The recession years had one pleasant side effect — a drop in the number of credit card offers filling consumers’ mailboxes. But now that all the banks have learned their lessons and will never again lend out money to people who won’t pay it back, they are once again ramping up the credit card offers. [More]

wells fargo

Banks Working With HELOC Borrowers To Prevent Potential Loan-Default Disaster Before It Happens

The housing bubble that imploded spectacularly in 2008, taking a big chunk of the U.S. economy with it, has a second wave waiting to strike in the form home equity lines of credit (HELOCs). Having learned from the lesson that preventing a disaster rather than recovering from one might, in fact, be a better way to go, lenders — at the urging of regulators — are now working proactively with borrowers to stave off potential doom before it happens. [More]

Wells Fargo To Pay Fannie Mae $541 Million Over Toxic Loans

All those mortgages that weren’t worth the cocktail napkins they were written on are continuing to sting big banks, with Wells Fargo announcing this morning that it had reached a $591 million deal with Fannie Mae to resolve the mortgage-backer’s claims that Wells sold it a pile of loans that the bank knew were toxic. [More]

Wells Fargo Employees Say Threat Of Being Fired Leads To Bad Behavior

A few months back, we told you about the 30 Los Angeles-area Wells Fargo employees who became former Wells Fargo employees when it was discovered they were opening bogus accounts to meet the bank’s demanding sales goals. According to a new investigative report on the megabank, Wells workers around the country are feeling pressured into behaving unethically just to avoid being fired. [More]

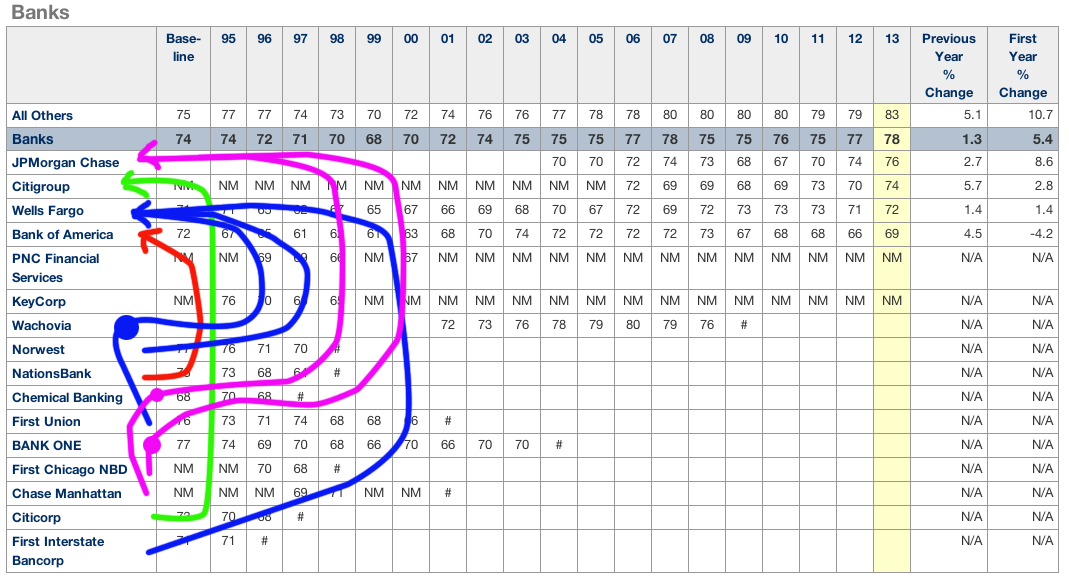

This Bank Customer Satisfaction Chart Is A Sad Reminder Of Rampant Consolidation

Maybe last week’s news that there are now fewer banks in the U.S. than ever before didn’t bother you. But here’s a chart of historic customer satisfaction scores that stands as a reminder of how so many banks have been absorbed into larger banking Voltrons in just the last two decades. [More]

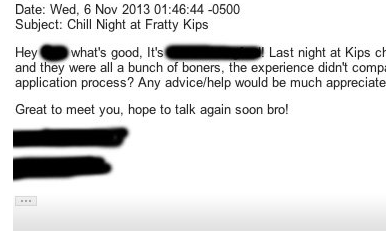

Fulfilling That ‘Banker Bro’ Stereotype In Job-Hunting E-mails Is A Bad Idea

It’s one thing (though still obnoxious) to be a brash, backstabbing alpha male when you’re out on the town with business associates. It’s another for a job applicant to be so dimwitted as to put that same arrogant attitude into an e-mail and assume it’s not going to be forwarded around, and probably end up on the smartphone screen of the very people you’re insulting. [More]

