A Recipe for Riches [Forbes] “Want to become a tech titan or hedge fund tycoon? Up your chances by dropping out of college or going to Harvard and working at Goldman Sachs.”

personal finance

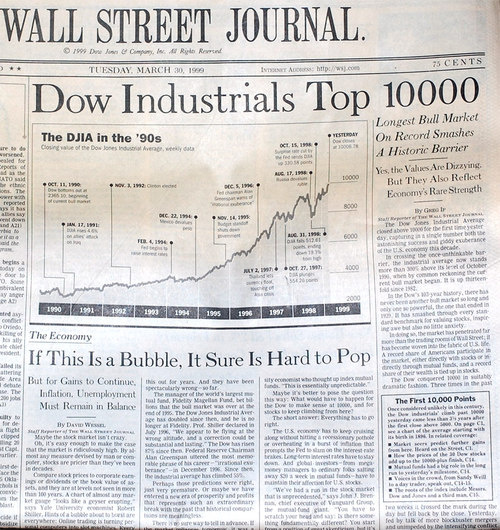

WSJ 1999: "If This Is A Bubble, It Sure Is Hard To Pop"

I just found this awesome Wall Street Journal front page from 1999 covering the first time the Dow broke 10,000. It’s full of unintentionally hilarious crap that gives keen insight into how we got into this economic catastrophe in the first place. Full-size inside.

Thief Runs Up $10,000 Credit Card Bill Using Only Name, Address, Social, DOB

John says that his wife’s identity was stolen two weeks ago and since TransUnion shows your full credit card numbers on your credit report, the thief was able to run up a $10,000 credit card bill in his wife’s name.

7 Tips to Save on Apartment Living

If you’re looking for a way to get a good deal on renting an apartment, personal finance blog Wise Bread has some suggestions. Recently, they offered seven tips for saving on apartment living which, surprisingly, didn’t focus completely on costs (there are quality of life issues to consider, of course.) Here are their ideas:

Debt Collector On Tape: "I'm Gonna F**** You Up"

“When I see you, I’m gonna f*** you up,” says debt collector “Mickey,” pictured at left, on the answering machine of a guy who bounced a check. WTSP obtained the messages, some of the worst debt collector recordings I’ve ever heard, and you can listen to them here.

Maine's Supreme Court To Decide If Consumers Should Be Compensated For Hannaford Security Breach

If a retailer doesn’t protect your credit card data and it gets stolen, should you be compensated? Not for any unauthorized charges, which are already covered under banks’ zero-liability protection, but for the time lost dealing with the problem, for the anxiety it causes, and for any future credit history/score issues it might cause?

9 House Fixes To Save $ Before Winter Starts

Before winter hits in full force, there’s still time to get your house ready with these nine steps that can save you on your utility bills and protect against unnecessary damage.

Consumers Pay Down Credit Card Debt For 11th Straight Month

The Federal Reserve has released data on consumer debt for August, and for the 11th month in a row we’ve paid down credit card debt and increased savings. Take that, rate-hiking credit card companies!

University Launches Free Financial Education Website

We love free, and we love attempts to make people savvier about personal finance, so we really like this new personal finance website from the University of Idaho. It’s got all the basics covered, and there are things like checklists and downloadable worksheets so you can practice what they’re preaching. Some of the information is geared specifically to Idaho residents, but for the most part this is useful content that anyone can take advantage of.

Personal Finance Roundup

Guaranteed income, but at what cost? [CNN Money] “Variable annuities may look like a surefire bet, but make sure you read between the lines before you invest.”

How to Get the Best Deal on Cable or Satellite TV

Comcast. DirecTV. Dish Network. Oh, we love to hate them, don’t we? But without these (and others), where would we get the mind-numbing entertainment that has America hypnotized? But of course we don’t want to pay a lot to be comatose, so that’s why Bible Money Matters’ suggestions on how to get the best deal when signing up for cable or satellite TV are so valuable.

UPDATED: TD Bank's Statement On Resolving This Week's Meltdown

TD Bank sent us the following statement – UPDATE: and now a new, revised one – about all the transaction and fee snafus that happened this week after they became one with the Commerce Bank customer data:

Inside The TD Bank Meltdown

Think it sucks to be a TD Bank customer this week, especially if you were formerly a Commerce Bank customer? Try being a TD Bank employee. One insider tells what it what was like yesterday on the other side of all those (still) unprocessed transactions and new fees.

10 Inexpensive To Start Small Businesses

Has the slumping economy got you looking for ideas to earn some extra money? If so, personal finance blog Wise Bread can help you out with their list of 10 small businesses that are free or cost little to start up. Here’s the list along with their “advice to live by” for each suggestion:

Some TD Bank Customers Still Not Seeing Their Paychecks

TD Bank customers, particularily former Commerce Bank ones, are still complaining about their paychecks and other transactions not posting. Other customers said they were being limited to $250 withdrawals. The problems arose Monday after they tried to combine their bank system with Commerce Bank’s, which TD recently bought.

Personal Finance Roundup

Furniture Shopping Secrets: How to Tell Superior from Shoddy [Get Rich Slowly] “What makes for a strong, long-lasting piece of furniture.”

USAA Online Checking & Savings Open For Non-Military

If you’ve heard us rave about USAA’s stellar financial services but grown sad when you learned that it’s only available for military-members and their family, have heart: you can get still get access to some of their services like banking and checking.

How To Reduce Your Insurance Premiums

Kiplinger has put together a list of ways to reduce costs for auto, home, and life insurance. For auto and homeowners insurance, boosting your deductible from $250 to $1000 can lower your premiums between 15-25%. If you haven’t looked at your life insurance policy in a while, don’t wait any longer to shop around—rates have “dropped significantly” over the past 15 years but are now on the rise. And when calculating homeowners insurance, don’t fall into the market value trap: make sure you’re covering the true cost of replacing only the home and what’s inside, not the value of the land.