Nicole was hit with a surprise 6 point interest rate increase on her Citicard, so she fought back. Her story is a good reminder that you should look at all of your options and be prepared to argue on your behalf, even if you’re not in a position where you can just pay off the entire balance and walk away.

budgets

Use Prosper.com Loan To Get Lower, Fixed, Interest Rate

Blogging Away Debt wrote about the 7 things she did recently to cut her finance charges from $400/month to zero, and one interesting one was using a loan from peer-to-peer lending site Prosper.com to get a break on interest rates:

Maximize Your Netflix Membership With FeedFlix

We first discovered the very useful FeedFlix back in May, and since then the site’s been updated to present more data on how well you utilize your Netflix membership. By pasting in any of your private Netflix RSS feeds, you’ll see a breakdown of your activity stats, like how long on average you keep titles and your average cost-per-rental. A handy new feature is the “email alerts” function, where you’ll receive a weekly reminder if you’ve kept a title past a certain number of days. We’ve included a screenshot below.

5 Expenses To Cut Right Now If You're In Debt

Let’s say that like so many storied former-investment-banking-giants, you, the average consumer, have found yourself over-leveraged (wink, wink) and are looking to clean up your act before the whole thing falls down around you like the house of cards it is. Well, since you can’t increase revenue at will, you’ll have to decrease your costs. Where should you start? Here are 5 expenses that you can cut right now — so you can take the extra cash and throw it at your debt.

12 Signs You're Addicted To Debt

The headlines are screaming that America is more addicted to debt than crack. Then there are people out there who actually have a psycophysical need to spend spend spend. Are you one of them? Is your partner or friend? These are the 12 warning signs to watch out for…

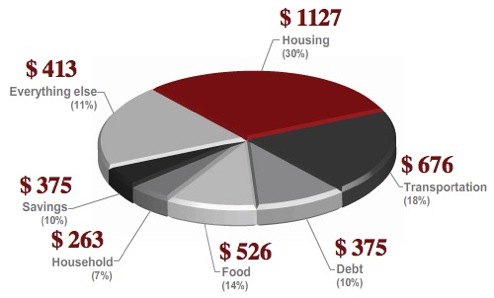

On The Money's Budget Calculator Helps Guide Your Monthly Spending

On The Money’s budget calculator makes it easy to determine how much you should be spending across the seven categories that make up any responsible budget. Regardless of income, tracking and limiting your overall spending is a foolproof strategy for keeping your accounts in the black. Though the percents will vary according to geography and personal situation, On The Money’s calculator gives you a quick glance at concrete spending targets that you can compare against your credit card bills and bank statements. Give it a try and tell us in the comments what other tools you use to control your spending.

Staying Out Of The Red Is The New Black

All of a sudden, everyone is interested in how their banks, credit cards, credit scores, credit reports, mortgages, and money actually work. Staying out of the red is the new black. Have you found yourself talking more about money matters and strategies with friends, family, co-workers, and even strangers?

Reader Saves $425 By Saving Save Every $5 Bill

Brandon Savage writes that he’s having success with saving by taking the advice in our “Get Rich By Saving Every $5 Bill” post. Since starting in August, he’s got $425 in additional savings this way. Here’s how he does it:

Make Converting Bank Transactions Easier With Sites Like Wesabe Or Mint

One unpleasant surprise about switching to USAA from Washington Mutual is that I could no longer download all my transactions in .CSV format. When I was with WaMu, this made it very easy to import all my banking into my tricked out Excel sheet I use to manage my finances. USAA only lets you download in Quicken or Microsoft Money’s proprietary formats. Cutting and pasting the transactions as they appear on the website, even in Print mode, still is less than perfect. What I found out though is you can use a personal finance management site like Mint or Wesabe to do most of the grunt work for you. UPDATE: Reader Stephen pointed out there is a handy link at the bottom of the USAA page that lets you export as .CSV. I didn’t see this link because I was looking at the “download fund activity link,” which doesn’t have a .CSV option.

Rent Your Next Wedding Cake!

We’ll admit, there’s a small part of us that’s impressed with the idea—save money on your wedding by renting a fake super fancy cake, and serve the guests a far cheaper sheet cake! But then we think about the bloated ecosphere of wedding planning, and how pointless it all is, and how nobody stays together anyway, and how “the perfect wedding” is all about vanity and wish fulfillment instead of expressing your love… and then we like this idea even more.

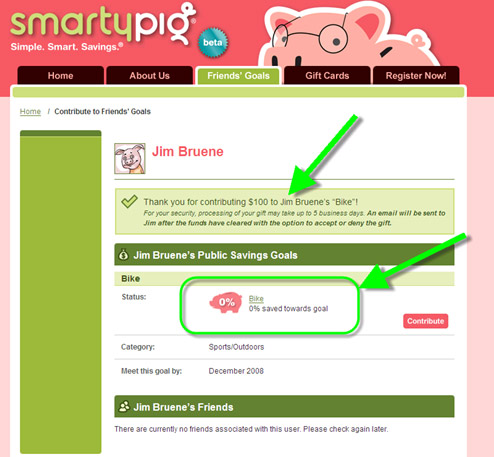

Save For Specific Goals With SmartyPig.com

“Saving up.” It’s nearly an alien concept in this “buy with debt” world, but into that breach steps SmartyPig. The site lets you set and save for specific goals in their online savings accounts at a competitive 3.9% APY savings rate. There’s all sorts of built-in graphs and widgets to track your progress, but then you can make it social, if you like, by making a page where your goals public and having friends and family or other random people on the net (export to Facebook, etc) track and root for your progress, or even contribute to your goal.

BoA's "Keep The Change" Program: Worth It?

What do you think of Bank of America’s “Keep The Change” program? How it works is every purchase you make with your BoA debit card you make gets rounded up to the next dollar. The difference between that and the actual price gets moved from your checking to your savings account. The idea is to help people save. Good idea, but there’s some potential downsides I can see:

Use Snowball Method Spreadsheet To Pay Off Debts

Do you have so many credit cards that you could sew a pair of pants from them? Confused as how to get rid of them? Try this handy Excel spreadsheet to generate a custom strategy for becoming debt-free.

4 Unusual Ways To Save Money

BusinessWeek has put together one of those accursed slideshows of 25 ways to save money, and while a lot of them are things you’ve heard before (use credit cards wisely! buy generic or used!), there are a few less common tips that you might not have considered. Here are four that caught our attention.