Some days, driving to the bank or searching for the right ATM, seems like too much effort to deposit a single check. Over the past few years time-crunched consumers have found some relief in the form of banks offering the ability to remotely deposit checks with a smartphone. While the technology may be convenient, a new report found certain drawback to the program, including poorly disclosed terms and conditions. [More]

banks

![Pew researchers analyzed 10 key elements of remote deposit services. [click to enlarge]](../../../../consumermediallc.files.wordpress.com/2014/11/key-points.png?w=300&h=225&crop=1)

Report: Many Banks And Prepaid Companies Lack Clear Disclosures For Smartphone Deposit Services

1-In-4 Americans Turn To Payday Loans & Other High-Cost Financial Products

When discussing the topic of payday loans — or other high-cost, short-term financial products like auto-title loans and check-cashing — there can be a tendency to treat them like something that only a small percentage of Americans use. But a new report from the FDIC confirms that 25% of us have turned to one of these potentially predatory services in the past year, and that this rate has not been going down. [More]

Service Members Deserve More Transparency From On-Base Banks, Credit Unions

The Military Lending Act attempts to shield military personnel and their families from some predatory lending practices, but a new report from the Pew Charitable Trusts claims that some traditional banks on military bases are nickel-and-diming members of the armed forces with excess overdraft fees, and a general lack of transparency.

CFPB: Michigan Bank Must Pay $37.5M For Failure To Provide Consumers With Relief From Foreclosure

Consumers facing the prospect of losing their homes have few avenues of recourse and when even one of those options is taken away, the results can be devastating. That’s just one reason why the Consumer Financial Protection Bureau announced action – to the tune of a $37.5 million – against a Michigan bank for its illegal conduct in blocking borrowers’ attempts to save their homes. [More]

Walmart Continues Acting Like A Bank, Now Offering Low-Fee Checking Accounts

It appears that Walmart is taking consumers’ willingness to do their banking outside of traditional banks to heart. The mega-retailer unveiled plans today that would put low-cost checking accounts into the hands of just about any consumer across the country. [More]

The Best Way For Students To Avoid High Fees With Campus Banking Products Is To Barely Use Them

All around the country, new and returning college students are being handed IDs they can use as debit cards or they’re being told they can have their aid disbursals deposited straight onto a school-branded card. It all seems incredibly convenient, especially for those who have limited experience handling their own finances, but these school-backed banking products are rarely the best available options for students, who could end up being nickel-and-dimed into debt.

[More]

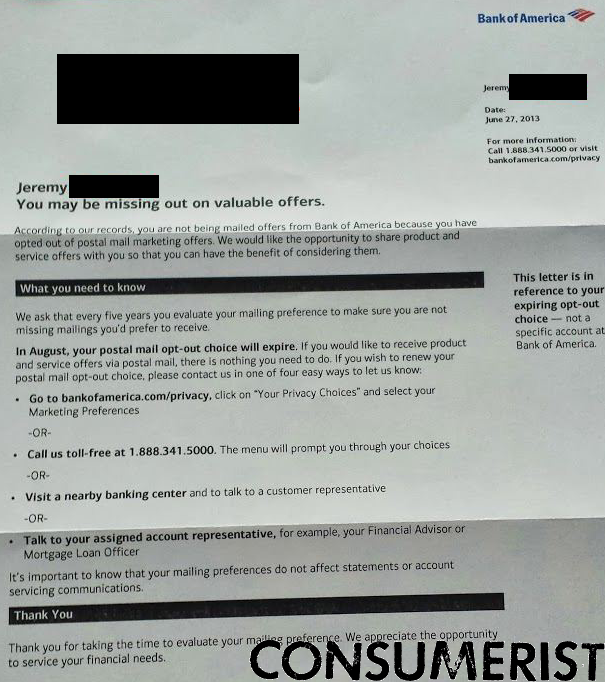

Remember: You’re Probably Only Opted Out Of Bank Junk Mail For A Few Years

Have you ever cut ties with a friend or loved one, thinking you’d never want to see them again? Have you later had second thoughts about taking the axe (metaphorically) to that relationship and wished you could rebuild what you once had? When it comes to banks, many of them just assume that people who opted out of junk mail are just sitting at home regretting that they ever stopped asking for their mailboxes to once again be filled with credit card, mortgage, and savings account solicitations. [More]

