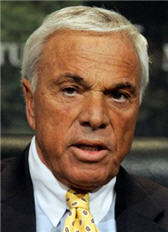

It’s been a while since we’ve heard from Angelo Mozilo, the curiously orange-tinted former CEO of Countrywide Financial, the nation’s largest mortgage lender during the housing boom; a mansion built on a swampland of toxic loans given out to just about anyone who applied. And even though Countrywide, a Worst Company In America winner, had to be bailed out by Bank of America — a deal that has since cost BofA at least $40 billion in settlements, penalties, write-downs, and legal fees — and even though Mozilo’s sunny mug will forever be seen as the face of the mortgage meltdown, he still doesn’t really see the problem. He also continues to refer to himself in the third person. [More]

angelo mozilo

DOJ Settles With BofA For $335 Million Over Countrywide Pushing Minorities Into Subprime Loans

Nearly four years ago, we first reported on allegations that Countrywide Financial, the failed lender that was bought by Bank of America after it collapsed, had their system set up so that non-white loan applicants were steered toward subprime loans, even if they could have qualified for a standard mortgage. Well, the wheels of justice turn remarkably slowly in Washington, DC, but today the Justice Dept. finally announced a settlement with BofA for $335 million over these allegations. [More]

14 Reasons Why Countrywide Is In The Worst Company Hall Of Fame

As the news breaks that Angelo R. Mozilo, the curiously orange former CEO of Countrywide Financial, has agreed to pay millions of dollars in fines, we decided to take a walk down Countrywide’s Memory Lane… which happens to be a street littered with abandoned and foreclosed houses. [More]

Bastard Ex-Countrywide CEO Must Pay $67.5 Million

Angelo R. Mozilo, former CEO of Countrywide Financial Corp, winner of the 2008 Worst Company In America award, and oddly orange-tinted bastard, has settled with the Security and Exchange Commission and will to pay fines and forfeit ill-gotten gains in excess of $67 million. [More]

SEC: Countrywide CEO Called Mortgages "Toxic" Three Freaking Years Ago

Today, as expected, is a crappy day for former Countrywide CEO and co-founder Angelo “Orangey Orangerton” Mozilo. The SEC is suing Mr. Mozilo along with several of his colleagues, claiming that they profited from stock sales while hiding information from investors.

Lawsuits: Countrywide Ex-CEO To Feel Wrath Of SEC

His extreme orangeness, former CEO and founder of Countrywide Home Loans Angelo Mozilo, is about to be slapped with civil fraud charges, according to the Wall Street Journal.

Consumerist's Top 10 Business Debacles Of The Year 2008

As is our habit, we provided Ad Age with a list of our Top 10 Business Debacles of the Year. Are you ready for the pain?

Countrywide CEO: "Countrywide Has Made A Positive Impact On The Country"

Countywide CEO Angelo Mozilo thinks his company being treated unfairly by the media according to a article in BusinessWeek. At the Countrywide annual shareholders meeting, Mr. Mozilo said:

Countrywide CEO Gave Below Market Rate Loans To Senators From A Special "VIP Desk"

Does Angelo Mozilo spend all of his time thinking of ways to be shady? Now ABC News says that Countrywide had a special “VIP desk” that gave out below market rate loans to Senators and other politically connected people.