FDIC & OCC Ask Banks To Please Stop Issuing Payday Loans As “Direct Deposit Advances”

While many payday lending operations are not directly tied to federally insured banks, some of the biggest names in banking — most notably Wells Fargo — offer what are effectively payday loans via “Direct Deposit Advance Loans.” But today the FDIC and the Office of the Comptroller of the Currency have given some guidance to the banks they regulate, basically saying “That’s enough of that, don’t ya think?” [More]

Wells Fargo Fires Employees For Creating Bogus Accounts In Customers’ Names

Some people will do anything to meet sales and customer satisfaction goals, even if it means falsifying signatures, and opening bogus accounts. Which is why around 30 people in the Los Angeles area are now former Wells Fargo employees. [More]

New York To Sue Wells Fargo For Failure To Comply With $26B Mortgage Settlement

Last spring, New York state Attorney General Eric Schneiderman threatened to sue both Bank of America and Wells Fargo, alleging that the banks had repeatedly failed to comply with the 2012 $26 billion settlement between multiple states and the nation’s five largest mortgage servicers. Now the AG intends to make good on that threat by actually filing suit against Wells. [More]

Wells Fargo Settles With Freddie Mac For $869 Million

Because a few days can’t go by without one of the few remaining big banks agreeing to pay out hundreds of millions of dollars (without ever admitting any wrongdoing), Wells Fargo has agreed to settle with Freddie Mac for $869 million over — you guessed it — toxic mortgages from the Bubble Era. [More]

Wells Fargo Fails At Getting Federal Mortgage Lawsuit Dismissed

The same day that trial began in the Justice Dept.’s lawsuit against Bank of America, the DOJ had another victory in a similar suit filed last year against Wells Fargo, as the bank failed this morning in its attempt to have the suit dismissed. [More]

Banks Received $814 Million In Federal Incentives For Mortgages That Ended Up In Redefault

According to the latest report from the Special Inspector General for the Troubled Asset Relief Program (or the much-cooler SIGTARP), the nation’s mortgage servicers have received more than $800 million in incentives for making modifications on mortgages that have ultimately resulted in the homeowner redefaulting on the loan. [More]

Wells Fargo Not Winning Many Fans By Refusing To Honor $10K Owed To Kidney Patient

Back in 1982, a man purchased $11,800 in cashier’s checks from Central Fidelity Bank in Virginia and put them into a safe deposit box. The idea was that this would be his rainy-day/emergency fund. Apparently, he didn’t need this money for three decades, as he only recently attempted to deposit the checks into his account. Problem is, Wells Fargo — which now owns Wachovia, which had previously acquired Central Fidelity — claimed it had no record of these checks and refused to honor them, even after a court ordered it to. [More]

Wear A Surgical Mask Into A Wells Fargo Branch, You Might Be Mistaken For A Bank Robber

Whether it’s Patrick Swayze in a Ronald Reagan mask or a woman holding up a McDonald’s with a girdle stretched over her face, robbers will wear just about anything to hide their identity from those being robbed. But sometimes a person walks into a bank wearing a mask not because he’s a criminal, but because he just underwent chemotherapy. [More]

BofA’s Customers Don’t Hate Bank As Much As Non-Customers (But They Aren’t Happy)

It’s no secret that Bank of America is the most-reviled of the nation’s large banks, mostly for its handling of the mortgage mess, including the most recent allegations that it deliberately deceived troubled borrowers in order to nudge them toward foreclosure. But even though BofA’s customers gave it the lowest marks in a new survey of banks’ reputations, those customers don’t hate the bank anywhere near as much as people who have no financial ties to it. [More]

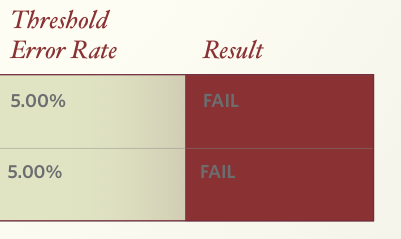

Big Banks Failing To Comply With All The Rules For National Mortgage Settlement

Remember that massive $25 billion settlement between the nation’s largest mortgage servicers — Bank of America, Wells Fargo, Chase, Citi, Ally — and attorneys general from around the nation? Well, it comes with a lot of rules for these institutions to follow. But the person in charge of monitoring the settlement says most of the banks are failing to comply fully. [More]

Wells Fargo To Pay $38.5 Million In Response To Claims It Neglected Bank-Owned Homes In Minority Neighborhoods

Add another stack of zeros to the running total of mortgage-meltdown-related cash laid out by banks, as Wells Fargo has agreed to pay a total of $38.5 million to advocacy groups and regulators to resolve complaints that the bank neglected foreclosure properties in predominantly non-white areas. [More]