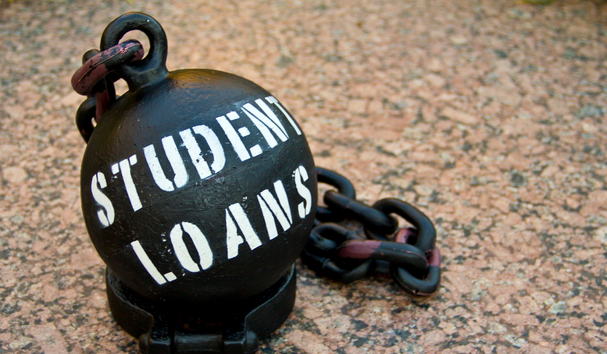

Each year, millions of college students rack up student loans that won’t come due until they leave school. But even with financial aid, some students have trouble keeping up with the soaring costs of tuition, and once that debt ends up in the hands of a collection agency, the amount can mushroom out of control while the student is still in school. [More]

student debt

Huge Collection Fees Making It More Difficult For Cash-Strapped Students To Afford College

From Forbearance To Garnishments: 5 Things We Learned About Student Loan Debt Collection

Student loans are big business, both for private lenders and the federal government. And with $1.4 trillion dollars in education debt outstanding, it should come as no surprise that these companies and the government would want to recoup these costs. However, that often comes at a cost to borrowers, from those who have fallen on hard times, to those failing to receive proper notice and options from servicers, or those who believe they were defrauded by the educators who promised them a better life. [More]

More Than A Year After Corinthian Collapse, Students Still Waiting For Financial Aid Help

Eighteen months after Corinthian Colleges Inc. completed its collapse – closing the remaining Heald College, Wyotech, and Everest University – tens of thousands of former students are still waiting to received some form of relief from the mountains of student loan debt they incurred to attend the defunct college. [More]

Amazon No Longer Marketing Private Student Loans To Prime Members

Just a month after Amazon announced it would partner with Wells Fargo to offer Prime members a discount on private student loans, nearly all traces of the criticized program have disappeared. [More]

Sorry, Class Of 2015: You Will Have To Be At Least 75 Before You Can Retire, Study Says

Retirement always feels like forever away when you’re in your early twenties. But for the young adults among the most recent cohort of college graduates, the age of retirement really is receding further and further into the distance than it is for their older peers. [More]

Legislation Once Again Takes Stab At Allowing Borrowers To Refinance Student Loans

Lawmakers have renewed their support for students buried under piles of educational debt by — yet again – introducing a bill that would allow borrowers to refinance their student loans. [More]

Court Case Illustrates Just How Difficult It Is For Borrowers To Discharge Student Loans In Bankruptcy

Students being crushed under the weight of mounting student loan debt have few options when it comes to receiving forgiveness for their debts, and bankruptcy is often the least obtainable – thanks in part to the nearly impossible to meet “undue hardship” standard. To see just how difficult and seemingly arbitrary this guideline is, all one needs to do is hear about a recent federal court case out of Maryland that determined a woman couldn’t escape her debt obligation because she had failed to make a good faith effort in repaying the loans despite the fact she’s unemployed, disabled and living below the poverty line. [More]

Student Loan Borrower’s Bill Of Rights Would Reform Disclosure And Servicing Standards

In recent weeks, legislators have introduced a range of bills aimed at addressing student loans and revamping the laws governing those debts. Today, that push continued with the reintroduction of a bill that would ensure student borrowers are treated fairly and understand the range of options at their disposal. [More]

Legislators Once Again Introduce Bill That Would Allow Student Loan Refinancing

If at first you don’t succeed try again… and again, and again. That appears to be the approach members of Congress are taking when it comes to a bill that would allow student loan borrowers to refinance their private and federal student loans. [More]

Senators Chastise Govt. For Making Money Off Struggling Student Loan Borrowers, Not Offering Enough Relief

For several years now the government has offered federal student loan forgiveness programs aimed at helping borrowers to avoid defaulting on their debts. While recent reports have shown that the popularity of the programs has exceeded expectations, a group of six senators say the Department of Education could do more given the billions of dollars in payments it receives from federal loans each year. [More]

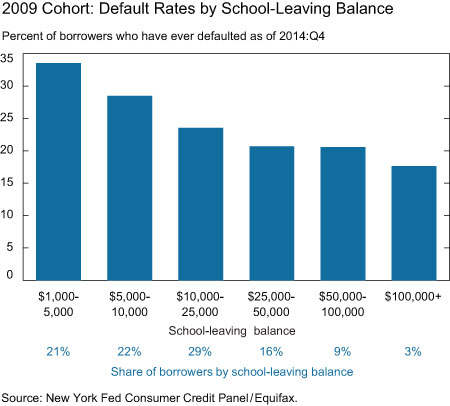

Why Are Borrowers With Less Student Loan Debt More Likely To Default?