Despite Regulations Most Consumers Don’t Understand Overdraft Penalty Plans; More Rules Needed

Since 2010, financial institutions have been required to obtain an opt-in confirmation from consumers before enrolling them in overdraft penalty plans, yet a new report found more than 50% of consumers who incurred such penalty fees in the past year don’t believe they opted into any such plans. This revelation, coupled with consumers’ concerns over fees and bank practices, has led to a call for federal regulators to improve rules governing financial institutions’ overdraft policies. [More]

Criminals Stuff Macau ATMs With Malware, Extract Customers’ Money

Did you think that tiny Bluetooth ATM skimmers were a terrifying prospect? Two men in Macau are accused of using long strips that look like circuit boards to infect ATMs and digitally extract customers’ card numbers and PINs. [More]

U.S. Prosecutors Pursue Criminal, Civil Probes Against 15 Banks, Payment Processors

Government regulators create laws and initiate investigations in order to protect consumers from an array of hurtful products and companies. One such consumer fraud investigation by the Justice Department is “Operation Choke Point” and it’s resulted in criminal and civil probes by U.S. prosecutors. But some legislators see the investigation as more hurtful than helpful. [More]

Banks Inside Walmart Stores Lead Nation In Raking In Fees From Customers

A number of different banks operate branches inside more than 1,000 Walmart stores in the U.S., and many of these banks market themselves to consumers who may not be targeted by larger institutions because of low income or lack of savings and credit. A new analysis of the institutions most frequently found at Walmart found that these banks are also the most reliant on charging fees to their customers. [More]

Colorado Won’t Be Getting Its Very Own Marijuana Bank Anytime Soon

In an effort one legislator likened to throwing spaghetti noodles against the wall to see what sticks, a proposal this week to set up a financial co-op within the marijuana industry has met with a swift death. [More]

Regulators Warn Banks To Plug Any Heartbleed Security Holes ASAP

While most major services you use like Facebook, Google, Yahoo, Twitter and others have likely (and hopefully) patched up any security holes at risk from the Heartbleed bug, U.S. regulators are warning banks to update their systems as well, and quickly. [More]

