Thanks to their bank, Victor Vangelakos and his family live by themselves in a 32-story tower.

mortgage meltdown

Lawsuits: Countrywide Ex-CEO To Feel Wrath Of SEC

His extreme orangeness, former CEO and founder of Countrywide Home Loans Angelo Mozilo, is about to be slapped with civil fraud charges, according to the Wall Street Journal.

New York City Converts Luxury Condo Into Homeless Shelter

Could this be the nicest homeless shelter in America? The Daily News is reporting that the city is paying $90 a night per apartment for the use of a failed luxury condo development — which features granite countertops, marble bathrooms and walk-in closets. (The $90 a night figure includes social services, housing help and job counseling designed to get families back on their feet.) Local residents, some of them interested in renting an apartment in the building, are pretty ticked off.

Foreclosures Hit Another Record High, Up 34% From 2008

One in every 324 households in this country received a foreclosure filing last month, according to RealtyTrac. This marks the all time high since the firm started tracking filings in 2005. Foreclosure filings are up 34% since last year.

Does Anyone Have $34 Billion For Bank Of America?

Kenneth Lewis is probably having a pretty crappy day. The government just told him that he needs to find $33.9 billion in order to “withstand any worsening of the economic downturn.” Anybody got any spare change?

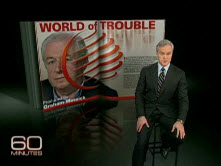

Meet The Savings & Loan That Destroyed Wachovia

60 Minutes recently took a look at World Savings Bank, the acquisition that ultimately wounded Wachovia so badly that it had to be acquired by Wells Fargo. What was wrong with an institution for which Wachovia was willing to pay $25 billion? Well, one whistleblower claims that World Savings was engaged in fraud and predatory lending — tricking its customers into signing up for dangerous “option-arm” or (as they cheerfully called them) “pick-a-payment” loans.

Faces Of Foreclosure: The Nonagenarian (He's 92.)

Our sister publication, Consumer Reports, put together some video interviews with people who, for one reason or another, are facing foreclosure. They are the human side of this financial meltdown.

Fannie Mae Lets Renters Stay

Good news for renters who’ve been dutifully paying their rent while their landlords failed to make the mortgages, and were facing eviction as a result: Fannie Mae will sign new leases with them. [NYT]

Pro-Consumer Regulation Needs Real Teeth So You Can Sue The Jerks

If the recent economic meltdown has a bright spot, it is the possibility that smart regulation may return. There will always be those who will cheat if they can, putting both consumers and the market at risk. It cannot function properly without regulation to prevent cheating and ensure consumers are getting a fair deal. But without a private right of action and attorney fees, consumer protection regulations are nearly worthless. A “private right of action” means…

Greenspan Says That His Free-Market Ideology Was Flawed

Here’s something that probably doesn’t happen too often. Former Federal Reserve chairman Alan Greenspan had a crappier day than you did. He had to admit before our federal government that his free-market, anti-regulation ideology was “flawed.” Ouch.

The Bailout Bill Helps Renters Keep Their Homes

Great news for renters facing eviction due to foreclosure: any mortgage owner seeking assistance under Congress’ mammoth bailout bill is required to let paying renters stay in their homes.

Not So Fast: Judge Blocks Wachovia Sale To Wells Fargo, Citibank Rejoices

Tsk tsk, Wells Fargo. You should’ve known that stealing Citibank’s unspoiled bride at the alter was going to draw a bitter legal challenge. Late last night, Citibank’s team of repo-lawyers claimed a partial victory, announcing that a New York judge has agreed to block Wachovia’s sale. Citibank is also demanding $60 billion from Wells Fargo for interfering with the deal.

Giddyup! Wells Fargo Rides In And Steals Wachovia From Citibank!

Attention Wachovia customers: Wells Fargo just rode on on that stagecoach thing of theirs and stole your bank from Citibank, says the NYT. Rather than pick apart the pieces of Wachovia, Wells Fargo is going to buy the whole darn thing.

UBS Uses Markets, Not Goverment, To Deal With Sub-Prime Crisis

Instead of sucking off the blood of taxpayers, Swiss banking giant UBS is weathering a financial crisis wrought by investing in bad mortgages by aggressively selling off its U.S. commercial and residential mortgage-related assets. Reports Forbes:

../../../..//2008/09/29/dow-industrials-fell-700-on/

Dow industrials fell 700 on fears bailout package vote would fail, but later recovered to a loss of about 400. Right now the “Nays” are winning, but the voting is still open, and arms are apparently still being twisted and anything could happen. No bailout. The House defeats the bill on the $700 billion rescue plan 228-205.[WSJ]

Congressional Negotiators Strike Bailout Deal

Congressional negotiators agreed in principle last night to a $700 billion bailout package. The bill is currently being transformed into draft legislation that can be voted on tonight tomorrow.