We were fascinated to discover today that Walt Disney reused animation cycles across different movies—the characters are unique (sorta) but the motions are cel for cel copies. It looks like the movies that reuse animation are from that infamous era in the 70s and 80s when Disney’s animation unit cut too many corners and churned out less “classic” fare. Well, they were copying classics—shouldn’t that count for something? Video clip below.

budgets

Suze Orman Says Build Up Emergency Cash As Much As Possible

In Suze Orman‘s most recent book, “2009 Action Plan,” she urges people with credit card debt to pay off their balances as quickly as possible using the high interest first method. “The fact that you pay just the minimum is a huge warning signal to your credit card company,” she writes, “that you may already be on shaky ground.” Now she’s changed her mind and says you should just pay the monthly minimum and put the rest of your money toward building an emergency cash stash. Based on the way credit card companies have been behaving, we think she has a point.

Private School Tells 300 Students To Pay Up Or Get Out

A new quarter just started this week at Marian Catholic High School in Chicago, and on the first day back, 300 students were pulled out of class and lined up outside the school, then told to contact their parents and pay their outstanding tuition or they’d have to leave. The Chicago Tribune writes that “by lunchtime, about 100 students were sent home-some confused, some embarrassed and a few angry.” The school says parents owe around $450,000 in outstanding tuition payments, far higher than usual, and that they’re trying to avoid layoffs and other budget cutbacks. Will the poor economy lead to higher attendance at public schools? “If you want a good education, you have to dish it out,” one parent told the paper.

Save Money On A Funeral

Someone wrote to us this week that a person in his family is terminally ill, and that he was told “that the cost of the casket, funeral, viewing, and burial would possibly exceed 12,000 dollars.” He thinks that’s an “exorbitant amount of money,” and so do we. There is no reason to pay that much money for a kick-ass funeral that people will be talking about for years to come. You don’t need to be a cheapskate to manage this, either—you just need to be aware of your rights and know what traps to watch out for. Here’s our list of what to do the next time you have to plan a funeral.

T-Mobile Customers Can Take Advantage Of Cheaper Plans Starting Today

The rumor was true—T-Mobile has started offering cheaper unlimited voice plans to existing customers. Matthew wrote to us, “The TMO loyalty plans are showing up on the site as of today…we just moved to the Unlimited Loyalty Family Plan at $89.99, which is $10 cheaper than the 2000 minute Family Plan we’d been on.”

Five Things Worth Paying For In A Recession

Just because the economy is imploding doesn’t mean you should entirely freeze your spending. The Wall Street Journal brings us a list of five things that are well worth their price, even in a recession.

Save Money by Spending Money

With the economy in the dumper, saving money is back in style. Simply comparing the number of “how to save money on (fill in the blank)” articles this year versus a couple years ago, our informal research shows the relationship at 234,000 to 1. Ok, so we made that up. But it does seem like savings tips are all the rage these days. Unfortunately, the key is finding new money saving ideas…

Oh No, People Can't Afford Stupid Crap This Valentine's Day

Yesterday I passed by a Godiva store in midtown Manhattan and saw that it was packed with frustrated looking men in suits lined up to the door. It reminded me of how manufactured this particular holiday is. After all, these men hadn’t all shown up at the same store, on the same day and for the exact same reason, spontaneously; it took years and years of conditioning. But is there room in the new Poor America for the sort of spendy nonsense that Valentine’s Day demands? The New York Times takes a look at how people are cutting costs, and ignoring mass-marketed fauxmance for cheaper and more personalized experiences.

Watch Out For Supermarket Price Spikes

A penny-pinching reader discovered that Giant Eagle—a supermarket chain that heavily promotes a savings club where you earn slight discounts on gas—has some jacked up soup prices, especially on their private label. Remember, if you’re not comparison shopping among local supermarkets, you can expect easy-to-miss price spikes like this one to wipe out any savings you thought you were getting.

../../../..//2009/01/28/save-money-by-polishing-your/

Save money by polishing your shoes with a banana. Monkeys have been doing it for millennia. [Huffington Post] (Thanks to daveburdick !)

../../../..//2009/01/27/heres-a-resource-to-help/

Here’s a resource to help you determine whether your library lends digital media such as audiobooks and ebooks. It also helps you locate other libraries that offer digital lending. [Overdrive] (Thanks to jojo319!)

So, Why Is The Price Of Gas Rising Now?

I just don’t get it. Does Consumerist know of a good media source that has a *current* (i.e., in the last week or two) breakdown of why the heck gasoline prices are rising 10 cents a week and more in the last month?

Oprah & Orman Give Out Free Book: "2009 Action Plan"

“Suze Orman’s 2009 Action Plan” is free to download from Oprah.com for the next week. Unlike last year’s “Women & Money,” this book is intended for pretty much everyone. We haven’t read it, so here’s a line from the Amazon editorial review: “There are safeguards to put in place, actions to take, costly mistakes to avoid, and even opportunities to be had, so that you are protected during the bad times and prepared to prosper when things take a turn for the better.”

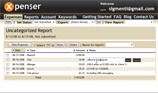

Track Expenses Easily With Xpenser

Looking for a “fire and forget” way to track your expenses and receipts? Check out Xpenser. You can submit data from any device or even phone them in, and Xpenser takes care of putting it all together. Plus it’s free. [Xpenser]

../../../..//2008/11/20/if-you-have-an-account/

If you have an account with Mint, and you’ve enabled mobile alerts, you can now text “Bal” or “Balance” to 696-468 (MyMint) and receive a summary of all of your accounts. [Mint]

20% Of Citigroup Cardholders Can Expect Rate Increases For 2009

If you have a Citigroup-issued credit card and you haven’t had a rate increase over the last two years, expect to be notified of a 2-3% rate increase on your November statement. Congratulations! You’re going to help Citigroup offset its losses in the global credit card division, whether you were directly part of those losses or not. As the New York Times points out, by doing this Citigroup is breaking the promise they made to Congress in 2007 that they would not arbitrarily raise rates on accounts—which may be why they’re offering a fairly lenient opt-out policy.