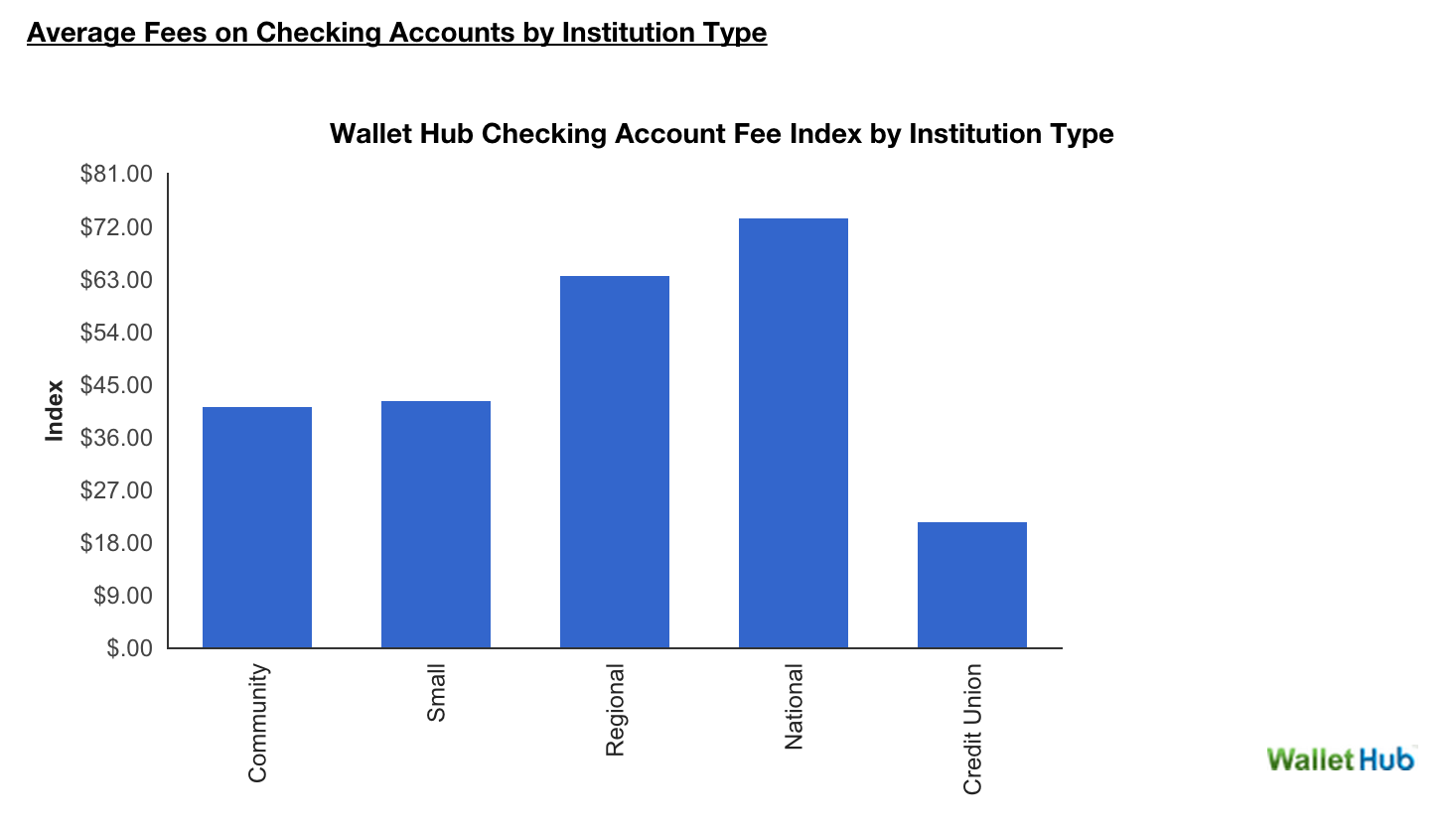

Banks Improve Disclosures, Falling Behind On Overdraft Fees, Binding Arbitration Clauses

Checking accounts come in all shapes and sizes to fit every consumer’s needs – fine, not every consumer. While options can be good when you’re shopping around for a new bank, they also lead to a plethora of fees and risks for consumers. While some practices have improved, a new Pew Charitable Trusts report shows banks have a long way to go and it’s time the Consumer Financial Protection Bureau took action. [More]

Is In-Person Banking Going The Way Of The Dodo?

When I was a child, I remember going to the bank every Friday with my mom. She’d run inside to deposit her paycheck, or pull up to the drive-thru window where the teller would sometimes put a candy in the cash envelope if he or she saw me or my siblings sitting in the car. It’s all very quaint and rose-colored now, but that notion of going to the bank on a regular basis appears to be a thing of the past. [More]

How Did Woman Who Died in 2008 Vote In 2010 Election?

We’ve been following the story out of Michigan of the woman who disappeared into her own house for more than five years, with no one noticing her absence because all of her bills were on auto-pay. As investigators try to figure out what happened to her, they’ve found another mystery: she appears to have voted in 2010, even though the evidence shows that she died in 2008. [More]

Capital One Isn’t Coming To Visit You, Probably

A few weeks ago, Capital One sent customers a contract update that told them that it could drop by their home or workplace whenever they feel like it, and call them up without disclosing their identity. Capital One must not have predicted the response from customers, since now the company really, really want them to know that debt collectors are not going to stop by for a chat. Unless it’s about your snowmobile. [More]