Co-signing a younger relative’s private student loans doesn’t seem like such a reckless idea. After all, it’s an investment in their education and careers, they’ll certainly be able to pay it all back once they’re educated, and they’re going to outlive you, anyway. That’s not always the case, and the risks can be substantial. Jessica’s best friend had her grandfather, now 80 years old, co-sign her private loans with Citibank. After her sudden and shocking death, now he’s on the hook for $70,000. [More]

Education

Key Finally Decides Not To Make Family Pay Dead Student's College Loans

When a person dies and their estate is settled, any remaining debt dies with them, including student loans. But there’s an exception: if a parent or other responsible grown-up co-signs a loan and the borrower dies a tragic young death, that co-signer is on the hook for the entire amount of the loan. That’s how co-signing works, after all. But after a Rutgers student died in 2006 after two years in a coma, most of his lenders (credit cards and student loans) deferred, then forgave his debts. Key Bank was the holdout, since the student’s father had co-signed his college loans at Key. Since 2006, the family has paid $20,000 of the $50,000 balance. It took an awful lot of negative publicity, but Key says that they will forgive the debt, and might not even put future families in the same terrible situation. [More]

Effort To Keep Student Loan Interest Rates Low Gains Bipartisan Support

Yesterday, presumed Republican candidate for President Mitt Romney mentioned his support for extending the current cap on interest rates for federal Stafford student loans, meaning that this is one issue both candidates appear to agree on. The question is, can something be done before those interest rates double in July? [More]

Law Would Forbid Colleges From Using Federal Money For Advertising

The nation’s 15 largest for-profit colleges get nearly 90% of their annual revenue from federal aid programs for students. New legislation introduced in the U.S. Senate today would prevent any of that money being used on advertising, marketing and recruitment. [More]

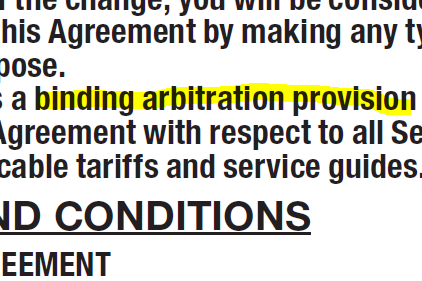

Which Worst Company Contenders Force Customers Into Mandatory Arbitration?

As we sifted through the mountain of nominations for this year’s Worst Company In America tournament, we noticed a trend of readers who cited companies’ mandatory binding arbitration clauses as a reason for nominating. And while it’s businesses like AT&T and Sony that have made all the headlines for effectively banning class action lawsuits, there are a lot of other WCIA contenders who are forcing customers into signing away their rights. [More]

Worst Company In America Round One: Sallie Mae Vs. Ticketmaster

For today’s afternoon bout, two companies that probably avoid walking down dark alleys for fear of being beaten up by angry consumers get a chance to kick each other in the teeth. [More]

130,000 Students Petition Congress To Not Double Interest Rates On Stafford Loans

While interest rates on federal Stafford loans have stepped down over the last several years from 6.8% in 2007 to 3.4% for the current school year, that number is set to bounce all the way back up to 6.8% on July 1, leading 130,000 students to deliver letters to lawmakers in protest. [More]

Are Student Loans A Ticking Time Bomb For The Economy?

Four years later, we’re still standing on the rim of a smoldering crater where the housing market used to be, pledging we’ll never let another financial disaster like that happen again. But some prognosticators worry we could soon be bracing for another blast, judging by the growing number of people who can’t pay back their student loans. [More]

Here It Is, Your Lineup For Worst Company In America 2012!

Welcome to Consumerist’s 7th Annual Worst Company In America tournament, where the businesses you nominated face off for a title that none of them will publicly admit to wanting — but which all of them try their hardest to earn. So it’s time to fill in the brackets and start another office pool. That is, unless you work at one of the 32 companies competing in the tournament. [More]

Got A Student Loan Complaint? Take It To The CFPB

The Consumer Financial Protection Bureau has opened up its latest portal for American consumers to register their complaints with various types of lenders. Now people with issues regarding their federal or private student loans have a place to connect — and hopefully reach some sort of resolution. [More]

5 Student Loan Terms To Learn

The process of applying for student loans, using them and eventually paying them back can be a decades-long class that teaches you a plethora of difficult lessons about personal finance. One of your first quizzes is something of a vocabulary test when you’re trying to wrap your head around what the terms mean. [More]

Sallie Mae Agrees To Stop Pocketing Forbearance "Good Faith Deposit" & Actually Apply It To Student Loan Balances

Working off the peitition model that forced Bank of America to back off its $5 debit card fee, one woman’s crusade against Sallie Mae’s “good faith deposits” of $50 per loan in forbearance every three months has seen some success. The fee will still be applied, but now they actually deduct it from the total loans owned. [More]

Hard-Up College Students Turning To Food Stamps

Being in college and having an empty wallet tend to go hand-in-hand. A full course load can make it difficult for students to find steady work, and in many college towns the work that’s available isn’t going to pay for very much. But while my fellow students were undergoing (legal) drug trials and donating whatever bodily fluid they could get a few cents for, some in the current generation of cash-strapped collegians are turning to food stamps. [More]

Have A Private Student Loan Horror Story? Today Is The Last Day To Tell The CFPB

We see enough horror stories about private student loans that we know there must be quite a few of them out there. If you’d like to contribute to the public good by sharing your experience, the Consumer Financial Protection Bureau would like to hear what you have to say. And if you actually had a good experience the CFPB would like to hear about that, too. [More]

A College Financial Aid Primer

Students need to call upon several sources to cover the massive expenses college drops on them. Unless they’re independently wealthy or have a large college fund set up for them, they’ll scramble to come up with the funds to pay for tuition, fees, books and living expenses. [More]

Average Student Loan Balance For New Grads Is More Than $25K

If college sent you into the real world last year saddled with $10,000 in student loan debt, take solace in the realization that there is someone out there who owes $40,000 in order to average things out. A newly released study found that the average balance of a student who took out loans and graduated in 2010 was $25,250 — a 5 percent increase from the previous year. [More]

White House Announces Plan To Cut Some Student Loan Payments

The Obama administration has announced two initiatives to lower student loan payments for some borrowers. One, an update to the existing income-based repayment program, will cap loan payments at 10% of discretionary income for certain borrowers. The other proposal will let some borrowers merge older student loans with newer ones. [More]

Dept. Of Education's New Site Giving Headaches To Folks With Student Loans

Paying your student loan is enough of an annoyance without the Dept. of Education making it more difficult. Unfortunately, the new site for the Federal Student Loan Servicing Center has people tearing their hair out in frustration. [More]