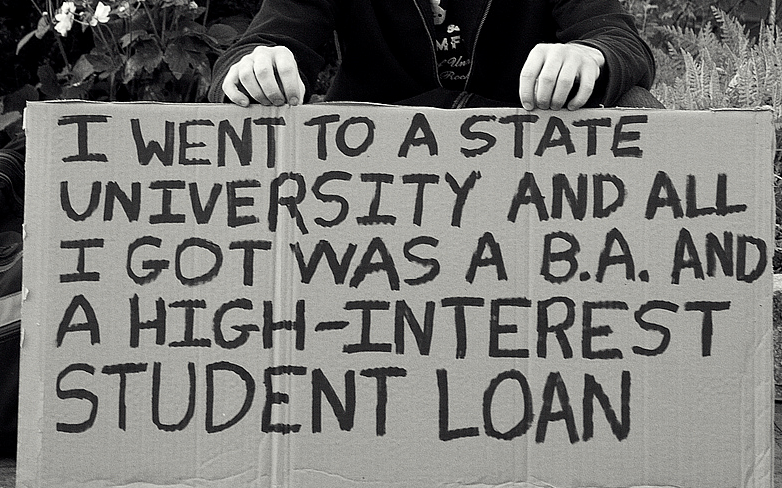

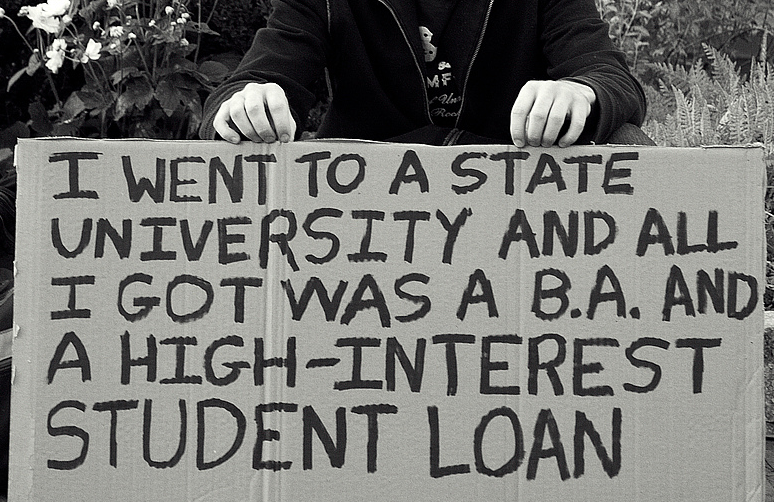

Lawmakers have renewed their support for students buried under piles of educational debt by — yet again – introducing a bill that would allow borrowers to refinance their student loans. [More]

refinancing

More Banks Are Offering Student Loan Refinancing, But Is It Really Safe & Beneficial?

For the last several years legislators have repeatedly introduced a bill that would allow student loan borrowers to refinance their private and federal student loans to the lower interest rates at which new loans are currently being issued. Although the legislation hasn’t managed to make it into law, that hasn’t stopped banks and credit unions from creating their own refinancing programs to help alleviate the debt burden for student loan borrowers. [More]

Legislators Once Again Introduce Bill That Would Allow Student Loan Refinancing

If at first you don’t succeed try again… and again, and again. That appears to be the approach members of Congress are taking when it comes to a bill that would allow student loan borrowers to refinance their private and federal student loans. [More]

Senate Set To Vote On Bill To Refinance Private & Federal Student Loan Interest Rates

A bill left for dead in the Senate back in June has been resurrected. The Bank On Students Emergency Loan Refinancing Act that would allow consumers to refinance their student loans to the rate currently being issues on new federal and private student loans is slated for a vote Tuesday morning. [More]

The CFPB Answers Your Student Loan Questions, Part 2: Repaying, Consolidating, Refinancing

Earlier today, Rohit Chopra, Student Loan Ombudsman for the Consumer Financial Protection Bureau, responded to questions from readers about applying for schools and comparing financial aid packages. In this second part, he deals with the many issues involved with repaying your student loans. [More]

Majority Of U.S. Homeowners Paying At Least 5% Interest On Mortgages

While interest rates for 30-year fixed-rate mortgages have been hovering around the 4% mark for around a year — and 15-year fixed loans have dipped below 3% in recent months — nearly 7 out of 10 American homeowners are still paying at least 5% interest on their home loans. [More]

Freddie Mac Told To Stop Betting Against Struggling Homeowners

Yesterday, it was reported that bailed-out mortgage titan Freddie Mac had invested billions in mortgage-backed securities that would really only pay off if struggling homeowners were unable to refinance their high-interest mortgages; investments that appear to put Freddie in direct conflict with its goal of making it easier to own a home. Now the federal regulators in control of Freddie Mac say they have already put a halt to these trades. [More]

Freddie Mac Sorta Hoping You Can't Refinance Your Pricey Mortgage

Even though the job of bailed-out mortgage backer Freddie Mac is supposed to be about making it easier to own a home, the traders at Freddie have reportedly been buying up investments that put the company at odds with homeowners who want to refinance their pricey mortgages. [More]

Don't Let Your Parents Fall For Refinancing Scams

Your parents may assume they have more financial knowledge than you due to their extensive experience, but you shouldn’t assume the same. New scams pop up all the time to exploit needs and trick people looking for quick fixes. If you can’t protect your parents from these types of financial traps, there’s probably no one who can. [More]

US Expands Mortgage Refi Plan A Smidge

The federal government announced on Monday an update to a program for homeowners that would let borrowers who were underwater – owing more on the mortgage than the house is worth – to refinance their loans at the new historically low interest rates of almost 4%. [More]

Warning Signs Of Online Loan Scams

With loan rates bottoming out, borrowers may feel hurried to get out there and snag a low rate for a mortgage refinancing or debt consolidation as quickly as possible. But thanks to con artists out to take advantage of borrowers, a blind rush at the most appealing numbers could lead to disaster. [More]

Fifth Third Is Jealous You're In A Committed Mortgage Relationship With Another Bank

It’s not all that interesting that Fifth Third Bank sent Jeff and his wife a letter encouraging them to refinance their mortgage: after all, they’re Fifth Third customers, but their mortgage is with another bank. What is interesting is that they just took out the mortgage a few months ago, and they went with another bank because Fifth Third turned them down. [More]

How A Disputed Item On Your Credit Report Can Screw Up Your Home Loan

Thanks to federal regulations, when you dispute an account on your credit report and the dispute is resolved in your favor, the credit reporting agency is required to remove or correct the account. Credit reporting agencies often don’t do this, though, and the Washington Post notes that it can come back and interfere with your next home loan application.

Wells Fargo Will Let You Refinance For No Closing Costs Online

If you’re saddled with a Wells Fargo mortgage, now would be a good time to slash your rate and payment through little effort by hitting up the bank’s streamlined refinancing program, which under certain circumstances lets you refi without being gouged for closing costs.

Fannie Mae Relaxes Standards For Refinancing

Bloomberg says that Fannie Mae will loosen standards for refinancing in the hopes that more homeowners will be able to take advantage of historically low interest rates.

../..//2008/01/30/how-to-use-the-drop/

How to use the drop in interest rates to refinance your home mortgage and get a better deal. [Kiplinger]

Make Sure Your Refinance Loan Isn't A "Tax Trap"

“If you fail to follow some little-known rules for calculating your home mortgage deduction, you may be writing off too much interest. Instead of saving on taxes, you could wind up owing them,” says Business Week in next week’s “Personal Finance” column.