V. and her parents are having a heck of a time cashing in the certificate of deposit they opened jointly. She says it just matured, but she’s in Canada (she doesn’t say where her parents are) and they gave power of attorney to another party. BofA won’t deal at all with this other person, but what’s worse, V. says they’ve taken her name off the account entirely. [More]

banks

Man Jailed For Threatening To Rob BofA After They Robbed Him

An unemployed 40-year old mechanic is in the clink after he threatened to rob Bank of America as revenge for an erroneous service fee. He’s in jail on $75,000 bond, which neither he or his 72-year old frequent surgery recipient mother can afford. The man he was arrested after he called a local news channel and told them to show up tomorrow as he was going to rob the bank. It was unclear how he planned on pulling off the heist. Maybe he was going to raise their APR without notice?

Man Infuriated By Overdraft Fee Jailed After Threatening To Rob Bank [Huffington Post]

Ally Launches Free Online Checking

Online bank Ally has launched a new free online checking account that looks pretty decent. Free ATM access, free online bill pay, free checks, with no monthly minimum balance or maintenance fees. And get this, insufficient fund fees are only $9. That’s not per item, that’s just $9 for every day you are overdrawn. [More]

Bank Sues Victim To Avoid Replacing $200k In Stolen Funds

What constitutes adequate security for a bank? PlainsCapital Bank in Lubbock, Texas says what it currently has is enough, and if after all that some crooks still manage to steal your money, it’s not the bank’s fault. The bank has preemptively sued a business customer, Hillary Machinery, to absolve itself from any liability on what it couldn’t get back from the more than $800,000 that was stolen by foreign hackers last November. [More]

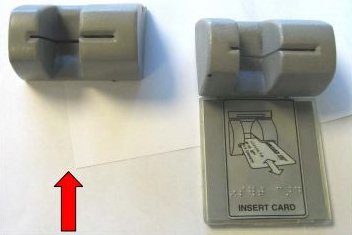

Would This ATM Skimmer Have Fooled You?

Would you have noticed this ATM skimmer, spotted on a Citibank ATM in California? The actual card slot is on the left. The skimmer is on the right. The contraption is seemingly custom-designed for this model ATM, and includes a pinhole camera for capturing victims’ PINs. Fancy. [More]

Citi: We Lost $7.6 B, But On The Bright Side, We Fired 100,000 People

Citi CEO Vikram Pandit is reassuring investors today after his firm lost $7.6 billion in 2009 by telling them to look on the bright side — at least they fired 100,000 people. [More]

Here's A Possible Way To Avoid Citibank's New Account Fees

Next month, Citibank will implement its new $7.50 fee on what were formerly free checking and savings accounts. The only way to avoid the fee is to keep a total of $1500 minimum in your linked accounts. John wrote in to tell us that when he went to his branch and asked about the new fee, they found a way to get around it. It may not work for anyone else, but it’s worth sharing. [More]

Gov To Hit Banks With New Fees

The White House could be planning to start charging banks new fees as a way to trim the deficit, get paid back for the bailout, and teach bankers a lesson they hasn’t sunk in yet. What?! A fee on banks? You’re crazy. Only banks are allowed to make up fees. [More]

Consent-Only Overdraft Protection: Maybe Not So Great

Starting on July 1st, the Federal Reserve has required banks to get consent from customers before enrolling them in overdraft protection programs so they can experience the excitement of cascading overdrafts. The problem is that consumers may be trading overdraft fees for insufficient funds fees and good old-fashioned bounced checks…and end up worse off in the long run. [More]

BoA Explains Fees With Pretty Lady On Talking Website

Bank of America launched a new sub-site to help explain their banking penalties to fee-curious customers. I always feel safer when my website talks to me and pretends to be alive so Bank of America has also included “Janet,” a walking talking video actor to help guide me through the process. I appreciate that she is wearing no belt. It sends the signal, “hey, we’re keeping it cas.” [More]

Banks Ring In 2010 With Exciting New Fees

New laws and rules affecting banks and credit card issuers go into effect soon, depriving them of their badly needed profits. Since sudden rate hikes and cascading overdraft fees are soon to be things of the past, bankers are busy formulating creative new fees. Here’s what you have to look forward to in the new year. [More]

New Rules Require Lenders To Say Why They're Gouging You

Under new rules issued by the Federal Trade Commission and the Federal Reserve Board, lenders will be required to tell consumers why they’re sticking them with high rates or other lousy terms. How will creditors perform this incredible feat? By lying, of course. No, just kidding. They’re going to give you a free credit report and a note explaining their decision. [More]

Bank Of America Names President Of Consumer Banking As New CEO

Update your EECB contact lists: Bank of America has named their new CEO. The new man in charge will be Brian T. Moynihan, who has been the president of president of Consumer and Small Business Banking since August. According to BusinessWeek, the board chose Moynihan after an external candidate dropped out of contention. [More]

This Citibank Balance Transfer Offer Sure Sounds Dangerous

RP was just offered a transfer on his Citi card by a Citibank CSR, but the CSR was kind of vague on the details of the offer and could only repeat the benefits. RP looked online while the CSR pitched the offer, and found that there’s quite a big catch in the fine print–after six months, the interest rate jumps from 3.99% to 29.99%. [More]

Why Can't Macy's Reverse This Charge On Their Customer's Debit Card?

Amanda has been having a hard time getting Macy’s to reverse an incorrect charge on her credit card–a charge that was canceled less than five minutes after it was made last week. Her story includes almost all of the things that can go wrong with customer support, including random transfers, rude employees, and broken promises. If she’d just been made to hold for 45 minutes before one of the disconnections, she’d have collected the set! [More]

Reach Chase Executive Customer Service

Here’s another Chase Executive Customer Service contact to add to our collection: [More]