The crush of consumers packing the department store’s eight-story shopping emporium on 34th street in Manhattan would seem to belie the notion that this will be a dark Christmas for retailers. However, the red crossouts on the price tags reveal two, three rounds of price-slashing. While the crowd is packed, their shopping bags are not. Passing underneath arches of holiday bowers sported animated signs with sparkle dust writing out “Believe,” they are gleaners, browsing for bargains, and choosing but a few of them. I took a panorama shot. (2000 pixel version) [More]

money meltdown

Action Alert: Stop The CFPA Gutting

Idaho Rep. Walt Minnick (D) is trying to abort the the Consumer Financial Protection Agency (CPFA). If you care about this agency getting established, call your Reps now (call1-877-445-1317 to get connected directly to your Reps office) and tell them to oppose the Minnick amendment to the Wall Street Reform and Consumer Protection Act of 2009”, H.R. 4173 that would strip out the provision creating the CFPA. UPDATE: The amendment was rejected, 222 to 208. [More]

Consumers Permanently Downgrading Brands They Buy

A new McKinsey report says that a large number of consumers who are switching to cheaper brands during the recession are switching for good. Of those surveyed, 34% said they no longer preferred the costlier products. 41% said that although the liked the better stuff, it wasn’t worth it anymore. Have you downgraded during the recession? Is the switch for good? Leave your thoughts in the comments. [More]

$700 Billion Bank Bailout Extended Until 2010

The administration announced it’s extending the $700 billion financial bailout program until next fall. The Treasury said it’s important to hold onto money and have it available in case any new catasrophes slam our financial system: [More]

Sample Phone Scripts Used By Sleazy Subprime Lenders In 2005

An ex-subprime lender employee of a sent us the scripts they used to cold-call homeowners back in 2005 to get them to ditch their 30-year fixed mortgages for risky sub-prime loans. One of them is called, “Wholesale Gangsta Script,” which I think about says it all right there. [More]

Slothful Home Loan Modifiers Earn More Money When You're Delinquent

With a rising wave of foreclosures looming, the Treasury is stepping up pressure on lenders to finish modifying home loans and to pick up the pace. Potentially exacerbating the problem is that many loans are held by servicers whose fees increase the longer borrowers remain in default. [More]

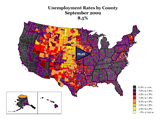

Animated Map Of Rising US Unemployment Since 2007

It’s like watching a slow-motion video of cirrhosis of the lung.

Middle Class Shoplifting To Keep Up Appearances

Shoplifting is up 20% in the UK as choice cuts of meat, fresh fish and fancy cheeses are increasingly getting stolen, mostly by middle-class women from boutique food emporiums and convenience stores

Citibank: Transfer $5000 In Debt Onto This Card Or We'll Double Your APR

“It’s the increased cost of doing business,” was Citicard’s constant refrain when Kent’s husband called to complain about their latest pre-CARD act adverse action insanity: transfer $5000 in balances from other credit cards to this credit card or we’ll double your interest rate. Listen to Kent’s message left on the new Consumerist hotline and/or read the transcript:

Goldman Secretly Bet On Housing Crash

A 5-month investigation by McClatchy Newspapers has found that Goldman secretly bet on the housing crash, went out and pimped the dickens out of assets it knew were junk, and may have broken securities laws in doing so. McClatchy found that Goldman…

Giant Lender CIT Goes Bankrupt And 9 Banks Go Under

Ghosts were not only cruising sidewalks looking for candy this weekend, they had also infested some banking balance sheets.

Former Citigroup Head Waxes Nostalgic For Regulation He Helped Kill

Retired head of Citigroup John Reed seems to have some misgivings about the repeal of the Glass-Steagall Act of 1932, which his company lobbied to kill in the first place.

You Wouldn't Be Eating Cat Food If We Had Listened To Brooksley Born

Meet the canary in the coal mine that no one wanted to listen to: Brooksley Born. As head of the obscure Commodity Futures Trading Commission she sounded the warning in the late 90’s about the need for more transparency and regulation of the derivatives market, but a coalition of Beltway insiders, including the then rock star Alan Greenspan, formed against her to shut her up and shut her out. After the economic collapse, it’s time for them to eat crow. Learn more in tonight’s FRONTLINE presentation of “The Warning” on PBS at 9pm eastern, or watch online.

BoA CEO Resigns

Bank of America CEO Ken Lewis resigned yesterday after becoming a lightning rod for criticism after his controversial takeover of Merril Lynch. Even though BoA has appeared in our Worst Company in America contests each year, it’s kind of sad because his office had a good record of solving our reader’s problems they sent in to the executive office. Too bad that ethos couldn’t have flowed downhill more.

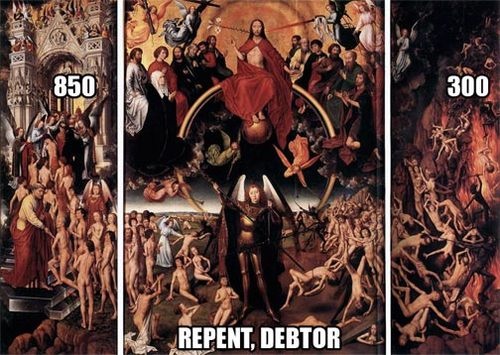

Old Debts Under $100 Don't Matter Under FICO '08

An update to how the new FICO ’08 scoring system got revamped this year:

Fed Keeps Interest Rates At .25%

Interest rates will stay at at a low low .25%, the Fed announced today. For you this means…

How Economists Got It So Wrong

How did economists get it so wrong, asks Paul Krugrman in a recent NYTM article. He examines several fallacies of these dismal professionals who, until everything exploded, were slapping each other on the back for having achieved something like the superstring theory of money. Oopsies.