Last year, Consumerist reported on why you shouldn’t run out to sign up for a reverse mortgage just because Fred Thompson or other paid spokespeople opine about the benefits in national advertising campaigns. Today, the Consumer Financial Protection Bureau echoed our fears that these ads can be misleading by releasing the results of a focus group and issuing an advisory warning consumers that promotions for the costly product often don’t tell the whole story. [More]

reverse mortgages

Reverse Mortgage Complaints Show Consumers Confused By Loan Terms

While reverse mortgages are only available to a select group of consumers – those 62 years and older – the alternative loan product still makes up a large portion of complaints received by the Consumer Financial Protection Bureau. Today, the Bureau released a report highlighting the most common consumer complaints about reverse mortgages, along with advice for borrowers [More]

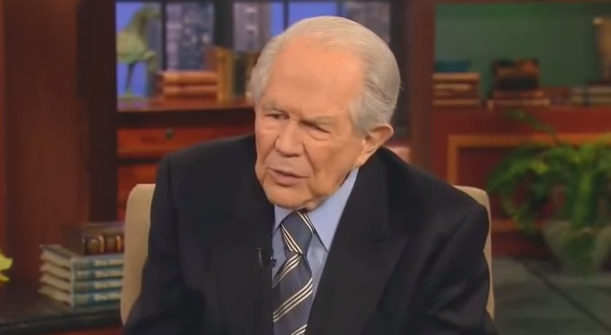

Pat Robertson’s Description Of How Reverse Mortgages Work Isn’t Accurate

As we’ve mentioned before, consumers contemplating taking out a costly reverse mortgage shouldn’t be swayed by what they hear on television, even if the person recommending the financial product happens to be well-known. Pat Robertson isn’t a financial advisor, but people do write to him seeking financial advice. Unfortunately for his many viewers who might be considering a reverse mortgage, he made some serious errors in a recent segment of his television program. [More]

Why You Shouldn’t Get A Reverse Mortgage Just Because Fred Thompson Tells You To

Turn on the TV and you’re just about guaranteed to come face-to-face with a celebrity or public figure selling a product or service. While those spokespeople may carry an air of respect and trust with consumers, what happens when the product they so happily lent their voice to turns out to have devastating affects on the consumer? Not much really, but it might be time for that to change. [More]

CFPB: Reverse Mortgages Still A Risky Financial Decision Despite Some Added Protections

The decision to take out a reverse mortgage should never be taken lightly, and the Consumer Financial Protection Bureau wants to make sure consumers are considering all of the perks and numerous pitfalls. [More]

Reverse Mortgage Company Caught Mailing Deceptive Info To Seniors

Even under the best of circumstances, choosing to take out a reverse mortgage is a difficult and often costly decision for many senior citizens and their families. But when you throw in a number of half-truths and marketing materials designed to mislead consumers into thinking they are taking part in a government-run program, well, that’s just wrong. And the state of New York won’t stand for it as one company recent found out. [More]

Despite Regulations, Survivors Face Foreclosures After Reverse Mortgage Borrower’s Death

There are a number of reasons someone might take out a reverse mortgage: to pay for prescriptions or medial care, to subsidize their daily living expenses or even to settle their fear of becoming a burden to their family. But the product that was designed to keep elderly consumers in their homes is now wreaking havoc on their surviving loved ones. [More]

Advocates: Now Is The Time To Reform Reverse Mortgages

A large chunk of the U.S. population is heading into what are supposed to be their golden years. But between financial hardship and shortsighted financial planning, many of these people are not able to retire comfortably, if at all. A reverse mortgage that allows homeowners who are at least 62 years old to borrow against the equity of their property may seem like a more appealing alternative to working into one’s 80s, but there are pitfalls involved — some of which can be fixed by a bit of reform. [More]

Thinking Of A Reverse Mortgage? Here Are Things To Watch Out For And Some Alternatives

With a large group of Americans at or nearing retirement age — and with many of them having inadequate savings to last them through retirement — so-called “reverse mortgages,” wherein a lender converts the equity on a home into monthly payments to the homeowner, are being marketed as a financial cure-all to people wondering how they will be able to afford their golden years. But before anyone dives into the reverse mortgage pool, there are some thing worth pointing out. [More]

Four Charged In Alleged $2.5 Million Reverse Mortgage Racket

For their victims, the phone call sounded like salvation. Seniors, living on a fixed income and having trouble with the bills, they were glad to hear someone offering them a reverse mortgage that would allow them to turn the equity in their house into cash. But the four mortgage professionals charged with perpetrating a $2.5 million reverse mortgage fraud scheme are anything but angels. Their aftermath has left those who signed up with them impoverished and close to foreclosure. [More]

Wells Fargo Is Next Bank To Dump Reverse-Mortgages

Wells Fargo is the next bank to announce that they are pulling out of the market of selling reverse-mortgages, a loan typically sold to to seniors that converts their home equity into a stream of monthly payments. The lender gets paid when the home is sold at the borrower’s death or when they move. Without reliably rising home values, it’s not a very profitable proposition for lenders. [More]