With the housing bubble burst and evaporation of credit, short sales have grown in popularity as debtors behind on their mortgage seek to offload their depreciated property and avoid the derogatory effects a foreclosure can have on their credit report. Ads in the paper and tacked onto telephone poles at intersections scream about the great steals to be had.But what is it actually like to go through this process whereby the bank agrees for the house to be sold at a small loss instead of incurring the sizable fees a full foreclosure would entail? A lot harder than the brightly colored bold letters would have you believe. Long-time reader kyleorton walks us through what he went through to buy his a house listed at $274k via short sale for $229,000, a procedure complicated by Bank of America bureaucracy and a seller’s agent that didn’t feel like doing any work. [More]

money meltdown

10 Things You Don't Know About The Goldman Sachs Case

The media spin cycle is churning out its typically tepid hogwash about the SEC’s suit against Goldman Sachs. The Big Picture skewers 10 myths about the case and gets to the heart of the matter: Goldman is screwed. Here’s why: [More]

Sand Art Portends Economic Apocalypse

Is the Icelandic volcano ashsplosion actually just another of the seven seals bursting before The Economic Rapture envelops us all? These guys seem to think so. I like how they say, “Thanks.” [More]

What? An Ad Agency Is Hiring 230 People? In This Economy?

Need a job? One green shoot of the economic recovery is the hiring glut going on over at the R/GA digital advertising agency, with 230 jobs open. That’s on top of the 130 they’ve already hired this year. But I thought advertising was dead, or at least severely atrophied? [More]

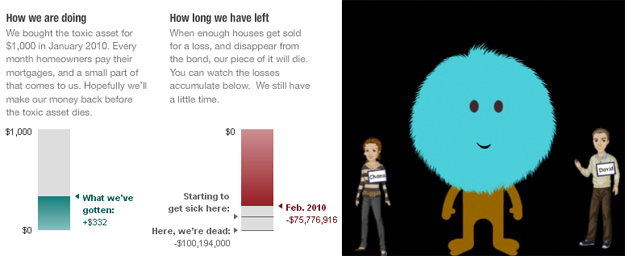

Reporters Buy Up Toxic Assets

To dig right into the meat of the story they’ve been tracking for over a year, NPR Planet Money reporters David Kestenbaum, Chana Joffe-Walt plunked $1000 down and bought up a securitized pack of Countrywide mortgages. At one point it was worth $75,000. Will the homeowners pay their mortgages and the reporters make their money back or will too many houses get sold at a loss and the asset implode? Follow along and find out. [More]

Aw, You Missed Your Earnings Target. Here's A Pity Bonus.

Some execs are getting a “pity bonus” in their stockings this year. With the recession on, many execs are finding it hard to meet earnings targets or suffer from pummeled stock prices. So boards are having heart and changing the rules so the execs can still get a bonus. [More]

Poll: Are You Underemployed?

The unemployment rate may be near 10%, but what about those who would do more work if they had the chance? Yes, the underemployment rate in this country, which adds to the unemployment count those who work part-time but want to work full time is nearly 20%, according to a Gallup phone poll of 19,800 American adults. Let’s do our own poll. What’s your work situation? Would you work more hours if they were available? [More]

80% Of Today's Delinquent Homeowners Will Lose Their Homes

If you know 5 people behind on their mortgage payments, 4 of them are going to end up losing their homes, according to a new study released by John Burns Real Estate Consulting. [More]

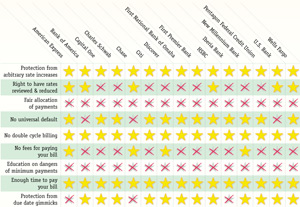

CARD Act: Who's With It, Who's Not

The CARD act is supposed to go into effect next week, Feb 22. As we get close to the deadline, is your credit card complying with the rules? Courtesy of BillShrink, this giant infographic is here to tell you the answers. Teaser: absolutely zero issuers are doing fair allocation of payments. [More]

Wall St. Helped Hide Greece's Debt, Now It's Kablooie!

Looks like Goldman turned the Parthenon into a gunpowder magazine for a second time; Greece’s recently revealed debt crisis is rattling the world economy and familiar culprits are at play: Wall Street banks, off-the books loans, derivatives, and other occult financial instruments. I guess we blame the consumer on this one too? [More]

Break Up With Your Bad Big Bank This Valentine's Day

You know what, it’s just not working out. I’m sorry, giant bank, but it’s time for both of us to move on. This Valentine’s Day, it’s time break up with your big bank, and this website will help snip the ties that bind. [More]

Economy Grows 5.7%, Still Sucks

The US economy expanded 5.7% in the fourth quarter of 2009, making it the second straight quarter of growth, and the fastest in six years. However, it’s important to remember that for 2009 overall, real GDP shrank 2.4%, the largest decrease since 1946. So, it’s a gain for sure, but starting from a very low place and there’s a long way to go. Like jobs. Some jobs would be nice. [Bloomberg] [More]

Tavern On The Green Auctioning Off Ladies Riding Tigers And Other Crazy Stuff

Now you can own a piece of the twinkly and storied history of the (bankrupt) Tavern on the Green by jumping in on the auction action. To appease a gala ballroom’s worth of rapacious creditors, everything must go! Lot 598: Etched Glass Mirror of Lady Riding a Lion (starting bid: $2000). Lot 617: Four Sets of Six Mother of Pearl Caviar Spoons (starting bid: $100). Maybe buy some place settings and a few choice pieces and recreate your own Tavern on the Green in your breakfast nook? [More]

Move Your Money From Big Banks To Small Ones

The canaille likes to bitch that big banks haven’t been punished enough, so why not put your money where your mouth is? That’s the premise behind “Move Your Money” which encourages everyone to withdraw their savings from the pockets of the pimps of Wall Street and redeposit with well-rated community banks. [More]