After a recent report alleged that Wells Fargo had charged its auto loan customers for unnecessary and unwanted insurance — resulting in 25,000 repossessed vehicles — the bank now faces a lawsuit from one of those borrowers. [More]

auto insurance

Wells Fargo Customers Sue Bank Over Alleged Insurance Scheme That Led To Vehicle Repossessions

Report: 25,000 Wells Fargo Customers Lost Vehicles After Bank Charged For Unwanted Insurance

Nearly 25,000 Wells Fargo customers, including many servicemembers, lost their vehicles after failing to pay for unneeded, unwanted insurance the bank charged them for, according to a new report suggests. [More]

Some Minority Neighborhoods Pay Higher Car Insurance Premiums Than White Areas With The Same Average Risk

If you drive a car, you probably already know that your driving record affects the amount you pay for auto insurance. But what you might not realize is that that price you pay can be greatly affected by purely demographic information — like your zip code. [More]

Should Your Job Be A Factor In How Much You Pay For Auto Insurance?

While many consumer advocates believe that drivers’ auto insurance rates should be based on factors that only relate directly to their activity on the road, many states allow insurers to use a wide variety of considerations — including education, marital status, homeownership, and occupation — to help set those rates? With one state looking to halt the use of occupation data, we wanted to know what our readers think. [More]

Liberty Mutual Settles Over Ads For Accident Forgiveness Insurance Where It Isn’t Allowed

Accident forgiveness in auto insurance is a pretty simple concept: while plans that have the feature cost more, your insurance company can’t hike your premiums after you get in a crash and actually need the insurance. It also happens to be illegal in California, which is why the district attorneys in San Diego, Riverside, and Los Angeles counties filed a consumer protection lawsuit against Liberty Mutual over ads touting the feature, which it settled for $925,000. [More]

State Farm Already Figuring Out How To Insure Autonomous Cars

If error by fallible human drivers causes 90% of car crashes, what will happen in the future when most or all of the cars on the road are autonomous? Insurance companies are already working on the answer to that question, and one of them, State Farm, had a few years’ head start. [More]

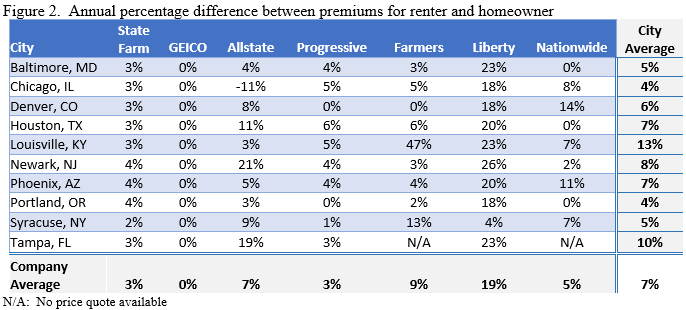

Home Renters Pay Up to 47% More For Car Insurance Than Homeowners

Renting a home means that you’re not responsible for fixing the leaky roof or replacing the broken furnace, and you aren’t wedded to a mortgage for the rest of your life. But according to a new analysis of auto insurance rates, it also means you could be paying a lot more to insure your car. [More]

Some Drivers Don’t Want Insurance Companies Tracking Them, Even If It Means Discounts

A longstanding complaint against auto insurance is that it sometimes lumps in drivers based on things — like location, type of car, and age — that may have little-to-nothing to do with a particular driver’s behavior or history. In recent years, some insurers have begun offering drivers a way to get more personalized rates by allowing the insurance company to track their vehicular movements, but many American consumers simply aren’t willing to share that information. [More]

Read The Fine Print: Allstate Safe Driving Bonus Checks Aren’t Available In All States

Sometimes, it’s annoying to watch television and see ads for businesses or products that don’t exist in your area, like the Sonic ads on cable that taunted us here in the Northeast for years. In a series of Allstate ads that air nationwide, the insurer talks about a biannual bonus check that customers who don’t get in accidents receive. “Where’s my check?” asked one Allstate customer who hasn’t had an accident in decades. Where, indeed? [More]

Looking For New Auto Insurance? Walmart Offers A One-Stop-Shop For That Now, Too

Here’s our idea of what a typically Walmart shopping list looks like: bread, butter, milk, eggs, toothpaste, shampoo, and auto insurance. That is not a typo, Walmart has officially entered every facet of our lives with the launch of their new auto insurance comparison service. [More]

Uber To Tack On $1 “Safe Rides Fee”

Getting a ride via UberX, a service that pairs up those in need of a lift with pre-screened drivers in the area willing to give them that lift, is getting slightly more expensive, as the company adds a one dollar Safe Rides Fee. [More]

15 Things You Need To Know About Buying Auto Insurance

This is the first in a multipart “How To Not Suck…” series on insurance. Upcoming installments will cover homeowner’s, life, long-term care, and disability insurance.

Whether you just drove off the dealer’s lot in a shiny new vehicle or you’re puttering down the highway in an old clunker, you must protect yourself, others, and your two/three/four/eighteen-wheeled investment with auto insurance. [More]

If You’re Not The GEICO Pig, You Should Probably Have Your Paper Insurance Card Handy

Unless you’re like me and the sight of the GEICO pig on your TV has you instantly lunging for the mute button, you may have seen the ads where the porcine insurance shill blabs on about the convenience of having his insurance card on his smartphone. That’s nice and all, but it won’t currently fly in most states. [More]

As The Auto Insurance Industry Spends Billions, Fewer Drivers Switching Insurers

All those ads trying to wheedle, cajole, convince and otherwise get drivers to switch car insurers add up to billions of dollars for insurance companies. But a new study says that even with all that financial heft, fewer drivers are deciding to take the plunge and go elsewhere. That sound you hear is money sliding down the drain. [More]

MetLife Caught Penalizing Drivers Who Weren’t At Fault In Accidents

This story isn’t just about possible malfeasance by MetLife insurance in Massachusetts. It’s also a good example for why screwed-over consumers should file complaints with regulatory agencies. [More]

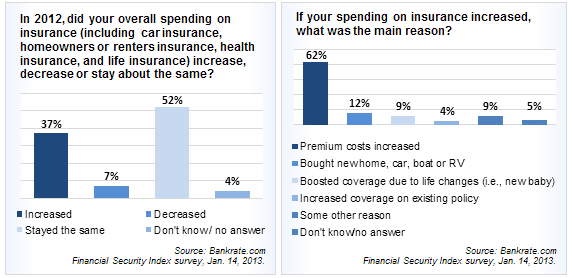

More Than 1/3 Of Americans Paid More For Insurance In 2012

If the amount of money you paid for insurance last year went up, you are not alone. According to a new survey, 37% of Americans paid more for home, health, auto, or life insurance in 2012, while only 7% of people saw their insurance bill shrink. [More]

Should Your Driving Record Impact Your Homeowner's Insurance?

You don’t need a driver’s license to own a home. You don’t need to own a home to drive a car. But Allstate insurance has launched a product in Oklahoma that looks at policyholder’s driving records when determining their homeowner’s insurance rates. [More]

../..//2009/06/08/when-your-credit-score-sustains/

When your credit score sustains a dent, make sure your car doesn’t. Because higher car insurance is just what you need when you’ve lost your job. Auto insurers use customers’ credit scores as part of the formula to determine premiums. Shop around—different companies assign different weights to credit score in their calculations. [MainStreet.com]