A new piece of federal legislation would delay consumers’ ability to hold businesses legally accountable for failing to comply with the Americans with Disabilities Act (ADA) — a move that some critics say could allow companies to never comply with the ADA in the first place. [More]

legislation

Feds Release Guidelines For Self-Driving Cars, But Does It Really Matter Yet?

While we might dream of a day where we can sit behind the wheel of a vehicle reading a book or watching a movie, all while the car drives itself, that day remains many moons away. But here’s the thing about technology — it changes, and it changes quickly. To that end, federal safety regulators are working to ensure that carmakers create safe systems to prepare for the day that self-driving vehicles are actually on the road. There’s a catch, though: It’s all voluntary. [More]

With 30 Hot Car Deaths So Far This Year, Lawmakers Once Again Push For Alert Systems

More than 30 children have died in hot cars so far in 2017, and two of those deaths occurred just last weekend. In an attempt to prevent these tragedies from happening, a group of lawmakers have once again introduced legislation that would require cars to be equipped with technology — that already exists — to alert drivers that a passenger remains in the back seat when a vehicle is turned off. [More]

Don’t Strip Consumers Of Their Right To A Day In Court, Say Advocates, Senators

Last week, bank-backed lawmakers revealed their plans to pass fast-track legislation that would undo the Consumer Financial Protection Bureau’s recently finalized rules that prevent banks and other financial institutions from stripping customers of their constitutional right to a day in court. Now, consumer advocates are urging the rejection of the legislation, expected to be voted on this week. [More]

AGs Blast Financial CHOICE Act, Urge Congress To Reject Proposed Bill

With legislation to roll back consumer protections and gut the Dodd-Frank Wall Street Reform and Consumer Protection Act expected to be discussed by the House as early as this week, several states are urging lawmakers to reject the legislation. [More]

New Law Would Ban Airlines From Bumping Passengers Involuntarily

United Airlines’ decision to forcibly remove a paying passenger to make room for an airline employee has led to increased pressure for carriers to change their policies. A new piece of legislation wants to stop make it illegal for airlines to bump a passenger without their permission. [More]

18 States Urge Congress Not To Stop Prepaid Card Reforms

Earlier this year, lawmakers on Capitol Hill began the process of dismantling the Consumer Financial Protection Bureau’s long-awaited prepaid card rules — meant to improve transparency and curb runaway fees — that are set to to go into effect. As Congress prepares to consider three bills that would erase these rules, attorneys general from 18 states have called on legislators to put consumers’ needs over those of the prepaid card industry. [More]

Lawmakers Try Yet Again To Create Minimum Seat Size Requirement On Planes

If at first you don’t succeed, just keep proposing legislation: A group of lawmakers Thursday introduced a pair of bills that would create a seat-size standard for commercial airlines, as well as a minimum distance between rows of seats. [More]

Legislation Would Give FDA Mandatory Authority To Recall Drugs

Last month, the Food and Drug Administration confirmed that it had found varying and elevated levels of a potentially deadly toxin in teething tablets sold under the Hyland’s brand. Despite the dangers posed by the tablets, the FDA couldn’t order a recall of the products — and the manufacturer refused to. But that could change in the future, as recently introduced legislation would give the agency the authority to order mandatory recalls of drugs and homeopathic products. [More]

Lawmakers Introduce Legislation That Would Abolish The CFPB

The future of the Consumer Financial Protection Bureau continues to remain in question with yet another attack being lobbed at the Bureau this week as lawmakers introduced new legislation both in the House and Senate that would abolish the agency. [More]

Bank-Backed Congressman Introducing Law To Gut Consumer Financial Protections

Less than a week after President Trump signed a mostly symbolic executive order directing federal regulators to revise the rules established by the 2010 financial reforms, one lawmaker (whose campaign just happens to have been heavily financed by big banks) is planning to introduce legislation to scale back consumer protections and allow banks to take more risks. [More]

Congress Trying To Roll Back Consumer Protections For Prepaid Cards

Last fall, weeks before the election, the Consumer Financial Protection Bureau concluded a three-year process of trying to make prepaid cards less costly. Those new rules, which would improve transparency and curb runaway fees, are set to go into effect later this year, but not if lawmakers on Capitol Hill have their say. [More]

Retailers Ask Congress To Please Not Roll Back Dodd-Frank Debit Card Reforms

Both the banking industry and conservative lawmakers are hoping that the incoming Trump administration will agree to repeal the 2010 Dodd-Frank Financial Reforms, but many in the retail world are calling on Congress to retain at least the portion of the law involving debit card transactions. [More]

New Bot-Blocking Legislation Could Make It Easier To Score Tickets To Popular Events

