Last week, JP Morgan Chase CEO Jamie Dimon was a wanted man in the city of Atlanta. The city solicitor issued a warrant for his arrest. [More]

banks

VIDEO: Should I Go Credit Union Or Bank?

Sick of interest rate hikes, new hidden fees, and their credit lines cut, more consumers are trying their local credit union a shot. This CBS video takes a look at a credit union in Michigan who bought back their credit card program that they had sold to large bank after members started complaining. [More]

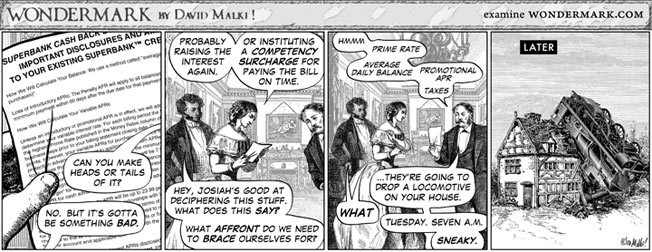

If I Read The Fine Print I Would Still Have A House

Credit card companies stuffed all the crazy they could into their contracts in advance of the CARD act taking effect. This time they might have taken it too far, even for banks. Shoulda read that boilerplate!

#599; The Boilerplate Clause [WonderMark] (Thanks to MercuryPDX!)

Is The Guy Who Bulldozed His Home A Folk Hero?

Terry Hoskins, the guy in Ohio who bulldozed his home earlier this month to prevent it from being taken back and auctioned off by his bank, is now the subject of a song. Someone else made t-shirts and caps–they feature a bright yellow bulldozer and the words, “Take ‘Er Down”–that are being sold to raise money for him. WLWT says Hoskins didn’t break any laws by dozing the home, but as he puts it, “I still have a mortgage of ($160,000). I still (have) to pay that.” [More]

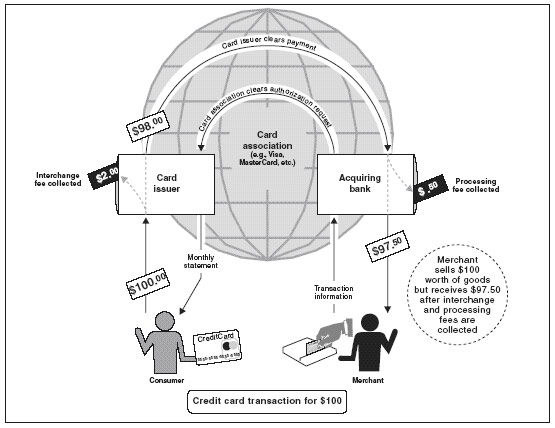

The Hidden Fee That Happens Every Time You Swipe Your Credit Card

It’s invisible to you but each time you swipe your credit card, a fee fairy gets its wings. An interchange fee fairy, to be exact. How does it work? This chart from the Government Accountability Office attempts to shed some light on the murky world of merchant processing fees. Did you know that over the past 10 years, while the technological costs of processing transactions has gone down, interchange fees have more than doubled? A cost that then gets passed on to you in the form of higher prices. [More]

"Robin Hood" Hacker Exposes Banks Awarding Secret Bonuses Despite Paycut Promises

A hacker has stolen the tax information for over 1,000 Latvian companies, and is now revealing, via Twitter, which banks did not take the paycuts they promised in return for government bailouts, and which are awarding secret bonuses. [More]

What Can $20 Billion In Wall Street Bonuses Really Buy?

After hearing Tuesday’s news that — only a year after an unprecedented federal bailout of the banking industry — Wall Street banks had rewarded their executives with over $20 billion in bonuses in 2009, we did a quick look around to see what else is worth that much cheddar. [More]

Bankers Back To Congratulating Themselves, Bonuses Up 17%

In these tough times, it’s easy to forget about the struggling bankers out there as you dodge their SUVs on your walk to the unemployment office. So it’s a good thing they have someone looking out for their financial interests — themselves. [More]

FDIC: This "Troubled Bank" List Is Getting Ridiculous

The Federal Insurance Deposit Corporation announced today that it had added 450 more banks to its troubled bank list. The list is secret, because announcing that a bank is in trouble is a good way to kill it for good. [More]

80% Of Today's Delinquent Homeowners Will Lose Their Homes

If you know 5 people behind on their mortgage payments, 4 of them are going to end up losing their homes, according to a new study released by John Burns Real Estate Consulting. [More]

Inexperienced Attorney Wins Epic Foreclosure Battle Against Wells Fargo

Consumerist’s Hero of the Weekend is attorney and writer Wajahat Ali, who fought an epic battle for a home loan modification against Wells Fargo and won. Eventually. It’s a well-written and terrifying look into the financial crisis, the state of America’s megabanks, and how homeowners in need seemingly stand no chance against the towering indifference, incompetence and confusion of those megabanks. [More]

It's Probably A Bad Idea To Cash A Check For A Stranger

I bet if some guy approaches you on the street right as you’re about to walk into your bank or credit union and asks you to cash a check for him, you’d say no. That’s a good idea. Apparently at least two people in Madison, Wisconsin thought they were doing a good deed and helped the man out. It turns out that the checks were drawn on a closed bank account in Atlantic City, NJ. [More]

Man Bulldozes Home After Foreclosure

A man in Ohio grew so angry at his bank for refusing to work with him to keep his home that he bulldozed it. He told WLWT News, “As far as what the bank is going to get, I plan on giving them back what was on this hill exactly (as) it was. I brought it out of the ground and I plan on putting it back in the ground.” [More]

How Do I Build Credit When No One Will Give Me A Credit Card?

Clarice is financially recovering from a divorce. Her husband handled all the finances, and it turns out that he had a card in her name but never paid off a $300 outstanding balance on it. Besides this card, she’s never had a credit card. Now she wants one and no one will give it to her, because of the outstanding derogatory item and lack of credit history. She’s tried applying for credit cards online, with her bank and with stores. She could get a co-sign from her father but “doesn’t want to wrap him up in all of this.” What can Clarice do? Well, the last thing she can try is to apply for a secured credit card. [More]

Break Up With Your Bad Big Bank This Valentine's Day

You know what, it’s just not working out. I’m sorry, giant bank, but it’s time for both of us to move on. This Valentine’s Day, it’s time break up with your big bank, and this website will help snip the ties that bind. [More]

Survey Indicates We All Distrust Big Banks

This may come as a surprise to exactly no one, but it looks like most customers of big national banks are less likely to believe their banks are trustworthy, according to a new Forrester poll. Even less surprising: the same poll is done every year, and it’s always the same big banks at the bottom of the list. A Forrester VP explains, “They are public institutions who are in business to make money for their shareholder and inevitably, that shows to customers.” [More]

Bank of America Screws Even Ex-Employees Of 21 Years On Mortgages

How many different ways can you screw a man? Vince couldn’t make his Bank of America mortgage, because they fired him after 21 years of service in the due diligence department. Even after he did a short sale 5 months ago, Bank of America still hasn’t cleared it off their books. Now the illegal debt collection calls start. Is new CEO Brian Moynihan powerless to stop his own company from shaking down its own employees? Let’s find out! [More]

"Move Your Money" Profiled On NPR

Last month, the Huffington Post launched a campaign called Move Your Money that urged people to support community banks. The idea is that by moving your money to a community bank, you can help put the “too big to fail” banks on a diet so that they get smaller, while at the same time help a local bank remain competitive. The NPR program All Things Considered took a look at the campaign over the weekend, and talked to some experts about whether it’s worth making the switch. [More]