All he wanted was to delay things just a little bit more so that his dad would have some more time to try to work out a deal between the lender to get that holiest of holies, a loan modification. So, in a desperate attempt to save his dad’s house, a guy shows up at the foreclosure auction and tries out two classic comedy bits. [More]

mortgages

GMAC Buys Your Mortgage, Tosses It In A Drawer

How are things in the mortgage industry today, in what is supposed to be the post-robosigner era? According to source on the ground, reader Chris, it’s not so great. Chris writes that when he and his wife refinanced their house, they knew that GMAC would most likely buy their loan from the mortgage originator. What they couldn’t have predicted was that GMAC would wait around for more than a month before they got around to actually acquiring the mortgage, then call Chris and tell him that he was delinquent on the mortgage that he had already paid. [More]

Reasons It's Not So Great To Own A Home Free And Clear

If you’ve signed your life away on a mortgage, you’ve probably dreamed of tossing that paperwork into the shredder after you’ve made the final payment. But outright ownership isn’t all positive. [More]

FTC Wants To Ban Mortgage Mod Services From Charging Up-Front Fees

To combat mortgage relief fraud, the FTC would like to make a new rule that would ban mortgage modification services from charging up-front fees. “Homeowners facing foreclosure or struggling to make mortgage payments shouldn’t have to contend with fraudulent ‘companies’ that don’t provide what they promise,” FTC Chairman Jon Leibowitz said in a statement. “The proposed rule would outlaw up-front fees so companies can’t take the money and run.” Indeed, there are some shady operators in this area and consumers need to beware. [More]

Here Is Why Bank Of America Is Being Sued

Last week, the attorney general in Arizona filed suit against Bank of America, alleging that it hadn’t made good on its promise to implement a functioning loan modification program. And while Christine doesn’t live in Arizona, her story should give her state’s attorney general reason to consider joining the legal fray. [More]

In Foreclosure Bungle, Banks Accused Of Illegally Breaking Into Homes, Stealing All Your Stuff

A new batch of lawsuits are accusing banks of essentially burglarizing people’s homes, reports the NYT. Before a foreclosure has been properly filed and processed, people behind on their payments have come home to find their locks changed and some or all of their possessions gone, taken by contractors working for the bank. [More]

Scams: Do You Know About Mortgage "Flopping?"

You’ve heard of “flipping” houses, well now there’s “flopping.” While the first was speculative, this one is outright fraud. [More]

Arizona Sues Bank Of America Over Home Loan Modifications

The attorney general for Arizona is none too pleased with Bank of America. Earlier today, he filed a lawsuit against BofA, alleging the bank misled customers about its home loan modifications. [More]

BofA Tortures My Sister With Mortgage Hoops

Hilary shares the struggles her sister is undergoing to close on a house with a mortgage through Bank of America. The closing date has been delayed and the loan officials keep demanding more paperwork and explanations of bank transactions. [More]

CitiMortgage Launches "Call-A-Thon" To Answer Distressed Homeowner Questions

Tomorrow CitiMortgage is kicking off a special 1-day “call-a-thon” where people in trouble with or confused about their mortgages with Citi can call in and talk to foreclosure prevention staff. In addition, “senior managers and increased numbers of supervisors will be on hand to provide additional support,” says Citi. [More]

Next Big Thing In Mortgage Fraud: Fake Attorney Signatures

The next big wave in disgusting mortgage fraud revelations could be faked signatures from foreclosure attorneys. And homeowners fighting foreclosure are using it to hold onto their house. [More]

Scammed In A Refi, Woman Loses Home

A woman who thought she was doing a simple refi for $50,000 and became the victim of an elaborate swindle was just dealt her final savage blow: her house is getting foreclosed on. [More]

Foreclosures Are Hurting The Children

Children are an overlooked victim in the mortgage meltdown. Experts are growing concerned about the negative social, emotional and academic impact foreclosure turmoil is having on kids. Everything from forced relocation, moving to a new school, seeing your parents at each other’s throats over money, to coming home and finding all your belongs in the trash takes its toll, and there isn’t currently a public policy response to address the issues. [More]

Strapped To A "Rocket Docket" Built For Max Foreclosure Speed

Florida has special high-velocity courts presided over by retired judges that process foreclosures at the rate of 25 per hour. That’s potentially one evicted family every 2.4 minutes. Rolling Stone reporter Matt Taibbi sat in on one of these “rocket dockets” to show what goes on, marveling at the shoddy and fraudulent paperwork the banks are cramming through the courts. [More]

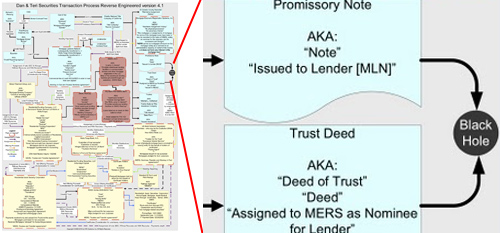

Super Complex Chart Of How A Mortgage Gets Securitized

Gee, how could people who haven’t graduated high school mess this up? This is a chart showing how a mortgage gets securitized made by a guy whose job is to audit securitizations by reverse-engineering them. This is one he did for the mortgage on his own house. My favorite part of the diagram is where the documents go into a black hole. Literally, that’s an actual part of this flowchart. [More]

Man Lets House Go Into Foreclosure Over $25 Fee

I think this qualifies as cutting off your face to spite your nose.

UPDATE: It seems our reader may have the last laugh, letting the house go into foreclosure, then buying it back at a discount.