One of the tricks that seasoned travelers know is to always deny the insurance when renting a car. Why? Because the credit card that they are using already comes with insurance that they are familiar with, and because you are required to deny coverage from the rental car company in order to take advantage of your credit card’s insurance. But how do you pick a credit card that has good rental insurance?

mastercard

More On Minimum Purchases, Surcharges, And Other Credit Card Merchant Agreement Violations, From The Companies Themselves

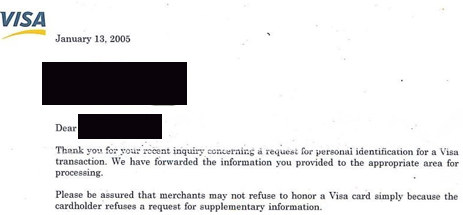

We’ve posted a lot of stories of businesses requiring customers who pay with a credit card to make minimum purchases, or pay a surcharge, or show ID. And as we’ve repeatedly said, the businesses’ merchant agreements with the credit card companies forbids these practices. A reader wrote in to argue that this might not be true, as many businesses contract with third-party credit card processors, and are not bound by the merchant agreement. So we did some investigating.

10 Credit Card Company Tricks To Beware

Are you smarter than a credit card company? They’ve got billions riding on their belief that you’re not. Check out these 10 methods, via the Americans for Fairness in Lending, credit card companies use to make extra money off you that you may not even be aware of, knowledge that could save you hundreds in extra fees.

10 Things You Might Not Know About Your Credit Card

You might think that everyone knows that you have to sign your credit card in order for it to be valid — after all — there’s a panel on the back that says “Not Valid Unless Signed,” but you’d be shocked at the number of angry emails we get from people who have tried to use an unsigned credit card with “SEE ID” or “CHECK ID” written on it and were turned away when they refused to sign their card.

This McDonald's Charges 25¢ To Use A Credit Or Debit Card, Violates Merchant Agreement

Reader Brandon sent us this picture of a McDonald’s violating its merchant agreement by charging a fee for using a credit or debit card. The text reads, “FEE ASSOCIATED WITH CREDIT/DEBIT CARD OF 25¢ WILL BE APPLIED TO CARD TOTAL.”

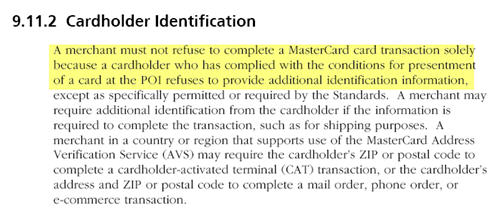

Mastercard Says Merchants Can't Require Additional ID, Except In Specific Circumstances

A MasterCard spokesperson has confirmed, just like we’ve been telling you all along, that a store cannot refuse to sell you something solely because you refuse to provide additional identification along with your MasterCard. The only time it’s ok is if it’s required for shipping, or when you’re at a gas pump or making orders via internet, phone, or mail, in which case they can use the MasterCard Address Verification System (AVS). But if you’re in a store, right in front of them, in the flesh, it violates their MasterCard merchant agreement. Consumers experiencing this can fill out a Merchant Violation form found in the FAQ/Contact US part of Mastercard.com. Full statement, inside…

Customer's EECB To Best Buy Scores Direct Hit—Rewards Glitch Is Fixed, Plus Here's $75

A few weeks ago, Zach emailed us to say that his Rewards Zone Mastercard hasn’t worked properly in the five months he’s had it, and no one at Best Buy had been able to help. We pointed him to our Guide To Fighting Back, and he responded tonight with an update.

IHOP Threatens To Call The Police Because You Refuse To Show ID With Credit Card

I went to IHOP(INTERNATIONAL HOUSE OF PANCAKES) on March 30th with my wife to eat. After our meal I went to the counter to pay and presented my Visa as payment. I was asked for photo ID, and kindly declined. I was then told that they were not going to be able to accept my card without photo ID.

Chase Reactivates Dead Card Without Your Permission

Erica writes:

Recently, my husband and I got two new Chase credit cards in the mail. I didn’t look closely, assuming that this was a new card for our never-used Chase Mastercard account. This account has been around for seven years, but we prefer another card with a rewards system; the Mastercard account is open only to benefit our credit rating. Therefore, no urgency in activating it — I dropped it in the bill pile to deal with later.

"For Security Purposes, This Card Is Not Active" Is A Lie

When you get a new or replacement credit card in the mail, you have to call the number on the back to activate it, or else you can’t use it, right? Wrong. Despite the sticker on the back that says, “For security purposes, this card is not active,” credit card companies are mailing out cards that can be used without phone activation. This is a problem if the letter containing your credit card is intercepted by an identity thief, like what happened to reader PC Guy. The kicker? He didn’t even request the card, it was a forcible reissue when his store-branded card switched from Visa to Mastercard. His story, inside.

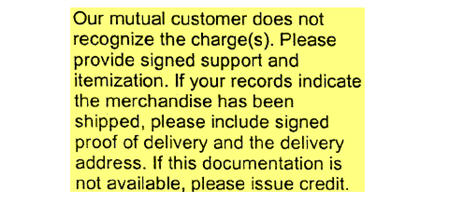

LEAKS: Amex Document Shows Proof of ID Check Is Not Required For Chargebacks

Reader W writes in in response to the so-called “retail manager” who said that credit card companies require video proof of cashiers checking ID.

Apple Demands ID With Credit Card Purchases, Violates Merchant Agreement

We received the following strangely awesome, if a bit strange, letter from a consumer who was not allowed to purchase something at the Apple store because he would not show ID. It was sent to Steve Jobs and William Rhodes (of Citibank.) Let’s listen in:

This Hooters Credit Card Is For Winners Only

Here’s a great credit card that will allow you to express how awesome you are at a variable APR between 7.75% and 26.95%. Yes, kids, it’s the Hooters MasterCard, and according to their website, it’s been “rated #1 by some fake award.”

TV Breaks Right After The Warranty Expired? Call Your Credit Card Company

Reader Brendan’s TV decided to die right after the manufacturer’s warranty expired. He tried asking Polaroid to extend the warranty. (They wouldn’t.) He tried getting the TV repaired. (Too expensive.) Not knowing what else to do, he sent us a 1,000-ish-word-long complaint detailing the frustrations one could expect when dealing with Polaroid. (It was very well written.)

How To Report Merchants For Requiring A Minimum Purchase Or Making You Show ID

Stores are violating their contract with the credit card companies if they set minimum or maximum charges, or force you to show ID in addition to your credit card (with the obvious exception being for age-limited purchases). Depending on your state and your card issuer, surcharges or “convenience fees” may be banned as well. The best way to straighten these guys out is to report them to the credit card company. People who have done so on the Credit Boards message board say that when they report a merchant, they get a letter from the credit card company and when they go back to the store, the shenanigans have stopped. Here’s all the contact infos for the credit card companies to file a merchant complaint, as well as links to merchant agreements, in case you feel like standing up for your consumer rights. Someone better warn Amy’s Ice Cream!

Citibank Sends You Letters To Let You Know Your Paperless Statement Is Ready

Corey writes:

I have a lovely Citi Mastercard with lots of rewards. I hate having to deal with paper statements, so I signed up for paperless statements (like I’ve done with all my accounts), available for viewing online at their website.

Credit Card Companies Say TJ Maxx Breach Affected 94 Million Accounts

According to new court papers, Visa and Mastercard are saying that the TJ Maxx security breach actually affected 94 million accounts—more than double the amount that TJ Maxx reported.