When you switch phone companies, you’re allowed to keep your phone number. So why isn’t there this “number portability” for bank accounts? Well, a bill has been introduced in Washington to let you do exactly that. [More]

news from the swamp

Watch Now The Live Senate Hearing On Whether Forced Arbitration Is Fair

Here’s a live webcast of the judiciary committee’s hearing on mandatory binding arbitration going on right now. The title of the hearing is “Arbitration: Is it Fair When Forced?” Arbitration clauses appear in all sorts of consumer contracts and they mandate that in order to use the product or service, you have to agree to give up your right to sue if anything goes wrong. Originally designed for businesses to expedite disputes with other businesses, binding arbitration clauses are now also a popular way for companies to strip consumers of their basic legal rights. Since the hearing is chaired by Senator Al Franken, you know there’s bound to be some good zingers. Pop the popcorn and sit back! [More]

Obama's Debt Reduction Plan Includes Letting Debt Collectors Robo-Call Cellphones To Collect On Federal Student Loans

One part of the debt-reduction bill Obama sent to Congress is a provision that would let debt collectors robo-call cellphones to collect on what’s owed to the government, like federal student loans. [More]

Delta And US Airways Will Refund "Taxes" Collected During FAA Shutdown

Delta was the first airline to start giving out refunds for the extra money they’ve been scalping from passengers while the FAA remains shut down. After the airline made the announcement Monday, US Airways on Tuesday said they would follow suit. [More]

What The Debt Ceiling Bill Means For Your Wallet

You need a flowchart and a spreadsheet to understand all the different stages of the debt ceiling bill that passed the House yesterday and is likely to pass the Senate today. But let’s not get hung up on who does what to whom at what point, and when that super-awesome “sudden death mode” of spending cuts kicks in. Instead, let’s look at what the debt-ceiling bill means to you and your wallet. [More]

Hours Left Before Debt Ceiling Vote Deadline, So Read The Bill

There’s just a few hours to go before the deadline to vote on raising the debt ceiling and steer clear of a federal default. Late Sunday a deal was worked out and the House and Senate are expected to vote on it. Broadly, the deal raises the debt ceiling, reduces the deficit, and avoids a credit default. More specifically… everyone should read the 74 pages of the bill before making a comment about it. If you don’t have time for that, the White House has also released a 1,465 word fact sheet, a “TL;DR” document of sorts for the nation. [More]

Senators Blast Airlines For Profiteering During Tax Holiday

Naughty, naughty. Senators Jay Rockefeller and Maria Cantwell are wagging the fingesr at airlines for raising airfares during the tax holiday that has resulted from the Federal Aviation Administration’s shutdown. The practice could have “long-term negative repercussions for the industry,” said the senators in a letter sent to the airlines on Tuesday. [More]

How A Wall Street Lobbyist Is "Reforming The Reform"

Banks are none too happy about how the passage of Dodd-Frank has been crimping their style. So they hired a Wall Street lobbyist, former Congressman Steve Bartlett, to lead the well-funded rearguard action by the ” Financial Services Roundtable” to neuter the laws. And darned if those cocktail parties aren’t working. [More]

Bill Introduced To Delay Swipe Fee Reform

Bills were introduced in both the House and Senate to delay “swipe fee reform” by at least a year and they call for a study of its potential effects. The new rules, scheduled to take effect July 21, would cap the fee banks can charge merchants for processing debit card fees at 12 cents per transaction. [More]

Why Banks Threatening To Limit Debit Card Swipes To $50 Is Horrible, And Hooey

As I mentioned on Friday, because the banks are pissed off, pretty soon you might not be able to pay for a restaurant meal or pay for groceries on your debit card. The banks are considering putting a $50-$100 cap on how much you can buy per transaction with a debit card. First, I think they’re bluffing. But, if they really followed through on it, this would seriously disrupt commerce across America. Let me paint you a picture of hypothetical supermarket checkout line. [More]

Banks Might Limit Amount You Can Buy On Debit Card

Grumbling over proposed limits to debit card swipe fees, banks are hinting they’re considering putting a cap on how much you can buy with a debit card. It could even be something like $50 or $100, forcing consumers to either pay with credit card or cash. [More]

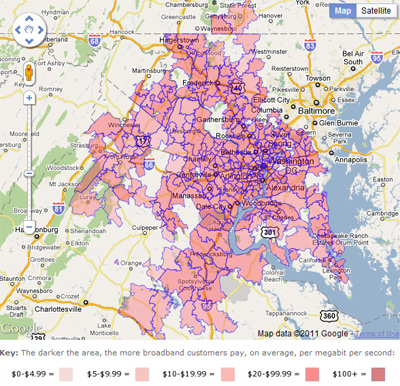

Rich DC Burbs Pay $9.58, Rurals Pay $31.17/Mbps

The rich get richer while the poor get…slower? A new report by investigative journalist John Dunbar cracks open the numbers that are tightly held by the industry and found vast disparities in the quality and price of service based on how close to town. By comparing customer speed tests and surveys, he found that while folks in the low-income areas outside of the Washington Metropolitan Area pay slightly less for their broadband, those in the wealthier DC burbs are getting far more bandwidth for their buck. The poor are paying on average $31.17/Mbps while the rich are paying only $9.58. [More]

Fed Might Rethink Capping Debit Card Swipe Fees

The Fed told Congress yesterday that it might rethink the plan to cap debit card swipe fees at 12 cents per swipe. One of the hopes is that merchants would be able to pass on the reduced costs to consumers in the form of lower prices. Lawmakers piled on in the hearing, saying that it would “batter banks still reeling from the 2008 financial crisis.” How banks can both be posting soaring profits and still be “battered” and reeling is an accounting trick way over my head. [More]

Bernake Says Unemployment To Stay "Elevated"

Federal Reserve Chairman Ben S. Bernanke testified before the House Budget Committee today that he expects unemployment to “remain elevated” “for some time.” So if you were putting your job search on the back burner, thinking, “oh, I’ll just try harder when the economy gets better,” it might be time to reevaluate that strategy. [More]

Ron Paul Wants Us To Use Gold And Silver Along With Paper Money

Ron Paul, career-long proponent of outmoded and discredited Austrian economic theory, went on Colbert last night to talk about how paper money sucks and he wants you you to be able to go into a store and buy a six-pack with some gold ingots. His proof? Paper money can rot and people have believed in the value of gold for centuries. So, gold is “better” because the collective hallucination around it is stronger. This wouldn’t be disturbing except for the fact that Ron Paul is the new Chairman of the House Financial Services Subcommittee on Domestic Monetary Policy. Yeeeeeks. [More]

Fed Announces It Will Buy $600B In Treasuries

Today the Fed announces it will buy back $600 billion in Treasuries, a nuanced effort that aims to stimulate the economy by lowering interest rates. [More]

FTC Squashes Payday Site For Putting $54.95 Charge For Empty Debit Card In Fine Print

You’re broke. How would you like a $54.95 debit card? It’s empty, but if you ever do get any money, you can put up to $2,500 on it. Yay. If that doesn’t sound like a bargain, it’s no wonder that one internet marketer of payday loan referral sites was hiding the fact that he was signing you up for these dodo cards via a pre-checked checkbox on the signup form, and the FTC smacked him down for it. [More]

Senate Passes Bill Banning Loud Commercials

Everyone hates loud commercials, which is why Senate Republicans and Democracts were able to agree on something and Wednesday unanimously passed a bill banning them. The bill would require commercials to be broadcast at the same sound level as the programs they’re interrupting. [More]