So you’ve fought the mighty rebaterus and won, prying your hard-won mail-in rebate money from its claws. If your rebate isn’t in the form of a prepaid debit card, it’s probably a postcard-sized check—cheap to mail, simple, easy. For the rebate fulfillment company. For the consumer depositing checks via ATM as banks cut back on their hours, it’s not so simple or easy.

checks

Overdraft Fees Up 35% In Past Two Years

As a nation, we pay more each year in overdraft fees than we do for books, cereal, or fresh vegetables, says the Center for Responsible Lending (CRL)—and considering how outrageously expensive cereal is, they must be talking about a huge sum. They are: “Banks and credit unions collected nearly $24 billion in overdraft fees last year, an increase of 35 percent from just two years earlier.”

Supermarkets Tell Shoppers To Leave Checkbooks At Home

Back when dinosaurs ruled the Earth and ATMs didn’t exist, if your cave-dwelling ancestor wanted to get cash in a hurry and didn’t want to deal with bank lines, he’d go to the local supermarket. There, the friendly high-school student at the checkout counter would allow him to write a check for the amount of cash he needed, and give him the cash in return. Today, however, the only people who actually still use those services are characters in a GEICO ad, so it should come as no surprise that some supermarkets are finally giving up on the practice.

Bank Of America Asks Armless Man For Thumbprint

A Florida man was unable to cash a Bank of America check because the bank required a thumbprint, and he had no arms.

USAA: Deposit Your Checks With An iPhone!

The friendliest bank in the world, USAA, will soon let customers instantaneously deposit checks through its iPhone application. Here’s how it works: you snap a picture of the front and back of your check, and send the picture to USAA. That’s it.

For Some Reason, People Don't Like Being Fingerprinted At The Bank

If you’re not a Bank of America customer, but visit one of their branches to cash a check, you’ll need to be fingerprinted. No, check cashing is not a crime, and the bank is trying to protect itself against fraud, but some people still don’t like the idea of giving up their prints for cash.

Snuggie Addresses Fake "Rebate" Check Story

Allstar Products, the company that makes Snuggies, sent out a clarification today regarding that weird $8.25 check that some customers were receiving in the mail. As far as they’re concerned, it was a small promo and they were upfront about everything—the check “is not a rebate, nor was it ever represented as a rebate.”

Warning: Read The Fine Print Before Cashing An Unexpected Rebate Check

At first, it looks like a rebate check, but read the fine print. It says if you endorse and cash the check, you are signing up for a marketing service called “Great Fun.” Then, your credit card will be charged $149.99. That subscription will renew annually unless you cancel it with Great Fun.

DealTree Sends Phone Trade In Money To Imaginary PayPal Account

What’s going on with DealTree? They handle Nokia’s “Trade-up” program, which reimburses you cash for your old phones. It says clearly on the “how it works” page as well as in their terms and conditions that they’ll mail a paper check to you after confirming your phone’s value. In Paul’s case, they say dumped his money into a PayPal account—and Paul says there’s nothing in his account and PayPal has no record of a transaction.

Circuit City Sends Rebate Check One Year After Purchase

Jan bought a keyboard from Circuit City last year. Since then, the company filed Chapter 11, the stores liquidated and closed, and another company bought the name. But last week, Jan finally-FINALLY-received her rebate check. Now she wants to know: is cashing this thing a good idea?

Chase/WaMu Changeover Leads To Comical Levels Of Customer Inconvenience

Shawn was a faithful Washington Mutual customer, and by default is now a Chase customer. Sort of. He learned that the transition will take until September (September?!) and he can’t deposit personal checks in his account—even at a branch—without elaborate workarounds. What kind of bank is that?!

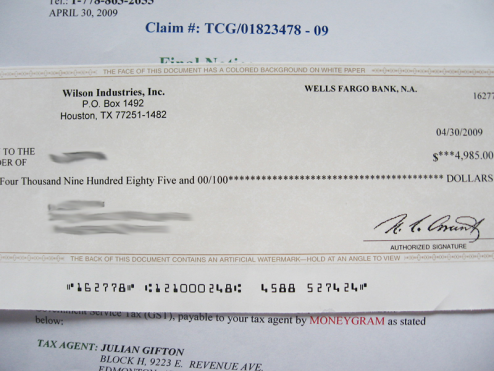

Look Out For These Check Scams

Check fraud has been around as long as checks, and even though technology is fast rendering the old-school payment method obsolete, check fraudsters have still gotta eat, so they’ve just got to try that much harder to con you out of your money.

Congratulations! You Just Won A Scam!

Is there anything scammers won’t try in their attempts to disguise advance fee fraud? Nope. Chelsea and her husband just found out that OMG THEY JUST WON 350K!!!1! from the Gaming Association of America. They’ll be receiving their check shortly, but in the meantime the GAA has sent them a much smaller check for about $5,000 to cover any fees associated with the prize. All they need to do is contact the “non-government service tax agent (GST)” to take care of cashing and handing over that $5k, and they’ll be swimming with hookers in champagne-filled pools.

Bank Of America Charges You To Cash Its Own Checks If You're Not A Customer

Bank of America doesn’t think cashing checks drawn on its own accounts is a service that should be free to no-name people who come in off the streets—they want $6 for that privilege, one reader recently discovered.

Help, This Restaurant Won't Accept My Restaurant.com Coupon!

Adam bought a gift certificate coupon from restaurant.com, but the restaurant where he tried to use it turned him down: “They informed me that restaurant.com had started selling certificates to their restaurant without the restaurant’s knowledge or approval.” Now he wants to know what to do.

Qchex Shut Down, Scammers Everywhere Weep

ArsTechnica reports that a judge has ordered Neovi, the company behind Qchex, to immediately stop offering their service, which allowed people to create and send checks drawn on any bank so long as they provided the account info. As you can imagine, this led to abuse by scammers who would use Qchex to create fraudulent checks.

GameStop Pays Its Employees In Hidden Fee "Cash Cards"

Remember our post on student loan debit cards? The cards are pitched as a great convenience, or less expensive to distribute than paper checks, or more secure, when in reality they’re germy with hidden fees that slowly nickel and dime your balance. Turns out, GameStop uses a similar system to pay its employees.

Stop Payment Orders On Checks Only Last Six Months

Jennifer says National City Bank has contacted her fiance to inform him that the stop payment order he placed on a check is about to expire, and he’ll have to pay another $32 fee to renew it for six more months. She writes, “Have you heard of stop payment now only being ‘suspend payment for six months’? This seems to me to be extortion.” We’re going to come down on the side of the banks in this case—but because of the recurring nature of the fee, it might just be cheaper to close the account.