Lots of people graduate college with minimal credit histories. Repaying student loans was always a dependable way to build that history. But recent, rampant growth in student loan debt in the U.S. could slow that process for an entire age group. [More]

Education

Kentucky Sues For-Profit College Over Misleading Job-Placement Stats

If you’re comparing college programs and see job-placement rates of anywhere from 80% to 100%, that might sound pretty appealing. But what if the real numbers are not so rosy? [More]

Bankruptcy Finally Ends Father’s 4-Year Struggle To Repay Dead Son’s Student Loan

Back in June, we told you about the California man who had spent years trying to sort out his late son’s student loans, only to keep running into dead ends and and roadblocks. Now, after four years of struggling to figure out how much is owed and to whom, he’s finally getting some relief. [More]

Some For-Profit Colleges Taking “Unlimited Data Plan” Approach To Tuition

A number of recent studies have cast a negative light on the for-profit college industry. A disproportionate number of students are not graduating or unable to find jobs that pay enough to allow them to repay their student loans. With so many people concerned that these schools might be debt traps, some programs are taking a new approach to tuition. [More]

New Bill Would Take Income-Based Student Loan Payments Straight From Your Paycheck

Student Loan debt in the U.S. recently crossed the $1 trillion mark, with a good chunk of that owed to the U.S. government. In an attempt to streamline the whole process, a soon-to-be-introduced bill would replace the current system of debt collection with automatic payroll deductions tied to the borrower’s income. [More]

Sallie Mae The Subject Of Nearly Half Of Student Loan-Related Complaints

The recently released annual report by the Consumer Financial Protection Bureau’s Student Loan Ombudsman looks at the variety and nature of complaints filed with the CFPB’s student loan complaint portal since it launched earlier this year. Not surprisingly to many people with these loans, Sallie Mae’s name comes up in almost half the complaints. [More]

Study: Women Earning Less Than Men Immediately After Graduating College

For anyone who thinks that the pay gap between men and women is something that doesn’t begin until later in their careers, or that this salary disparity is a disappearing relic of a bygone era, a new study claims that within one year of graduating from college, women are only earning 82% of what their male counterparts are making. [More]

Report Shows That College Debt Is On The Rise Again For Recent Graduates

Today in discouraging news: the amount of college debt held by recent graduates is on the rise again. Two-thirds of the class of 2011 nationwide held debt on graduating, and on average those students had about $26,600 to take away with them along with their diplomas. However, those numbers don’t even include most graduates of for-profit colleges, who usually borrow a lot more than other students. [More]

University Of Phoenix Not Exactly Rising From Ashes, To Close 115 Locations

With enrollment and revenue declining, the University of Phoenix announced yesterday that it will close about half of its physical locations around the country in an effort to save $300 million.

The closed locations includes 90 learning centers and 25 campuses, accounting for a total of 13,000 students. This will leave 112 Phoenix locations in 36 states. [More]

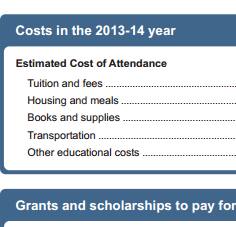

Students & Families Getting Screwed Because Schools Won’t Adopt Standard Financial Aid Letter

If you went to college, you’re probably familiar with the financial aid letters that detail — in not very much detail — the loans, grants and other assistance the school can offer. These letters vary from school to school, even though the Dept. of Education created a standard form, and it’s students and their families that pay the price. [More]

More Than 1-In-5 Students At For-Profit Colleges Default On Student Loans Within Three Years

For the first time, the Dept. of Education has provided stats for people three years into their student loan repayments, and the numbers don’t paint a pretty picture. The percentage of college students defaulting on their loans is on the rise, with 9.1% of recent students defaulting within two years of their first payment coming due, and a whopping 13.5% defaulting within three years. And at controversial for-profit colleges, that number is alarmingly higher. [More]

Study: Some State Universities Offer A Better Return On Investment Than Ivy Leagues

Sure, everyone has a hope that their kid can go to Harvard, Princeton — or even Brown, the Staten Island of the Ivy League — but a new study that compares how much graduates earn to what it cost for that framed piece of paper on the wall shows that there are many less expensive public universities that offer a better return on investment. [More]

Broke College Students Resorting To Sugar Daddies & Donating Baby-Making Cells To Cover Tuition

In case you hadn’t heard, college is like, really really expensive these days. Some students have their parents to help out, and many take out loans (even if they don’t know it). And then there are those willing to go to unconventional lengths to scrape up enough cash to cover the costs of their educations — things liked donating eggs and sperm, connecting with a sugar daddy or turning their bodies over to science. [More]

Apparently Not Many People Pay Off Their Student Loans In One Go

John had the money on hand to pay off the rest of his student loans all at once. Lenders don’t seem to get a lot of customers approaching them to do this, since student loan debt generally has lower interest rates than consumer debt. At least we’re guessing that they don’t get very many customers looking to rid themselves of all student loan debt, because they weren’t able to handle the request all that well. At least not without generating a teeny, tiny overpayment. [More]

Sallie Mae Can't Add, Thinks I Can't Pay My Bill

Reader Vanessa is paying her student loans on time. Really, she is. The problem is that she can’t manage the full amount herself right now, so the payment comes in two parts: one from her, and one from her mom. This is too difficult for our friend Sallie to understand, and they keep sending delinquency notices to Vanessa even though the monthly bill gets paid in full. No matter how many times she contcats the company about the problem, no one can figure out how to make it stop. [More]

We Cosigned Our Unemployed Son's Student Loans. Now We're Screwed

If you retain one piece of information from reading this site, let it be this one: never co-sign anyone’s student loans. Not your spouse’s student loans. Not your best friend’s student loans. Not your nephew’s student loans. Not even your own child’s student loans. It is the worst possible kind of debt to assume on behalf of someone else. The balances can be huge, the debt can’t be discharged in bankruptcy, and there’s nothing to repossess. That’s what anonymous parents M and D have learned, the very hard way. [More]

Student Loan Debt: It's Not Just For Poor People Anymore

While upper-income and upper-middle-income families have historically not needed to drink from the financial aid fountain to pay for their kids’ college educations, soaring tuition costs (and declining net worth) have forced even the well-off into taking out loans, adding to the already enormous $1 trillion ocean of student loan debt in the U.S. Surprisingly, this may end up being a good thing for the next generation. [More]

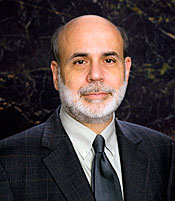

Fed Chair Bernanke: Smart Consumers Are Good For The Whole Economy

Too often when people talk about being a good consumer or being educated about financial matters, the big picture is ignored in favor of images of individual wealth and well-being. But Federal Reserve Chairman Ben “It rhymes with stanky” Bernanke says that it’s really in everyone’s best interest for us to be smart about what we do with our money. [More]