CNN says that a deal has been reached — sort of. A bipartisan counterproposal to Bush’s $700 billion bailout plan has been drafted. The plan calls for caps on executive pay, and provides oversight on the Treasury’s actions.

mortgage meltdown

WaMu Downgraded To Even Junkier Junk, Still Looking For A Life Preserver

The Wall Street Journal is reporting that WaMu is courting several private equity firms about a potential takeover after their debt was downgraded even further into junk status by Standard & Poor’s. Once merely “junk,” WaMu is apparently, “so junky we are not even kidding around about it anymore.”

Treasury Says It Will Agree To Cap Wall Street Executive Pay

One of the major sticking points of the inevitable Wall Street bailout was executive pay — but the New York Times says that Treasury Secretary and former CEO of Goldman Sachs, Henry M. Paulson Jr., has agreed to compensation caps for the executives of firms that benefit from the bailout.

What Else Can $700 Billion Buy?

A while back the New York Times was concerned about the cost of the Iraq War and published some estimates of what else we could have bought with that money. We didn’t find that very interesting at the time, but now, while trying to wrap our minds around just how effing huge the $700 billion proposed bailout of Wall Street really is, we decided to revisit that article. Here’s what you can buy for less than $700 billion, according to the New York Times.

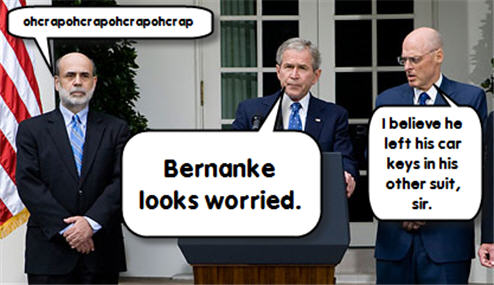

Finance Officials Beg Congress To Give Them $700 Billion

Treasury Secretary Henry M. Paulson Jr. was not warmly received at today’s bailout hearing when he stared down an angry and disenchanted Senate Banking Committee. Federal Reserve chairman, Ben S. Bernanke, who appeared with Mr. Paulson, warned that unless Congress gave Mr. Paulson $700 billion that “inaction could lead to a recession.” Oooh, they said the “R” word….

What Will The Largest Government Bailout Of Private Industry In US History Look Like?

A bailout of some kind is coming, but no one seems to know what it will look like and who it will help. The Wall Street Journal says that Senate Banking Committee Chairman Christopher Dodd of Connecticut has some ideas that might not go over too well with the Treasury Department.

It's "The End Of Wall Street As We Have Known It"

Goldman Sachs and Morgan Stanley will no longer be investment banks, says the New York Times. Instead, they will “transform themselves into bank holding companies subject to far greater regulation.”

10 Skills To Have In The Post-Financial Apocalypse

It’s the end of the world as we know it, but that doesn’t mean you should give up on yourself. Here are 10 skills to have in our brave new world…

../../../..//2008/09/19/morgan-stanley-might-sell-a/

Morgan Stanley might sell a 49% share of itself to a Chinese government controlled fund, says Bloomberg. [Bloomberg]

SEC, Treasury Throw More Sandbags Into The Wall Street Flood Waters

The SEC has temporarily banned short selling of 799 financial stocks, and the Treasury Department has said that it would guarantee (temporarily?) money market funds up to the amount of $50 billion. The New York Times called this move “startling” because money market funds have long been considered one of the safest investments — about as safe as a savings account.

Two Economists From The University Of Chicago Explain What The Hell Just Happened

It’s one thing to understand what just happened to the financial markets, and yet another to actually be able to explain what just happened. Thankfully, Steven Levitt from Freakonomics walked down the hall and found two economists from the University of Chicago (Doug Diamond and Anil Kashyap,) who gave him the best explanation I’ve been able to find about what the hell just happened.

../../../..//2008/09/18/were-not-the-only/

We’re not the only ones with a credit crunch. HBOS, Britain’s biggest mortgage lender, is going under.

Nobody Gave A Crap About The FDIC Until Fairly Recently

Spend a little time looking at Google trends and you’ll notice that no one really gave a crap about the FDIC until fairly recently.

Signs Of The Apocalypse: Even Money Market Funds Are Losing Money

In the history of money market funds, says the NYT, only one had ever “broken the buck” or actually lost money… before yesterday. On Tuesday, the managers of a multi-billion dollar money market fund announced that their customers might lose money in the fund– a type of investment that is considered as safe as a savings account.

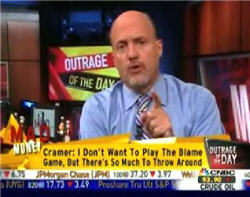

"Crazy" Jim Cramer Takes This Opportunity To Gloat

About a year ago, CNBC’s Jim Cramer completely lost his sh*t on CNBC, screaming at Bernanke to lower interest rates before millions of borrowers went into foreclosure. Now, as the “Armageddon” that he was carrying on about is in full swing, Cramer is taking this opportunity to gloat.

Facing Foreclosure? Buy A Second Home! Wait, What?

ABCNews says that more and more people who are facing foreclosure are just buying cheaper homes and then just walking away from their original mortgage. It only works for people who can afford the down payment on a new home and carry both mortgages until they’re in the new home, but for some people whose payments are about to balloon, it’s the most attractive option out there right now.

If Enough Banks Fail, The FDIC Could Run Out Of Money

Everyone knows that your money is safe in an FDIC insured bank because if the bank fails (Hello, IndyMac!) the FDIC will step in and repay your money (generally, up to $100,000.) But what if the FDIC runs out of money? It doesn’t have an unlimited supply and enough bank failures could completely drain its fund, says ABCNews:

Houses For $1: "My 14-Year-Old Son Could Buy a Block of Detroit Property"

Things are looking pretty bleak in parts of Detroit these days. In fact, you can get a house for $1. Yes, that’s right. A house.