We’ve heard numerous stories over the years of someone having their debit card stolen and then watching online in horror as their account was drained while waiting for someone at the bank to pick up the phone. But here’s a story of a woman who was able to nab the thief of her debit card — because he tried to buy $200 worth of toys with it right in front of her. [More]

wells fargo

Petition Demands Big Banks Give Consumers Back Our Right To Sue

Since 2011, when the U.S. Supreme Court affirmed that it was perfectly okay for companies to take away a consumer’s right to sue — and their ability to join other wronged consumers in a class action — by inserting a paragraph or two of text deep in lengthy, unchangeable contracts, the rush has been on for almost every major retailer, wireless provider, cable company, and financial institution to slap these mandatory binding arbitration clauses into their customer agreements. Now one petition is gathering signatures, calling on the nation’s largest banks to put an end to the practice. [More]

Wells Fargo Employee E-mails CEO & 200K Co-Workers Asking For Raises For All

How many times has someone asked for a raise only to have their boss say, “If I give you a raise, then everybody is going to ask for one”? One Wells Fargo worker pre-empted that part of the conversation when he e-mailed just about everyone in the company asking for raises for all. [More]

Wells Fargo Customer Learns $6,700 Lesson: Stop-Payments Don’t Guarantee A Payment Will Be Stopped

We’ve told you before about the idiotic loophole in some banks’ stop-payment policies that can allow a supposedly blocked check from being cashed after six months, but here’s a story about a Wells Fargo customer who got written confirmation from Wells Fargo that it had stopped payment on a check that had already been processed. [More]

If You’re Going To Commit $175K In ID Theft, Don’t Do It Under Your Real Name

One would think that a scammer clever enough to steal a victim’s personal data and trick some of the nation’s largest banks into helping her steal $175,000 would have the forethought to hide her own identity. But that idea apparently didn’t occur to a North Carolina who also posted helpful photos of herself online to aid police in their search. [More]

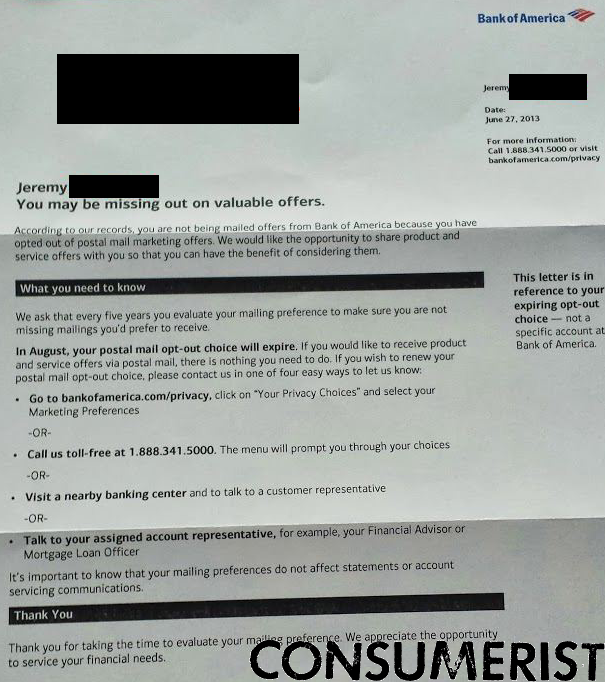

Remember: You’re Probably Only Opted Out Of Bank Junk Mail For A Few Years

Have you ever cut ties with a friend or loved one, thinking you’d never want to see them again? Have you later had second thoughts about taking the axe (metaphorically) to that relationship and wished you could rebuild what you once had? When it comes to banks, many of them just assume that people who opted out of junk mail are just sitting at home regretting that they ever stopped asking for their mailboxes to once again be filled with credit card, mortgage, and savings account solicitations. [More]

Wells Fargo To Stop Reordering Check Transactions; Should Reduce Overdraft Charges

A little talked-about way in which banks maximize overdraft fees is by processing transactions not in the order in which they are received, but in a way that results in the largest number of overdrafts. Now the folks at Wells Fargo are putting an end to this practice for its checking account customers. [More]

Here Are Some E-Mails To Consumerist That We Don’t Understand

Here at Consumerist, we receive a wide variety of e-mails: reader complaints, pleas for help, links to news articles and blog posts, bafflingly irrelevant press releases, grammar corrections, insider confessions, and funny photos. We read and appreciate all of it, but sometimes we receive messages that we simply don’t understand. [More]

Someone Returned $500,000 Taken In Wells Fargo Robbery: FBI Doesn’t Know Who

Last week, two masked robbers hit a Wells Fargo branches in Wheat Ridge, Colorado. Police believe the same pair robbed a different branch in January. They were verbally abusive toward bank staff, threatened them with handguns, and entered the vaults, taking $500,000 in the second robbery and $1 million in the first. This week, something strange happened: someone brought a third of the money back. [More]

As Fewer People Overdraft, Banks Are Raising Overdraft Fees

If you’re still opted-in to overdraft “protection” — which protects you by slapping huge fees on every purchase you make beyond the available funds in your account — you should probably opt out, as the costs associated with this lucrative system are on the rise. [More]