About a week after New York barred scalpers from using bots to scoop up tickets to sporting events, concerts, and other popular attractions, the U.S. Congress has sent its own anti-bot legislation to President Obama to sign. [More]

Airbnb Tries More Self-Regulation In New York, Too

If the vacation-booking site Airbnb has to be regulated, it at least wants to impose regulations on itself instead of having local governments do it. While the company is starting to self-regulate in San Francisco and cooperated with the city to make rules in Chicago, it also proposed rules for itself in New York. [More]

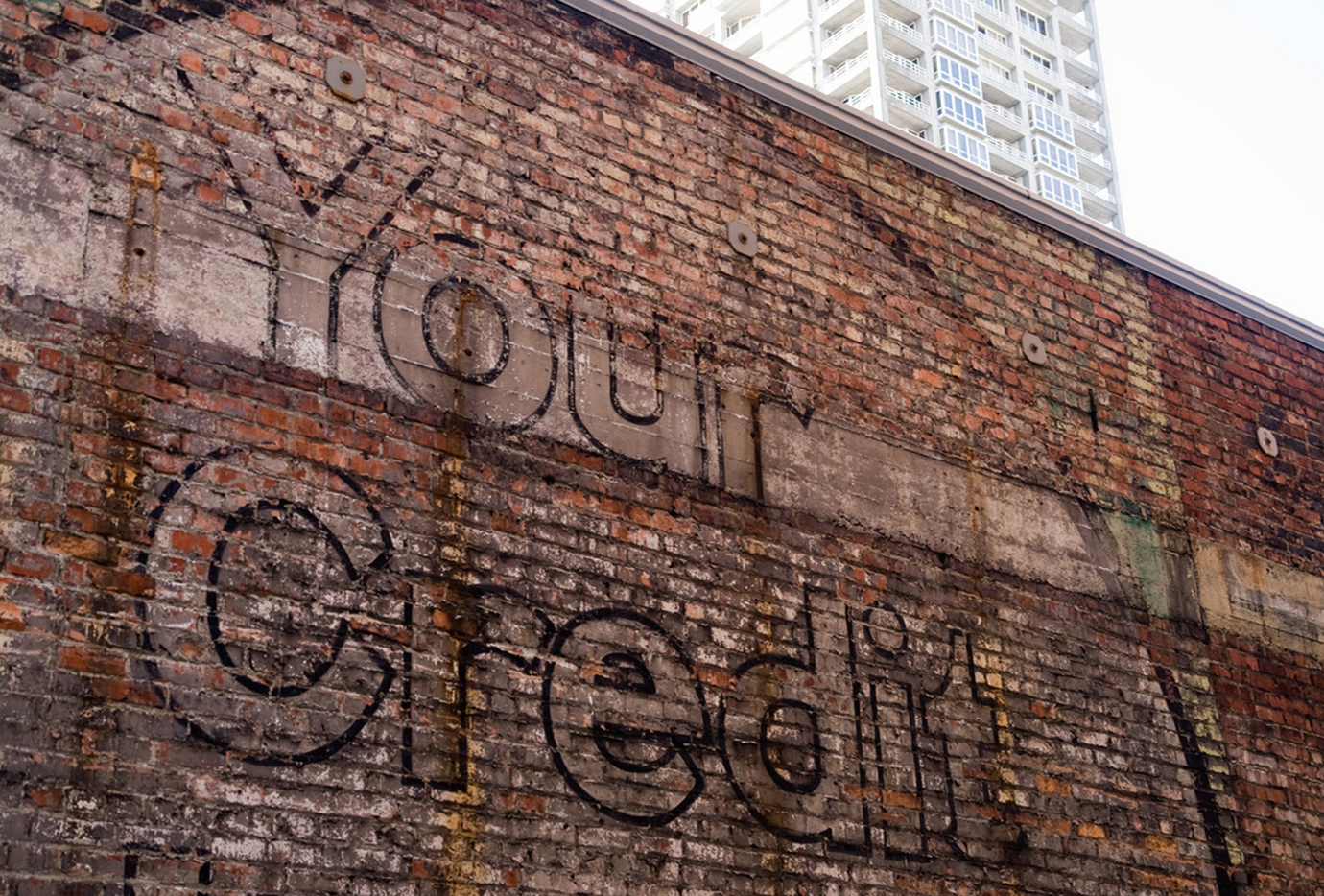

Bill Would Overhaul Credit Reporting System, Remove Debt After Four Years

Each year, thousands of consumers file complaints against the nation’s three credit bureaus — Equifax, Experian, and TransUnion. Most of these complaints are related to inaccurate information on a consumers’ credit report and the difficult time they often have in getting this misinformation corrected. That could change with the proposed overhaul of the system. [More]