Just days after the Federal Reserve Bank of New York showed that student loan delinquency rates were once again on the rise, a new Fed report finds it’s student loan borrowers with the lowest levels of debt who typically are the most delinquent.

[More]

Man Allegedly Takes Out $262,000 In Student Loans Under Stepdaughter’s Name, Doesn’t Use It For Tuition

Here’s the thing, when you take out student loans you sign a promissory note saying you’ll use the funds to pay for tuition related costs. If you don’t, then you’re committing something called student loan fraud. That’s apparently the case for a Pennsylvania man who must now stand trial for taking out hundreds of thousands of dollars worth of student loans in his stepdaughter’s name only to use the money himself. [More]

Report: Nearly Half Of College Students Don’t Know How Much Their Tuition Costs, If They Have Student Debt

Over the past year we’ve read a number of reports that shone a light on just how prevalent student loans are: nearly 40 million consumer have taken out at least one loan to pay for their education. Now a new report takes a look at just how much students actually understand about the cost of their education and student debt. And, as we all probably should have expected, the findings aren’t exactly pleasant. [More]

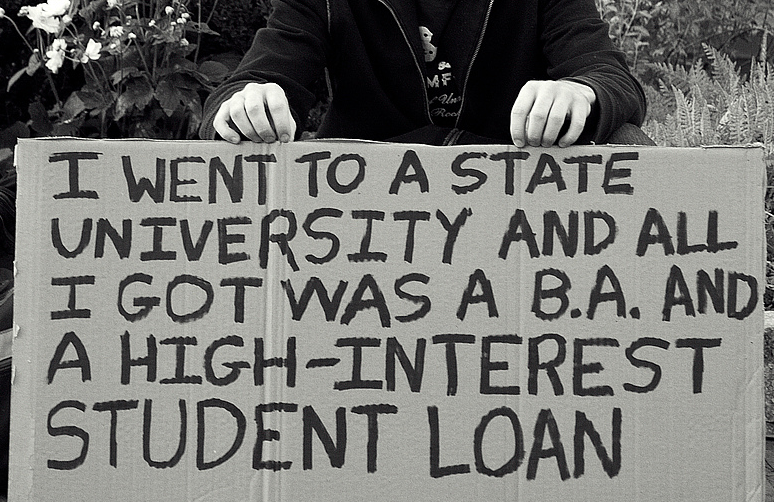

Loans & Stripping Aren’t The Only Ways To Pay For College — We Want To Hear How You Did It

With the price of tuition increasing each year and more families unable to save for future college costs, prospective students often turn to private and federal student loans to finance their education. But with one-in-three student loans currently considered delinquent and the weight of student loan debt burdening borrowers well into retirement, many consumers are seeking out other ways to pay for their post-secondary education while remaining relatively debt-free. [More]

College-Educated Consumers With Student Debt Have Median Net Worth Of Just $8,700

It’s no surprise that most college graduates leave with a degree and an excessive amount of student debt. But what was once promoted as a gateway to a better life has left graduates under 40 with lower accumulated wealth and a lower level of satisfaction in their financial situation. [More]

Apparently Not Many People Pay Off Their Student Loans In One Go

John had the money on hand to pay off the rest of his student loans all at once. Lenders don’t seem to get a lot of customers approaching them to do this, since student loan debt generally has lower interest rates than consumer debt. At least we’re guessing that they don’t get very many customers looking to rid themselves of all student loan debt, because they weren’t able to handle the request all that well. At least not without generating a teeny, tiny overpayment. [More]

Law Dropout Debilitated By Asperger Syndrome Gets $339,361 In Student Loans Forgiven

College debt is one of the few debts that can’t be discharged in bankruptcy, unless you have a really, really good reason. You pretty much have to be dead or have a debilitating disability that keeps you from working. So it caught the attention of the National Law Journal when a Maryland woman in her 60s had $339,361 in college debt discharged in bankruptcy court earlier this month. [More]