Michael is in a situation that we anticipate will become very, very common in the coming months. His credit card company has imposed a $99 annual fee. He can accept the fee, or close his account. Not only is this his only credit card, but it’s the oldest credit line he has, so closing it would hurt his credit score. What would you do?

credit scores

Freescore.com Sues Yahoo To Reveal Blogger's Identity

Freescore.com is one of those online companies that offers a free trial, and then attempts to enroll its customers in a $30/month subscription service. Now they’re suing Yahoo in an attempt to reveal an anonymous blogger who quoted a Reuters article when criticizing the service, and who pointed out that Freescore is owned by a company with a reputation for billing customers without permission.

Homeowners With Good Credit Are More Likely To Strategically Default

Here’s an interesting discovery about mortgage defaults from the LA Times:

Old Debts Under $100 Don't Matter Under FICO '08

An update to how the new FICO ’08 scoring system got revamped this year:

Credit Card Limit Cuts May Lower Your Credit Score

As credit card companies hedge their economic bets by lowering customers’ credit limits, they’re also hobbling their credit scores.

Will My Credit Score Hurt If I Pay Off And Close My Credit Card?

Does paying off and closing a credit card hurt your credit score? That’s a two-part question. The answer to the first one is no, it helps, and the answer to the second is yes, closing your credit card hurts your credit score. Credit bureau Exerpian’s “Ask Max” says,

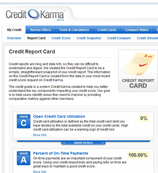

Take Your Score From 650 To 800 With The Credit Karma Report Card

Credit Karma recently launched the free Credit Report Card service that assigns letter grades to each component of your credit score. If you want to improve your credit score, try to bring up your performance in areas where you have low or failing grades. Not every component has the same bearing on your score, so underneath each section Credit Karma tells you how much weight it has. For those who look at their reports and scratch their head, the Credit Karma report card, which is drawn from your TransUnion report, makes understanding why your credit score is the way it is a snap. Full screen shot inside.

Dirty Credit Report Scuttles Job Prospects

Dan Denton was about to get a much-needed job. Then the recruiters saw his blemished credit report and took away their offer.

../../../..//2009/06/08/when-your-credit-score-sustains/

When your credit score sustains a dent, make sure your car doesn’t. Because higher car insurance is just what you need when you’ve lost your job. Auto insurers use customers’ credit scores as part of the formula to determine premiums. Shop around—different companies assign different weights to credit score in their calculations. [MainStreet.com]

The Good, The Bad And The Ugly Of Fixing Credit Report Errors

A great way to improve your credit score is to get rid of errors on your credit report that are dragging you down, but how do you start?

Citibank Comes Up With Elaborate Cash Back Offer That Reduces Credit Limit And Temporarily Suspends Card

Compared to what some other banks and card companies are doing to reduce their exposure to debt, we guess Citibank’s cash back offer isn’t that bad—it’s sort of a “let us help you help yourself get rid of your debt” scheme. It’s funny, however, if only because it’s such an elaborate way to get customers to self-select for a reduction in credit.

Credit Scores: How Do They Make 'Em?

A three-digit number that creditors use to quickly evaluate whether to give someone a loan and how favorable the terms should be, the credit score remains something of a mystery to many. How is it figured out? What matters, and what doesn’t matter? The exact scoring system is a proprietary secret of the Fair Issac corporation, but there are 5 general categories, each weighted differently, that determine where you sit on the range from 300-850. In easy-to-read outline form, let’s take a closer look.

Debt Collectors Mess With Your Head To Get You To Pay More

Santana had actually already sought permission from the bank to settle for as little as $10,000. It’s an open secret that if a debtor is willing to wait long enough, he can probably get away with paying almost nothing, as long as he doesn’t mind hurting his credit score. So Santana knew he should jump at the offer. But as an amateur psychologist, Santana was eager to make his own diagnosis – and presumably boost his own commission.

Your Credit Card Company Is Building A Psychological Profile Of You

The next time you apply for a credit card, your credit report and income will be only a part of the criteria used to determine your creditworthiness. For that matter, as long as you have the card, what you use it for will be noted and added to a growing set of data that makes up your psychological profile, which will then be referred to every time the bank deals with your or reevaluates your risk as a customer.

Five Money Lessons For New Grads That Everyone Should Follow

New graduates are about to walk smack into the Great Recession, and they need every bit of financial advice they can get. The Wall Street Journal has five excellent money tips that should apply not just to new graduates, but to everyone.

Spread It Around: A Low Balance On Each Card Is Better

When the little trolls with the green visors determine your credit score, a big factor in their abacus-shuffling is how much percent of your credit limit you’re using. However, it’s not just your total credit utilization, all of your credit limits added together and divided by how much of that you’ve tapped, but also how much of each credit line you’re using, the individual credit utilization. Say what?