Are you a coupon clipper? No? Lots of people like saving money, but don’t really buy the sort of products that have coupons, or don’t have time to waste searching and clipping. These tips are for you.

budgets

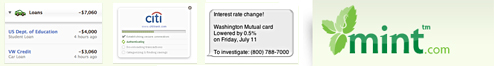

Mint Adds Loans, Mortgages, CC APR Changes

Popular personal-finance management site has added some cool new features. You can now add your student and auto loans, monitoring balances and getting reminders when it’s payment time. Over 1000 lenders were added. Mortgages are now supported, letting you set auto-reminders for when payments are due. The site also now tracks your credit card interest rate, sounding the klaxons when your rate goes up. This gives you a chance to negotiate a better rate (here’s a sample script) or port your balance to a lower-rate card (here’s how). More banks and other features have been added, with investment and home value support on the way, bringing it closer to the promise of being your free one-stop total web-based personal finance dashboard.

Sorry Telcos, Landlines Are Now A Luxury Expense

But in this first real slowdown of the wireless age, consumers seem to be saying that home-based telephones are expendable luxuries, like Starbucks lattes or Coach handbags. And it makes sense. Confronted with high inflation, soaring energy costs, and stagnant wages, millions of households are facing choices about which monthly bills to pay and which commitments to maintain. And if it comes down to one or the other, the mobile or the home-based land line, it’s clear which is a necessity and which is an option.

Get Rich By Saving Every $5 Bill

There’s a woman who saves every $5 bill she gets, blogs Get Rich Slowly. She’s been doing so for three years and has saved $12,000.

Succeed Through Self-Undermining!

Our post on freezing your credit cards in a block of ice got me thinking. Anything that slows, stops, or impedes making transactions can be used as a technique for limiting your spending. Whatever it may be, cutting up your credit cards, locking up most of your money in an account it takes 3 days to transfer from, giving yourself an allowance, it will be a variation on a single principle: It’s easier to put a hard limit on the future then to make the right decision in the impulsive moment. Installing some kind of an automatic hiccup can help break you out of your desire-driven action and give you the breathing room to step back and make the right choice. So if you have trouble with overspending (or overeating or any kind of bad habit) and your sheer willpower is sometimes lacking, aka, you’re human, try brainstorming ways you can trip yourself up. The world is full of obstacles, it shouldn’t be too hard to find one.

Stop Spending By Freezing Your Credit Card In Ice

If you have trouble controlling the amount and frequency of your credit card purchases, try putting your credit card in a glass of water and putting it in the freezer. This makes it so every time you want to use your credit card, you’ll have to wait for the credit card to melt. By the time the ice has thawed, your desire to impulsively purchase may have evaporated as well. I read about this in Predictably Irrational; Dan Ariely called it, “The Ice Glass Method.” Apparently, it doesn’t ruin the credit card, although it will if you try to microwave-defrost it. This method is probably only good for people who do their shopping sprees in-person. Online shopaholics would just look through the ice.

The Envelope System: The Spreadsheet-Free Way To Manage Your Cash

Want to get some kind of money plan in place but spreadsheets cause hives to burst all over your face? Then you might like The Envelope System, and No Credit Needed’s video explaining how it works. Basically, you cash your entire paycheck each pay period and then put every dollar in a series of envelopes in different categories, with set limits for each category. Once you’ve spent the envelope for that category, no more spending in that category. Change goes into a piggy bank. Excess left over at the end of the pay period goes into savings or to paying off more debt. As a very “analog” “lo-fi” “old-school” method of budgeting, the envelope system is hard to beat.

../../../..//2008/06/10/this-blogger-will-save-350/

This blogger will save $350 a year with his decision to stop drinking soda. [No Credit Needed]

../../../..//2008/06/09/consumers-are-responding-to-higher/

Consumers are responding to higher priced goods buy buying more private label items, says a Citibank analyst. The increase in market share is small—private labels occupy less than 12%—but significant enough to note for investors. Are you buying more private labels at the grocery store? [Reuters]

../../../..//2008/06/03/maybe-a-whole-generation-will/

“Maybe a whole generation will wake up and realize that collecting points on your Discover card doesn’t make you rich.” – Dave Ramsey. [TIME]

How To Say No To Charities

Trent at The Simple Dollar blog has a post about how to say no, especially to charitable requests. One of his readers describes the problem:

12 Ways To Save Money Without Scrimping

Some economists think we’re starting to pull out of our not-recession. For those of us who believe them and want to save without putting too firm a dent in our wallets, consider these twelve tips endorsed by the Wall Street Journal.

../../../..//2008/04/25/going-broke-on-100000-a/

Going broke on $100,000: A sample budget showing how easy it is for a family making six figures and with 2 kids to get sucked into deficit spending. [Dr. Housing Bubble]

10 Ways To Save Real Money

The champagne is dry and crusty, and all the hundred-dollar bills used to light cigars have crumbled into ash. It’s time to tighten our belts and get real about spending less and saving more. Here’s 10 ways to save some serious cash…

Advice On How To Raise Financially Savvy Kids

CNN asks some money experts for tips on how to teach kids about personal finance. Laura Levine, the executive director of Jump$tart Coalition for Personal Financial Literacy, says she uses a special piggy bank for her 3-year-old son—it has four chambers, “one for saving, one for spending, one for donating and one for investing,” and helps teach him that money is not just for “one thing.”