Legislators Once Again Introduce Bill That Would Allow Student Loan Refinancing

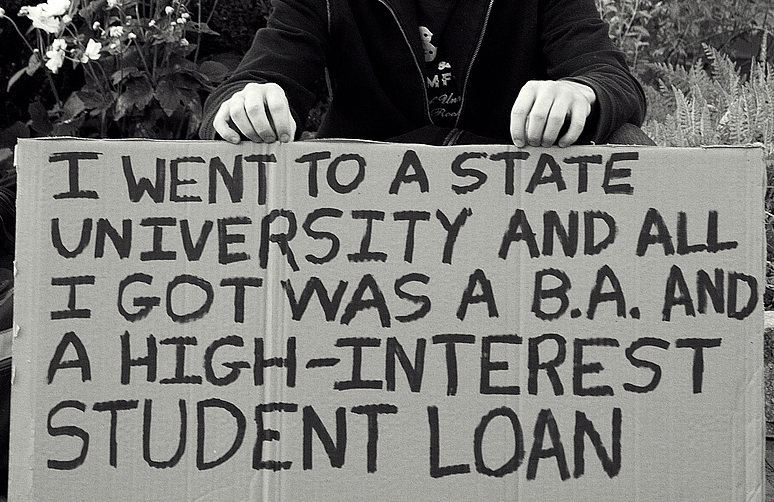

If at first you don’t succeed try again… and again, and again. That appears to be the approach members of Congress are taking when it comes to a bill that would allow student loan borrowers to refinance their private and federal student loans.

Yesterday, a number of senators banded together to once again introduce the Bank on Students Emergency Loan Refinancing Act that would allow consumers with outstanding student loan debt to refinance at lower interest rates currently being issued on new federal and private student loans.

Currently, students taking out loans pay a rate of 3.86% under the Bipartisan Student Loan Certainty Act passed by Congress in 2013. However, students who are currently repaying loans taken out several years ago are stuck with interest rates of nearly 7%.

Allowing for these loans to be refinanced would put student debt on a more level playing field with other consumer debts, such as mortgages.

“For too many of America’s young people, pursuing a college education has become a one-way ticket to a lifetime of student loan debt,” Senator Dick Durbin said in a statement. “Giving student loan borrowers the option to opt into a lower interest rate by allowing them to refinance their loans will be a financial relief to millions of families in Illinois and America.”

If the proposed bill sounds familiar, it should. Last year, the Senate voted to block the bill by only a few votes.

The previous version of the bill was introduced by Massachusetts Senator Elizabeth Warren in May 2014 and co-sponsored by more than a dozen legislators.

While full details of the new bill are not yet available, the previous version would have allowed federal and private student loan borrowers to refinance to rates set for first-time borrowers; 3.86% for Undergraduate Direct Loans, 5.41% for Graduate Loans, and 6.41% for PLUS Loans taken out by a student’s parents.

Borrowers looking to refinance their student loans would have to be current on their payments and meet debt-to-income ratios that would have been set by the Department of Education.

In addition to refinancing student loans, the bill set forth a number of tax reforms intended to enact what is called the “Buffett Rule,” a reference to billionaire Warren Buffett’s statement that he shouldn’t pay lower taxes than his secretary.

Durbin, Bustos Introduce Bank on Students Emergency Loan Refinancing Act To Tackle Student Debt [Dick Durbin]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.