Some homeowners are taking advantage of a little-known loophole in the bankruptcy law to get rid of their second mortgage and also avoid the pain of foreclosure, reports the San Jose Mercury News. Here’s how it works: [More]

real estate

Mortgage Rates Hit 4-Month Low

For those potential home-buyers with enough money for a down payment, it looks like you may want to start scanning the real estate listings. According to Freddie Mac, the average rate on 30-year fixed-rate mortgages has hit a four-month low. [More]

When Should You Strategically Default?

Homeowners who owe more on their house than it’s worth face a dilemma. Should I stay or should I go now? Suze Orman tells CBS Sacramento’s Call Kurtis that those folks need to take a hard look at the value of their homes and make a tough decision. “If you own a home that is 50% underwater, 70% underwater, it will never ever, ever come back to where you purchased it.” she said. [More]

Bank Gives Failed Flipper Foreclosed House For Free

A guy who deserves no breaks at all, a speculator who jumped onto the house-flipping craze just before the music stopped, just got a huge one. Instead of making the final stroke to finish foreclosing on his house, the bank decided to write off the loan and just give it to him for free instead. [More]

Groupon Gets Into Real Estate Deals

In a move that some will say is an example of the flexibility of the Groupon model, and that others will point to as a shark-jumping moment, the online deals site has partnered with a Chicago-area real estate firm for its first ever venture into the home-buying market. [More]

Surviving And Thriving As A Long-Distance Landlord

Being a landlord can be a dream, with an easy stream of income with little ongoing effort required, but the career can also be a nightmare of repair bills and troubling tenants. [More]

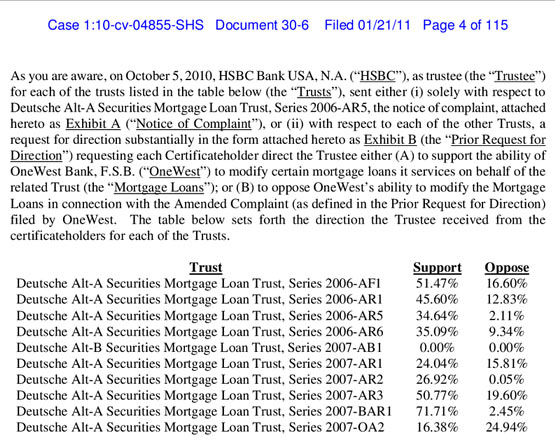

Middlemen Blocking Mortgage Mods

Homeowners trying to get loan mods often run into resistance by banks who say they’re powerless because they need to protect the interests of investors. But ProPublica reports a recent lawsuit uncovered a document where, when HSBC polled investors, a majority of those responding say they favored letting the loans being modified. [More]

Where Are They Now? The First-Time Homebuyers And The Secret Room Filled With Moldy Garbage

Last June, we shared the story of Jeannine and her husband, who discovered all kinds of exciting surprises in their home after purchasing it. These included a sealed room filled with garbage coated in a fuzzy white mold and a shower literally patched up with duct tape. None of these issues were disclosed by the sellers, or noticed by the inspector that the couple hired. Consumerist readers had 266 comments’ worth of advice for Jeannine and Mr. Jeannine, but we never heard back from them. So where are they now? Things have actually gotten worse. [More]

New Home Sales Dive To Lowest Level In Nearly 50 Years

As housing prices sank to their lowest levels since 2002 in February, the number of new houses sold took a much harder fall, dropping 16.9 percent from the previous month. [More]

17.45% Of Florida Homes Are Vacant

The latest Census Bureau results show that 17.45% of homes in Florida are vacant. That’s 1.558 million houses sitting there soaking up the sun. Florida’s housing bubble was one of the hottest and now their vacancy rate is the highest. [More]

Is The 30-Year Mortgage On Death Row?

Plans are in the works to dismantle Fannie Mae and Freddie Mac, and that could mean that what many Americans had assumed came fourth after “life, liberty and the pursuit of happiness,” the 30-year mortgage, could be on the outs. [More]

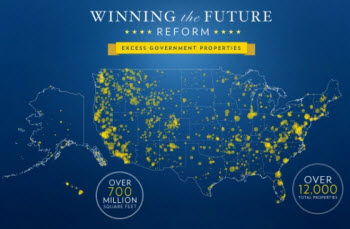

Government Says It Has A Stupidly Large Number Of Buildings It Doesn't Need

On Whitehouse.gov today there’s a post declaring that the government has a stupidly large amount of real estate that taxpayers are paying to maintain — but that it doesn’t really need. [More]

Home Prices Hit New Lows In 11 Cities In December

While the latest numbers show consumer confidence may be at a three-year high (which may not be saying much), the average home price in many major cities continues to sink, with nearly a dozen of these areas hitting post-boom lows in December. [More]

Experian Adds Rent Payments To Credit Reports

In what could be a boon to renters looking to build a credit history (or bad news if you have a roommate who always delays your rent), credit reporting agency Experian has begun incorporating data on rental payments into its reports. [More]

U.S. Homes Now At Pre-Bubble Affordability Level

A new study says that housing prices in the U.S. have finally gone back to a level of affordability that we haven’t seen since before the rapid price inflation of the mid-2000s housing boom. [More]

Detroit Mayor Offers $1,000 Homes To Cops, Firemen

In a bold offer that speaks volumes about Detroit’s housing market as well as its state of public safety, the city’s mayor has offered to provide homes for as little as $1,000 to police and firefighters. [More]

The Top 10 Foreclosure Hotspots In The U.S.

We already know which states were hit hardest by last year’s foreclosure boom, but today CNN.com has a look at the 10 cities with the fastest-growing foreclosure rates in the country. [More]