Between credit cards, online payment services, and good ol’ cash, many consumers have sequestered their checkbooks into cupboards and drawers that seldom see the light of day. Still, not everyone has left their checkbooks to waste away; many consumers use the notebooks from time to time, whether it be paying a bill, rent, or other expenses where plastic or cash aren’t options. [More]

checks

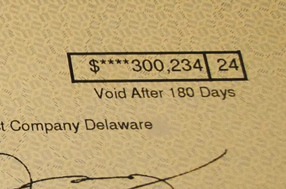

A Stop Payment On A Check Only Lasts About Six Months

When you write a check and it’s lost, stolen, or you have some other reason to do so, you call your bank and ask for a “stop payment” on it, usually incurring some kind of fee. Stopping the payment means that no one can ever deposit or cash that check, though, right? No: generally, the order lasts about six months. [More]

What’s The Fastest Way To Beam 10 Bucks To A Friend?

Let’s say that you owe a friend money, but you can’t just hand them some cash and call it a day: your friend lives in a different state. What is the easiest, most cost-effective, and most importantly the fastest way to beam money from one person to another? Over at the Wall Street Journal’s Marketwatch, staffers decided to race four different services and see how they differed. [More]

Held In The Disney Movie Club’s Enchanted Prison

Sandra was trapped. She was trapped in the enchanted prison of the Disney Movie Club. She didn’t need someone to cast a spell and set her free, though: what she really needed was to pay off her entire account balance. The problem is that the enchantment robs the Movie Club of the ability to read checks, so they dragged out her departure by logging her $35 check as a $25 one. [More]

What Teller Would Cash This Clearly Fraudulent Check?

Vanessa’s rent check was stolen somewhere between her mailbox and the property management office. It ended up in the hands of unsavory fraudsters, who altered the check in a decidedly low-tech way: with a Sharpie. [More]

HSBC Just Assumes You Want The $90 Check-Printing Service

Adam never received checks for his new HSBC account, so he stopped by his branch to order some. He must have struck bank employees as the kind of guy who demands nothing but the best, since branch employees handed him the order form for the most expensive checks. The ones that cost $90. [More]

Apocryphal And Hilarious "Letter A 98-Year Old Woman Wrote To Her Bank" Makes The Rounds Again

An amazing letter that a 98-year old woman wrote to her bank to protest a bounced check is making the rounds. She complains about a check getting bounced from her account because it occurred “three nanoseconds” before her pension got direct-deposited. She then says that going forward the bank will have to appoint a special rep to open her mortgage and loan payments, he has to use a 28-digit PIN to talk to her, and will have to go through a lengthy phone tree. It’s quite clever, but it’s not real. Not exactly. [More]

Crooks Crack Check Image Sites, Steal $9 Million

Know how when you go into your online checking account you can click on checks that you’ve written and see the scanned image of them? Well, those pictures have to be stored somewhere, and they’re not always secure. Russian crooks broke into three sites that store archival check images, stole the information, and wrote over $9 million in phony checks against over 1,200 accounts. [More]

Bank of America Makes You Renew Stop Payments On Checks Twice A Year

At many banks once you stop payment on a specific check, it’s dead forever. Bank of America has a different policy, though, the New York Times reports. Once you stop payment on a check, that’s just the beginning of a lifetime ordeal. You’ll have to renew your stoppage every six months, otherwise the check is fair game to be cashed or deposited once again. [More]

Medicare Donut Hole Checks Being Sent Out This Week

Hey people with Medicare, you’re about to become a little more attractive to scammers. That’s because this week the government will start sending out its one-time tax free rebate checks to those of you who have already hit the donut hole gap in your Medicare coverage. The main thing to know, advises Medicare, is that you don’t need to provide any information to anyone to get the rebate–it’s automatic. [More]

Someone Else With My Name Cashed My Mis-Delivered Google AdSense Check

Lee never received a check from a Google AdSense account, then tried for weeks to track it down. Finally, Google offered scans of the check, and it turned out someone else with the same name had gotten the check by mistake and cashed it through a local bank, which couldn’t determine whether or not the check was a fake and decided to “try depositing it and see what happens.” [More]

Fidelity Sent Me Someone Else's $300,000 Retirement Savings

Douglas received an unexpected delivery from UPS last week: a check from Fidelity Investments made out to Vanguard Fiduciary Trust Company for over $300,000, along with a bunch of 401(k) rollover paperwork that included the real account holder’s address, date of birth, SSN, and phone number. [More]

It's Probably A Bad Idea To Cash A Check For A Stranger

I bet if some guy approaches you on the street right as you’re about to walk into your bank or credit union and asks you to cash a check for him, you’d say no. That’s a good idea. Apparently at least two people in Madison, Wisconsin thought they were doing a good deed and helped the man out. It turns out that the checks were drawn on a closed bank account in Atlantic City, NJ. [More]

Slim-Fast Thinks Its Shakes Are Worth About 29 Cents A Can

Daniel agreed to throw away 35 cans of Slim-Fast after the company announced a recall last month over fears of contamination. He called the number provided by Unilever and provided his address, and then waited for the full refund they promised. What he got was a check for $10.20. [More]

Check Fraudster Strikes On Craigslist

Hopefully most of you know better than to ever accept a check from a stranger, but I think it’s always good to share horror stories like this one to remind people of why it’s a bad idea. The problem is, if you deposit a check that turns out to be fake, you’re the one who will be held responsible for it. Unlike credit card theft, there’s no law or rule in place to protect you from check fraud or advance fee fraud–and your bank doesn’t want to be left holding the bag any more than you do. [More]

New Jersey Wants Marketers To Stop Mailing Unsolicited Checks

Assemblyman Paul Moriarty wants direct mail marketers to stop sending out those “free money!” checks that auto-enroll you in expensive programs when you deposit them, while a senator has introduced a similar measure. “Instead of relying on tricks, companies looking to sell their services in New Jersey should go back to the old-fashioned way: earning consumers’ trust,” said Moriarty. [More]

Fewer Consumers Write Personal Checks, Fewer Retailers Accept Them

Reader broncobiker sent us the photo at left, wondering whether check acceptance policies might be getting a little out of hand. But checks have so much potential for fraud, and so few shoppers use them, that many merchants have just stopped accepting them entirely.