An elderly Oregon woman has filed a lawsuit against Wells Fargo, alleging that a bank employee harassed her by telling the police she was threatening suicide — and running up a $1,055 hospital bill in the process. [More]

wells-fargo

Almost All States Sign On To Massive Mortgage Settlement

Last night was the deadline for the attorneys general of each state to sign onto a massive settlement with the nation’s five largest mortgage lenders, and more than 40 of the states opted to join in the pot-sharing. [More]

California City Thinking Of Closing Wells Fargo Account Over Foreclosure Debacle

It’s not just individuals and small businesses that are peeved about the way big banks have mishandled the massive amount of foreclosures during the last half-decade. The city government of Berkeley, CA, is looking to pull several hundred million dollars out of its Wells Fargo accounts and plunk the pile down at a more consumer-friendly financial institution. [More]

Wells Fargo Thinks USPS Is Fastest Way To Tell Me About Bounced Check

When you think of the fastest, most-efficient way for a business to contact a customer about a problem, you obviously think of an antiquated, bloated, nearly insolvent government-operated organization that is synonymous with sloth. Oh wait — you don’t? Well, Wells Fargo apparently does. [More]

Big Banks Pinky-Swear To Overhaul Lending & Foreclosure Practices

Nearly a half-decade after the U.S. housing market collapsed like something that collapses really badly, the country’s five biggest mortgage providers — Bank of America, Chase, Wells Fargo, Citi and Ally — are oh-so-close to reaching a settlement with the states that could include overhauls to how they operate when it comes to the whole lending/servicing/foreclosing process. [More]

Should Companies Advertise To Kids At The Library?

Who doesn’t like stuffed animals? Free stuffed animals, even! E. isn’t happy, though. At storytime at her local public library, people representing Wells Fargo brought stuffed ponies with the Wells Fargo logo to distribute to the children, and donated a large pony to decorate the children’s section. [More]

PayPal And Wells Fargo Promise To Get Your $400 Back, Don't Know How

Shannon made an error when transferring money out of her PayPal account, giving them an incorrect Wells Fargo account number that belonged to an actual person. PayPal assures her that the money will come back to her if she’s patient, but $400 is a lot of money to her, and she’s losing patience. She’s caught in a loop between PayPal and Wells Fargo, and neither company knows how to get her money back. [More]

Wells Fargo Changes Consumer Agreement, Banning You From Suing Them

Jason is a good consumer, and so he made sure to read through a notice from his bank, Wells Fargo, about changes to his consumer agreement. And it’s a good thing he did read it, because in it, they informed him he’ll no longer be able to take them to court. [More]

Wells Fargo Tries To Predict The Future, Sucks At It

A few months before her wedding, Megan bought her bridesmaids’ dresses at J. Crew, and opened a store credit card account to get 20% off. She scheduled a payment through her bank, Wells Fargo, to pay off the balance, then panicked weeks later when she saw a large chunk of money leaving her bank account that she didn’t remember authorizing. She called to cancel, remembered what the payment was for, then canceled the cancellation. This led Wells Fargo’s fraud-flagging systems to believe that the next time Megan opened a store credit card and paid the bill, they should just go ahead and cancel the payment. [More]

Wells Fargo Does CD Paperwork For Wrong State; It's Your Problem

Earlier this year, Ken’s father passed away. He had been investing in certificates of deposit for decades, and had set up each CD with one of his sons as beneficiary, so that accessing or re-investing the money would be simple…or as simple as any transaction with a megabank ever is. Out of all of the CDs, the only problem was one at Wells Fargo. Since the beneficiary information was missing from their computer systems, they needed the original receipt from when the account was opened. Ken’s dad was originally issued the wrong type of receipt for the state he lived in, so there was no proof that Ken was the beneficiary for the account. Now he needs a court order to get to the account. [More]

Banks To Offer Foreclosure Reviews To More Than 4 Million People

Millions of Americans have lost their homes in the last few years and — as any reader of Consumerist knows — the banks who foreclosed on those properties have also made more than their fair share of errors. Thus, starting today, 14 of the country’s largest mortgage servicers are contacting millions of foreclosed-upon former homeowners to offer them the opportunity to have their cases independently reviewed. [More]

Wells Fargo Admits To Sending Thousands Of Statements To Wrong Addresses

Need another reason to make the move to paperless bank statements? How about the fact that one of the nation’s biggest banks managed to send thousands of its customers’ statements to the wrong people? [More]

You Have To Call Up Wells Fargo To Ask For Your Extra Payment To Be Applied To The Late Fee

Keith just found out the hard way that if you try to pay off your late fee with Wells Fargo, you can’t just add it on to the regular payment. You have to call them up and tell them where to apply it. [More]

Bank Of America, Chase, Wells Fargo, Visa, MasterCard Sued Over ATM Fees

Have you ever glared angrily at the ATM, knowing that you’re going to be saddled with fees and wishing you could sue everyone involved? Well, it looks like more than one person has followed through on this idea. [More]

Consumers Union Urges Bank Of America CEO To Drop Debit Card Fee

Two weeks after asking regulators to investigate Bank of America’s plan to charge some customers a $5 fee to make purchases with their debit cards, our cousins at Consumers Union have taken their case directly to the bank’s CEO. [More]

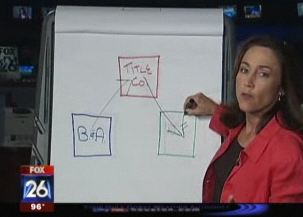

Wells Fargo Forecloses On Home Because The Title Was Never Transferred

We’ve covered a number of stories of homeowners who weren’t behind on their mortgage payments but found themselves the subject of foreclosure because someone at the bank transposed a number or didn’t pay attention to the documents they were robo-signing. But here’s one about a Houston couple who find themselves facing foreclosure from Wells Fargo, all because someone never transferred the title. [More]

Wells Fargo Ignores Homeowners Trying To Make Good On Missed Loan Payments

While it might make sense for lenders would go after homeowners who can pay their mortgage but choose not to, what about those people who missed payments because they were out of work but are now trying to make good on their debt? [More]