several different people as they close their bank accounts and give their reasons for doing so. One person wants to save money, another disagrees with the bank’s foreclosure practices, a third is mad about the bailouts, and the last is a union withdrawing its funds to show solidarity with holding Wall Street accountable. [More]

Class Action Suit Against BofA For Deceptive Loan Mods Goes National

Olly, olly, oxen, free. A class action lawsuit against Bank of America claiming they were less than above board with their loan modification practices has been certified for national participation. [More]

Chrysler Repays $7.6 Billion To U.S. And Canadian Governments

Chrysler today paid back $5.9 billion it had borrowed from the U.S. government, along with another $1.7 billion due to the governments of Ontario and Canada. No, Chrysler isn’t suddenly flush from selling cars. The money to pay back the governments comes from bonds the automaker sold to banks and private investors last week. [More]

Treasury Impotent To Penalize Wrongfully Denied Loan Mods

For all its tough talk, the Treasury can’t do jack to reign in lenders who are wrongfully denying home owners loan modifications. After seeing reports that some banks were basically modifying no loans at all, Treasury staffers huddled up to talk about withholding payments and levying fines on the baddest of the bunch. Unfortunately, they were told by their own lawyers that they don’t have that power. ProPublica reports, “staffers were walked back by Treasury lawyers, who said the government was only party to a commercial contract with servicers and not acting as their regulator.” [More]

GM Wants To Be Able To Pay Executives More Money

General Motors Co. Chief Executive Daniel Akerson says he’d like a little more leeway on executive compensation from the Obama administration because the company is having trouble attracting quality executives. [More]

Geithner: TARP Will Cost Taxpayers Under $50 Billion

As the Troubled Asset Relief Program winds down, post-mortems for the program are rolling in. According to Treasury Secretary Timothy Geithner, the bailout effort — which was launched by former President George W. Bush in 2008 and officially ended last month — will end up costing taxpayers a mere $50 billion, rather than the $350 billion that the Congressional Budget Office pegged it at last year. [More]

BoA Sued For Taking TARP $ But Not Helping Foreclosures

A class action lawsuit has been filed against Bank of America for taking $25 billion in federal TARP bailout money but intentionally failing to live up to its part of the bargain. The deal was that banks were supposed to use use the money to allow struggling homeowners to reduce their payments to affordable levels. “Bank of America came up with every excuse to defer the Kahlo family from a home loan modification, from stating they ‘lost’ their paperwork to saying they never approved the new terms of the mortgage agreement,” said the plaintiff’s attorney. “And we know from our investigation this isn’t an isolated incident.” Bank of America declined to comment.

Washington homeowners file class action against Bank of America [Seattle PI]

Government Mortgage Relief Plan May Buoy Underwater Homeowners

A new program announced by the Obama Administration today could help homeowners whose homes have declined in value by offering new government-backed loans and getting lenders to reduce the principal owed on homes whose values have fallen by at least 15%. The catch? Investors who own existing mortgages won’t be forced to participate in the new, voluntary program. [More]

Citi Getting Out From Under TARP

Citigroup plans to repay $20 billion that it borrowed from U.S. taxpayers through the Troubled Asset Relief Program. That’s good news for Citi execs, who will be able to pay themselves whatever they want once they’re free from TARP restrictions. And it may be good for taxpayers, as long as Citi doesn’t take any of those ultra-cheap Federal loans like BofA did. Citi shareholders? Hey, somebody’s gotta pay for this. [More]

Bailout Banks Will Keep Using Your Money For Private Jets

Under government pressure — and by “pressure” we mean asking meekly in a very soft voice — companies that have received funding from the taxpayer-funded TARP program have outlined the controls they plan to put in place to limit “luxury expenditures.” And — surprise! — the definition of “luxury” is very different for the corporate titans spending your money. While most big banks have put at least some limits on personal use of corporate jets, many seem to echo Bank of America‘s policies on official use, which state that that execs can use private planes for “safety and efficiency reasons,” no advance approval required.

Taxpayers Unlikely To See Much Auto Bailout Money

A new report by the Congressional Oversight Panel — an independent, yet totally powerless, group appointed by the Senate to review the results of the recent government bailouts — states that we’ll get a few bucks back from the automakers, but shouldn’t count on it to cover our car payments:

Bank Of America Wants To Begin Paying Back Bailout Money, Avoid Government "Fee"

The Wall Street Journal says that Bank of America is interested in paying back a portion of the bailout money it received, with the goal of getting out from under the purview of the salary czar and reduce a “layer of federal involvement in its affairs.”