I think this qualifies as cutting off your face to spite your nose.

UPDATE: It seems our reader may have the last laugh, letting the house go into foreclosure, then buying it back at a discount.

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

I think this qualifies as cutting off your face to spite your nose.

UPDATE: It seems our reader may have the last laugh, letting the house go into foreclosure, then buying it back at a discount.

When you swipe your plastic overseas those currency conversion charges, usually 1-3%, can really add up. So here’s some cards that have no foreign exchange fees at all. [More]

If you have already refied your mortgage, or are unable to because of new tighter loan restrictions, there’s an additional and little-known step you can take to lower your monthly payments. It’s called “recasting” or “re-amortizing.” [More]

Career Insurance: Insuring Your Most Valuable Asset [Free Money Finance] “This Career Insurance is not a product you can buy, but a series of actions you can proactively take to minimize the chance that your career will take a major hit.”

7 Ways to Save on Holiday Travel [Kiplinger] “Bargains are scarcer this year, but you can fly the holiday skies for less if you use these strategies.”

Make More Money: How to Supercharge Your Income [Get Rich Slowly] “Almost anyone should be able to find some ideas here to make more money.”

5 Tips to Win the Rebate Game [Money Talks News] “So what can you do to avoid rebate hell? Try these tactics.”

6 habits that will make you broke [MSN Money] “Even some well-intentioned practices like clipping coupons could result in your spending more.”

A woman says a funeral home’s debt collector threatened to dig her deceased daughter’s body up and hang it from a tree unless she paid what she owed for the funeral service. That’s when she started recording the calls, capturing such things as, “We’re going to have your dog arrested, we’re going to shoot him, and we’re going to eat him,” and, “Are you going to pay this bill or not or am I going to have to kill you?” [More]

Feel the hair on your neck rising? Your bank is watching, with greater scrutiny then ever before. Banks are figuring out new scores and models to figure out your credit worthiness, using everything from how you deposit and withdraw money to how you pay your rent. [More]

If you’ve got some extra scratch you’d like to grow into something bigger, do not risk it on the Arizona Cardinals against the point spread. The stock market is definitely a better option, but its volatility and complexity can scare people off. [More]

For the first time in a long while, foreclosures actually dropped in October, falling 9%. The big drop came about as several big banks halted foreclosures across the board after news about the robo signers began to emerge. Foreclosures are expected to pick back up again November, albeit at a softened pace. It may be 3-4 months before the rate fully resumes. So take a gasp, homeowners behind on your mortgage, you just caught a temporary break. [More]

If you’re savvy enough to read Consumerist you probably know your way around a budget, and the more you think you know about money the harder it is to resist sharing your unsolicited advice with others. [More]

I spotted a coffee shop charging customer a $.50 for using a credit card on any purchase that is under $10. It doesn’t break any laws, but it does violate their agreement with the credit card companies. [More]

Ever the hotbed of innovation, a new innovation in foreclosure defense is emerging in Florida. Until now, the big question for foreclosure lawyers is “how do we get paid?” If their client can’t afford to pay the bank, how are they going to pay for legal services? One firm has figured out a way. After the original mortgage is nullified or reduced, the client takes out a new mortgage for 40% of the savings, and pays it to the lawyer. [More]

10 Riskiest Places to Give Your Social Security Number [Kiplinger] “Here’s how to lower the chances of your number falling into the wrong hands — and what to do if it does.”

Holiday Non-Shopping: 7 Items Worth Waiting For [Money Watch] “Here are the top 7 items that you may want to put on your post-holiday shopping list.”

How to Pick Your Next Computer [Smart Money] “Here is my annual fall computer buyers’ guide, a simplified road map to the key decisions shoppers must make.”

10 Things Recruiters Won’t Tell You [Wall Street Journal] “#1. There are better ways to find a job.”

20 Places to Find Free Books Online [Northern Cheapskate] “The following sites provide free books that can be enjoyed online, downloaded to your computer, or transferred to an e-reader or MP3 player.”

San Francisco PD have caught a crook using an ingeniously low-fi method to rip people off ATMs: napkins. [More]

To shut down “fee harvesters” and other crafty tricks credit cards cooked up to escape the CARD act, the Federal Reserve has proposed three ways to tighten and clarify the rules. [More]

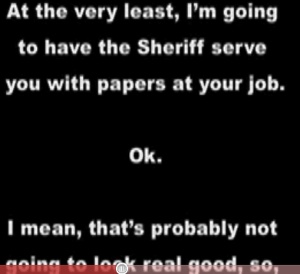

“I’ll go through any lengths I have to in order to embarrass you,” says one of the many debt collector chicks who keep calling this guy up at work, trying to get him to pay for a credit card debt from 1998 that he doesn’t remember and for which they refuse to provide verification. [More]

A debt blogger is midway through paying off $70,000 in credit card debt using the “debt snowball” method. Great stuff! [More]

A Seattle couple were 10 days from closing on their new house when they discovered squatters had moved in who claimed they had seized “free land.” [More]

Marty sent his rent in by money order and the landlord says he never got it. Marty is trying to get his money from the money order back, but is finding out that it’s not the same thing as a check. [More]

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.