For as long as we can remember, paying with a credit card required you to sign your name on the dotted line. While this system has changed over the years — mandating your John Hancock only for purchases over a certain amount — MasterCard is perhaps planning the biggest change of them all: The payment company will eliminate signature payments altogether. [More]

payments

Half Of America Is Not Prepared For A $100 Emergency

If you opened your mailbox today and found that you owed the city $100 and you had to pay it right away, would you be able to? A new report claims that nearly half of us are not prepared to absorb this cost, and more than 1-in-4 Americans is up a creek if they have to unexpectedly pay as little as $10. [More]

People Paying Back Student Loans Could Also Be Hurt By Outage Of FAFSA Tool

A Department of Education decision take down an online tool that helped student loan applicants file for aid isn’t just making things difficult on students. It’s also a problem for those who are repaying their student loans through a federal payment plan. [More]

Rumors Swirling Again Over Possible Apple Peer-To-Peer Payment System

It’s like we fell asleep and woke up in 2015: Once again, the rumor mill is whirring along with claims that Apple is working on a Venmo-like peer-to-peer service that would allow people to transfer money to each other with the click of a button. [More]

MasterCard Testing Chip-And-Fingerprint Payment Verification System

While many consumers are likely just getting used to their more secure, but far from perfect, chip-and-signature payment system and others are beginning to use a chip-and-PIN system, MasterCard is testing yet another secure transaction option: chip-and-fingerprint. [More]

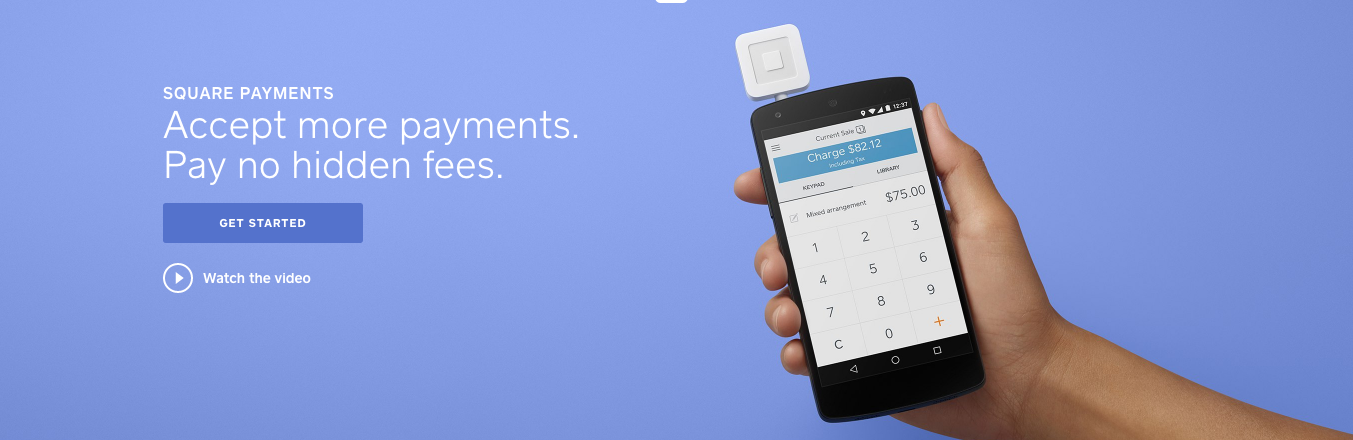

Square Payment Systems Restored After Two-Hour Outage

Some small business owners around the country were doing very little business for a few hours this afternoon, thanks to a widespread network outage for mobile payment system Square. [More]

Kohl’s Appears To Break Own Policy By Not Refunding $1,500 Credit Card Overpayment

When you overpay your credit card, should you be able to get a refund? One Arizona family accidentally paid their Kohl’s credit card bill twice, but the retailer refused to refund their $1,500, even though Kohl’s policies and federal regulations require it. [More]

Fitbit Kills Off Its ‘Coin’ Payment Service; Devices To Become Useless When Batteries Die

Last year, wearable fitness tracker/fitness watch company made a surprising acquisition, buying the payment company Coin with no plan to continue its products. Instead, Fitbit planned to kill off Coin’s own product and integrate the company’s payment technology into its own wearable devices. Now the service will be shutting down next month, and Coin magnetic stripe devices will work for as long as their batteries last, or until your payment card number changes. [More]

PayPal Now Lets iOS Users Send And Request Money With Siri

Don’t feel like tapping or swiping around on your phone, but have to pay your buddy $17 for all that pizza you devoured last night? If you’ve got the PayPal app on an iOS device, you can now just tell Siri to do it. [More]

Ticked-Off NFL Player Pays $3,900 Car Shop Bill Entirely In Coins

Carolina Panthers fullback Mike Tolbert was apparently so displeased with the service he received from a car shop that he paid the business almost $4,000 using nothing but change. [More]

Facebook Testing Messenger Feature That Prompts You To Pay Your Friends Back

If you’re the kind of person who’s always forgetting who you owe for dinner, cab rides, or coffee, Facebook Messenger is testing a new feature that will gently nag you into paying your pals back. [More]

Investigation At Wendy’s Turns Up Malware, Payment Breach At 300 Restaurants

Remember the suspected payment data breach at Wendy’s restaurants from earlier this year, which resulted in a class action lawsuit almost right away? It took a few months, but Wendy’s has confirmed that they did experience a breach dating back to fall 2015, and they’ve now fixed the underlying problem, which affected an estimated 5% of their restaurants. [More]

Yes, You Can Rent-To-Own A Dog & It’s Expensive

Rent-to-own deals — where you pay weekly or monthly installments on a purchase instead of buying it outright — are typically offered for pricier home goods, like furniture, appliances, and electronics, and often end up costing significantly more than you’d pay in cash or with a credit card. Some retailers are extending this idea to pet-buying, and just like renting-to-own a new TV or fridge, a rent-to-own puppy is going to cost you a lot more than you’d pay otherwise. [More]

6 Things We Learned About Pharma Payments To Doctors & Name-Brand Prescriptions

In news that really isn’t at all surprising — despite repeated denials from medical professionals — a new report found that doctors’ prescription habits are often influenced by the payments they receive from pharmaceutical and device makers. [More]

Retailers Have Chip-Enabled Card Readers, Aren’t Actually Turning Them On

If you’ve received a shiny new chip-enabled card from your bank or credit card company in recent months, then you’ve probably been through this at least once. You see that a store has the slot for your card, so you assume that the store actually accepts them. Silly shopper! The terminal tells you to swipe the magnetic stripe instead. [More]

Sam’s Club To Accept Visa Credit Cards As Of February 1

Shoppers at Sam’s Club will no longer need to ensure that they have the correct credit card on hand or that they’ve brought cash: as of February 1, 2016, the warehouse club will begin accepting Visa credit cards in its stores, finally making all four credit card networks accepted in its stores. [More]

Target To Be First Major Credit Card Issuer To Require PINs For Chip-Enabled Cards

While many banks and other financial institutions issuing credit cards have shifted from magnetic-strip cards to the more secure EMV smart cards, most of those companies have opted to let their customers continue signing for purchases rather than memorizing a PIN. That apparently isn’t the case for Target, which is poised to become the first major credit card issuer to convert to cards that require a PIN. [More]