Following a first quarter of 2011 that saw mall vacancies rise to 9.1 percent, the second quarter was no kinder, with the vacancy rate inching up to 9.3 percent. Strip malls are having an even tougher time keeping tenants, with 11 percent of storefronts sitting empty. [More]

real estate

Chase And BoA Quietly Cutting Balances For Option-Arm Mortgagors

It’s a lovely surprise to get in the mail from your bank, a letter telling you they’re going to cut your mortgage balance in half while increasing your interest rate slightly. NYT reports that tens of thousands of option-arm mortgagors, homebuyers with a loan that had a low introductory interest rate that shot up after a set period, have been getting such letters from Chase and Bank of America over the past year. [More]

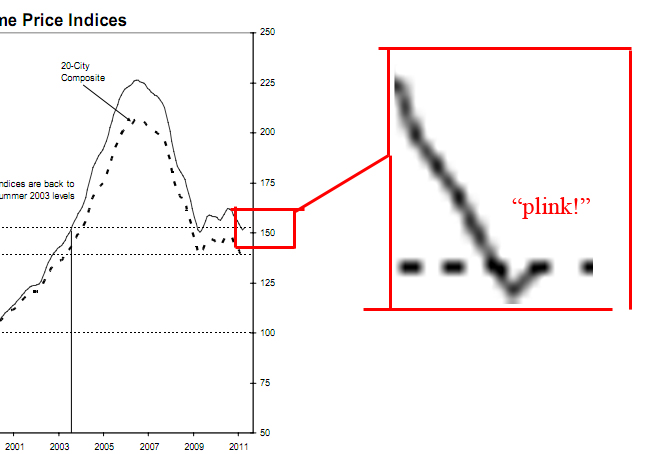

Here's What The .7% Rise In Home Prices Rise Actually Looks Like

As we noted this morning, there is a small respite from the recent glut of melancholic economic news: home prices inched upwards. Yep, on Tuesday, the widely-watched Standard & Poor’s/Case-Shiller index posted a rise of .7% for April. Let’s put that in context with this chart. No, that’s not just an ink smudge. [More]

Even The Home Alone House Can't Sell

The house made famous by Home Alone, the 1990 movie that showed us all it’s okay to be neglectful parents of obnoxiously precocious children because that same precocity will come in handy when fighting off a pair crooks straight from Central Casting, has been up for sale for a few months now. But in spite of all the press this piece of real estate has received, it hasn’t attracted a buyer. [More]

Will Take NY 62 Years to Get Through All The Foreclosures

At their current pace, it will take New York State lenders 62 years to repossess all the houses currently in foreclosure or severe default, NYT reports. That’s good news for some homeowners looking to get a break while they try to get out from behind the eight-ball with their debts. Some of them could even be dead by the time the house repo man comes to collect. [More]

Wells Fargo Is Next Bank To Dump Reverse-Mortgages

Wells Fargo is the next bank to announce that they are pulling out of the market of selling reverse-mortgages, a loan typically sold to to seniors that converts their home equity into a stream of monthly payments. The lender gets paid when the home is sold at the borrower’s death or when they move. Without reliably rising home values, it’s not a very profitable proposition for lenders. [More]

Meth House Haunts New Homeowners

A pregnant mother of two in Colorado and her husband are stuck making $1,114 a month payments on a house they can’t live in. Shortly after they bought their dream home, they discovered needles in the window well. It turned out their dream house used to be owned by meth heads, and the house was contaminated with meth residue. [More]

Homeowners Find Out Their House Is Stolen, Continue Making Mortgage Payments

A family in California thought they’d purchased their dream home last summer, only to later find out that the property had been stolen and illegally sold to them. Now they’re stuck making mortgage payments on a house they could be evicted from at any moment. [More]

Could Housing Market Stay Down For 14 More Years?

Home prices continue to fall so hard that it’s tempting to believe they’ve either hit bottom or will do so soon. But some economists think home prices will remain depressed for a decade or more. [More]

Home Prices Continue To Fall Everywhere Except Seattle & DC

The folks behind the all-important Case-Shiller Home Price Index have released their numbers for March 2011 and for the eighth month in a row, the average price of a home in the U.S. has declined. Only two of the 20 cities in the index — Seattle and Washington, D.C. — experienced even a slight uptick from the previous month, while a dozen cities are at or near four-year low points. [More]

Class Action Suit Against BofA For Deceptive Loan Mods Goes National

Olly, olly, oxen, free. A class action lawsuit against Bank of America claiming they were less than above board with their loan modification practices has been certified for national participation. [More]

BofA Giving Away 150 Free Houses

Want a house for free? Bank of America is giving away 150 of them in Chicago. It’s a great plan. The bank gets some worthless properties off its books without the cost of trying to hold on and sell them, the city gets some cheap affordable housing, and BofA gets a PR bump. It’s win-win-win, with two of those wins being Bank of America’s. That’s the Chicago way. [More]

Man Finds $45,000 In New House, And Returns It

It turns out there are still some good people left in this world. The Deseret News has the story of a man who was inspecting his family’s first home when a piece of cloth attached to the attic door grabbed his attention. Climbing up the ladder and through the hatch he pulled out a WW II ammo case. He opened the box and discovered inside an amazing treasure, which he ended up giving away that night. [More]

When Buying A Home, Get Out Of Your Head And Do The Math On Paper

In the heat of house-hunting, it can be easy to keep all the numbers in your head. You debate back and forth over which properties to target and for how much and under what conditions. But as the Trulia blog notes, if you mostly just do this mental math without putting it down on paper it can be easy to talk yourself into less-advantageous deals when the numbers in your head collide with the emotions in your heart. [More]

Home Buyers And Sellers Turning To The Supernatural For Help Because… Why Not?

The news about the economy — and more precisely the real estate market — is full of shrugs and dart-throwing guesswork about exactly where prices and interest rates will go in the coming year. So, reports the Boston Globe, a growing number of home buyers are looking to the spirit world for guidance and assistance. [More]

Man Lives In Awesome 258 Sq Ft Transforming Apartment

There’s those who bought too much house, and then there’s this guy, who lives in a fabulous 258 square foot apartment. Even in this tiny space he manages to cram in a full kitchen, refrigerator, bed, dining room table, balcony, and more. It’s all about hidden compartments and things that fold in when you need them, get stashed away when they don’t, and furniture that converts into multiple purposes. The primary inspiration was boat design, which manage to pack a lot of amenities into small space. And, of course, the Japanese! [More]

Dumping 2nd Mortgage Through Bankruptcy Is No Cake Walk

For anyone considering getting rid of their second mortgage in the manner described in yesterday’s post, bear in mind that it is by no means a painless process. One of our readers is a staff attorney for a Chapter 13 bankruptcy trustee, and he writes in with more details about what this process entails. [More]

28.4% Of All Homes Are Underwater

A new report by Zillow says that 28.4% of all single-family houses in America with mortgages are underwater. No, we’re not talking about flooding in the south, but homes that owe more on their mortgage than they are worth. It’s even worse in places where the bubble was the biggest. In Tampa, FL, 59.8% of homes have negative equity and in Phoenix, AZ, it’s 68.4%. Declines in home values are still happening and Zillow doesn’t see a bottom happening until 2012, at the earliest. [More]