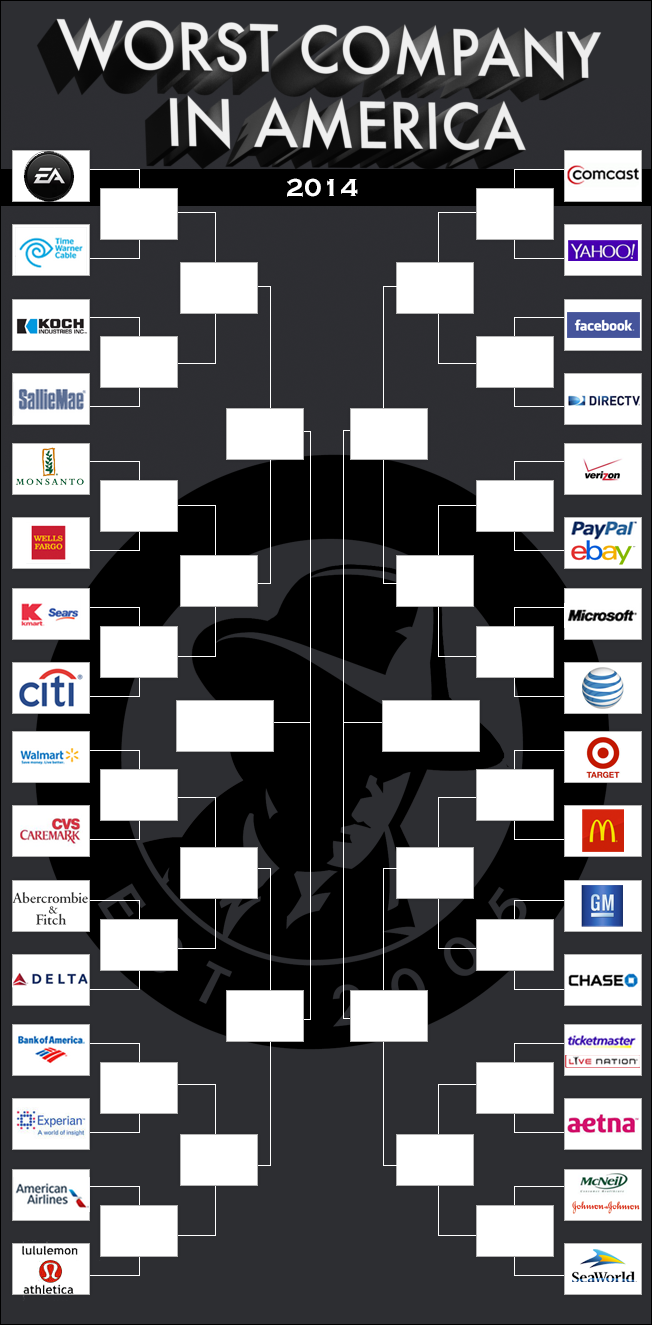

Bank Of America, Monsanto, Verizon Move On To Next Round Of Worst Company Competition

After three days of Worst Company In America voting, nine big businesses lie battered and bloody on the sandpaper mat of the WCIA Dodecahedron of Doom. But we are not here to mourn the fallen, but to hurl rotting fruit at the victors who survive to fight another day. [More]

Have Fun Breaking Down This Year’s Worst Company In America Bracket

The above bracket will be updated at the end of each day of WCIA competition to reflect that day’s results.

——————

After going through all of your nominations, then having y’all rank the contenders and eliminate the chaff from the wheat, we’re proud to present the first round match-ups for this year’s Worst Company in America tournament! [More]

Here Are Your Worst Company Contenders For 2014 — Help Us Seed The Brackets!

After sorting through a mountain of nomination e-mails, we’ve whittled down the field of competitors for this year’s Worst Company In America tournament to 40 bad businesses. Here’s your chance to have your say on how these players will square off in the bracket, and which bubble teams will get left out in the cold. [More]

Wells Fargo To Repay Homeowners Stuck With Forced-Place Insurance

Days after a judge signed off on the $300 million JPMorgan Chase forced-place insurance settlement comes news that Wells Fargo has reached a deal that would put a little bit of money back in the pockets of some homeowners who got stuck with overly expensive insurance policies by the bank. [More]

Man Sues Wells Fargo Over Robocalls Intended For Other Person

It’s bad enough to get endless collections call from your mortgage servicer over missed loan payments, but it’s next-level annoying when you’re not even a customer of the bank that won’t stop calling your phone day and night. [More]

Banks Ditched Payday Lending-Like Programs, But What’s Next?

Bank may have exited the payday lending business this month, but that doesn’t mean their next foray into small dollar loans will be any less predatory. That’s why the National Consumer Law Center is urging banks to show leadership in developing affordable credit options for consumers. [More]

Is Voice-Recognition The Future Of Banking? Wells Fargo Thinks So

Who needs to go to the bank when you have a smartphone. Unless you really want to talk to a living, breathing person, you might not have to trek to the bank in the future. That’s because some banks are looking to add voice-recognition technology to their mobile banking repertoire. [More]

And Then There Was One: Wells Fargo, U.S. Bank Discontinue Payday Loan Products

The small victories are adding up in the battle against predatory loans this week. Wells Fargo and U.S. Bank announced they will discontinue high-risk payday lending programs. [More]