If someone offers to sell you a life-changing product ranging in price anywhere from $10,000 to $250,000 — maybe more — chances are that most of you will at least attempt to negotiate that price down; only suckers pay sticker price. And yet, when it comes to a college education, it’s unheard of to call up competing institutes of higher learning to see if you can knock a few bucks off the MSRP. [More]

Education

Why Do Student Loan Borrowers Default?

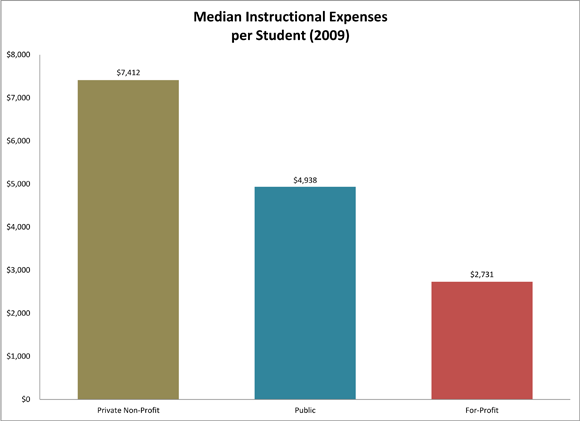

On Monday, we shared the results of a two-year Senate investigation into how much federal money is going to for-profit colleges, and what kind of return students and society as a whole are getting on that investment. (Answers: $32 billion, and a pretty terrible return on that investment.) A study that the National Consumer Law Center released yesterday shows the college bubble from a different perspective: that of student loan borrowers who have gone into default. It’s not pleasant. [More]

Report: $32 Billion In Federal Aid Going To Students At Underperforming For-Profit Colleges

Earlier today, the Senate Committee on Health, Education, Labor, and Pensions (HELP) announced the findings of its two-year investigation into exactly where the $32 billion annual investment in federal student aid is going — and whether students are getting a return on taxpayers’ investment. [More]

Citibank Doesn’t Understand The Word ‘Minimum,’ Cancels Deployed Soldier’s Student Loan Forbearance

Benjamin is in the military, and currently serving in Afghanistan. We’d thank him for his service, but Citibank says not to. They think that he’s not there anymore, and have ended the active-duty forbearance on his student loans. Calling up Citi and sending them documentation is tricky when you’re you know, in Afghanistan, but he’s doing his best. Nothing he sends is good enough for Citibank to actually believe him. [More]

Letter About 7-Cent Student Loan Bill Seems Like Efficient Use Of Government Resources

It was really thoughtful of the U.S. Department of Education’s Direct Loans program to let Puck know that his student loan payments, which he starts making in August, are too low to cover interest payments, and that some of that interest was about to be capitalized and become part of the loan’s total. It wasn’t all that thoughtful toward the environment or the program’s bottom line, though, because they printed and mailed a letter inviting him to use a forty-four cent stamp to pay off seven cents in accrued interest. [More]

Sallie Mae Bank Can’t Write You A Check, Despite Being A Bank And All

Sure, online-only banking is easy and convenient, but there are strange things that happen while the world gets used to this different way of banking. For example: JB received a call from Sallie Mae Bank that they couldn’t send him the balance of his matured certificate of deposit because they don’t have the capability to send checks to customers. Let me again emphasize that they are a bank. [More]

Student Loan Bubble Eerily Similar To Subprime Mortgage Debacle

Billions in high-interest loans being handed out to people who probably shouldn’t qualify for them, who may not understand the full terms of the loans, and who will likely have trouble paying the money back. Sounds a lot like the stories we were writing five years ago as mountains of subprime, adjustable rate mortgages were coming due, but now it’s about the massive number of student loans written in recent years. [More]

Fortysomethings Are The Worst Age Group When It Comes To Paying Back Student Loans

The group most likely to get in trouble when it comes to paying back student loans could very well have kids ready to set off on college careers of their own right now: Fortysomethings have the worst delinquency rates of all the age groups currently paying back loans. [More]

Congress Doubles Up, Extends Student Loan Subsidies While Funding Transportation Programs

As we mentioned the other day, the clock was ticking on Congress to agree on an extension to subsidies that would keep interest rates from doubling on federal Stafford student loans, and that this agreement would likely be tied to a bill recertifying lawmakers’ authority to spend money on federal transport initiatives. Well, with a vote of 373-52 in Congress and 74-19 in the Senate, that bundle of legislation is now headed to the White House. [More]

Say Goodbye To The Student Loan Grace Period

Though it looks like federal lawmakers will finally come to an 11th-hour deal to keep interest rates on federal Stafford student loans from doubling, certain programs that student borrowers have benefited from will be going by the wayside come July 1. [More]

Boehner: Congress Oh-So Close To Extending Lower Student Loan Interest Rates

The clock is ticking on the June 30 deadline for Congress to agree on a way to extend subsidies for federal Stafford student loans that would keep the interest rates from doubling to 6.8%. Now Speaker of the House John Boehner has said lawmakers are tantalizingly close to coming to an accord on the matter. [More]

Father Stuck With Dead Son’s Student Loans But No One Will Tell Him How Much He Owes

While federal student loans are forgiven if the student dies before the money is repaid, lenders of private student loans can choose to forgive the debt or go after a co-signer for the money. And just like mortgages, private student loans are bundled and re-sold again and again, leaving some parents struggling to figure out how much they owe on their deceased child’s student loan — all while being hounded by debt collectors. [More]

Show Us How Much You Owe On Your Student Loan

On July 1, interest rates on federal Stafford student loans are set to double from 3.4% to 6.8%, and lots of lawmakers in Washington seem to agree that the rates need to remain low, they can’t come an agreement on how to pay for it, meaning millions of students could be caught in the crossfire — and millions more could be added to the spreading ocean of student debt. [More]

Lawmakers Suddenly Care About Those Fee-Laden College Cards That Are Now In The News

Earlier today, we told you about the U.S. Public Interest Research Group report on how the growing number of ethically questionable partnerships between U.S. colleges and financial institutions was resulting in millions of college students being pushed toward receiving their financial aid payments on cards costing hundreds of millions of dollars in fees to users each year. The study appears to have gotten the attention of some folks in Washington. [More]

Millions Of College Students Pushed Into Receiving Financial Aid On Fee-Laden Cards

The cost of a college education continues to rise at the same time as many schools seek to trim their budgets. This means that a growing number of colleges are turning to financial institutions to handle the distribution of student aid. And that means that students all around the country are receiving their financial aid on cards that end up making money for the bank. [More]

Law Dropout Debilitated By Asperger Syndrome Gets $339,361 In Student Loans Forgiven

College debt is one of the few debts that can’t be discharged in bankruptcy, unless you have a really, really good reason. You pretty much have to be dead or have a debilitating disability that keeps you from working. So it caught the attention of the National Law Journal when a Maryland woman in her 60s had $339,361 in college debt discharged in bankruptcy court earlier this month. [More]

Sallie Mae Opts Not To Go After Family Of Dead Woman For $120K In Student Loans

As we wrote last week, while many parents consider it a no-brainer to co-sign their children’s student loans, that decision can come back to bite them later. And if that child passes away, there’s little stopping loan servicers from piling debt on the parents’ grief. But here’s one story where Sallie Mae ultimately opted to not go that route. [More]

Aspiring Nun Has Too Much Student Debt To Take Vow Of Poverty

In news stories about the student debt crisis, we hear about American young adults delaying the typical milestones of adulthood due to their student loans. They (well, we) postpone marriage, childbearing, and purchasing first homes. But what if you’re interested in a holier, more altruistic path? Men and women who want to join Catholic religious life must be debt-free before they even think about making their vows, and that’s a challenge for people who don’t realize their calling until after they’ve taken on student debt in the mid-five figures. [More]