A couple weeks back, we brought you the story of a reader who found out that Chase now considers playing the lottery as internet gambling — but only after they nailed him with exorbitant fees and sky-high interest. Now, the New York Lottery has turned the tables on Chase MasterCard, alleging that these extra charges are illegal. [More]

mastercard

USAA And Mastercard Turn Celebrity Librarian Into Unwitting Consumer Scofflaw

K.G. writes that she used her Mastercard to pay for a car rental from Avis. The card issuer, Consumerist darling USAA, assured her that the card provided insurance coverage for rental cars. Good to know! Except for how the insurance claim was denied, possibly because she used a coupon for the car rental. No one is entirely sure. The bill went straight to a collection agency without ever giving K.G. an opportunity to, um, actually pay it. Now she’s being penalized for ducking a bill she was never sent, and still can’t get a straight answer out of any of the companies involved. [More]

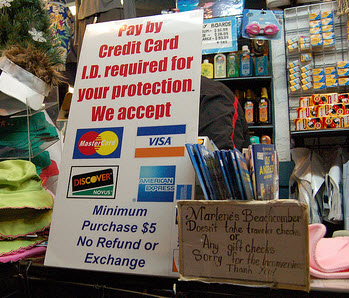

Walmart Demands My ID On Credit Card Purchase Over $100

A reader named Michael wrote in to tell us about a recent trip to his local Walmart, where he and his wife picked up a pile of groceries totaling over $100. When his wife attempted to pay with her MasterCard at the register, she was asked for a photo ID. [More]

Add Discover To The List Of Credit Cards That Allow Minimum Purchase Requirements

Yesterday, we told you how Visa and AMEX now allow merchants to require customers up to a $10 minimum for credit card payments and how MasterCard will soon be changing their policy to allow for the same. We’d naively hoped that Discover — who hadn’t yet replied to our query — would be the lone holdout, but… not so much. [More]

AMEX, Visa, MasterCard All Give Thumbs Up To $10 Credit Card Minimums

For years, educated credit card holders have been safe in the knowledge that a merchant could not require them to purchase a minimum amount in order to charge something to their cards. But with the recent passing of the finance bill, the door has been opened to allow such minimums — and the card companies are just fine with that. [More]

"$10 Minimum For Credit Card Purchase" Signs May Soon Be Totally Legit

As we all know, merchants are generally not supposed to mandate minimum credit card purchases. It’s a violation of the merchant agreements they sign with the credit card companies. (For more info, check out this article.) The proposed finance bill, however, may legitimize those handwritten signs if it ends up passing. [More]

If I Can't Check ID's, How Am I Supposed To Prevent Credit Card Fraud?

We’ve told you that it stipulates in the contract between merchants and credit card companies that stores aren’t allowed to force you to show ID when you buy stuff, but what about the other side of the story? Alex is a 26-year old small business owner and Consumerist lover, but he doesn’t know how he’s supposed to prevent fraud if he can’t check people’s ID’s. Contrary to what some commenters assume, when a stolen credit card is used, the money gets yanked out of Alex’s bank account and he is unlikely to get it or the missing merchandise back. He gets jacked twice: once by the fraudster, and once by the credit card company. What should he do? Switch to cash only? His story, inside… [More]

Sign The Slip Or Enter Your PIN? The Difference Is Fees

The NYT has an interesting article about what does on behind the scenes when you make a purchase at a retailer with your VISA debit card. You typically have two choices — you can enter your PIN or choose to sign. When you sign the retailer has to pay higher fees to VISA. [More]

10 Reasons Why Gift Cards Suck

When we announced the availability of free Consumerist anti-gift cards yesterday, we were surprised to see so many pro-gift card comments. So, we decided to put together a quick list of the reasons we think gift cards are lame — especially compared to cash. [More]

No Visa Or MasterCard Gift Cards This Year, Please

If you want to spread some fiscally sound good cheer this year, consider asking your friends, relatives, and coworkers not to give gift cards backed by the major credit card companies. Why am I making such a sour suggestion? Because a new study from two consumer advocacy groups indicates that most of the population still doesn’t recognize what a money trap those little plastic cards can be.

Citi Mysteriously Closes Scads Of Mastercard Accounts Nationwide

Without warning, Citi decided to close a swath of gas-station co-branded Mastercard accounts nationwide. The trouble seems to have started October 15. Quan was one of the affected customers and the credit card company was pretty disingenuous about it when called.

GEICO Mastercard Slashing Everyone's Credit Limit To $500?

Dan wrote in to let us know his $8,800 GEICO Mastercard now has a $500 line of credit. “It’s not you, it’s us,” is basically what GEICO told him in their letter on March 12th. They also say they’re doing this to every one of their Mastercard holders. Dan notes, “Interestingly enough, this new limit is less than the 6 month rate GEICO was charging me for my two cars, meaning that I couldn’t even use their preferred card to pay their premiums.” You can read their letter below.

Another Month, Another Massive Credit Card Data Breach

Don’t be too surprised if you get a letter from your bank or credit union in the next few weeks telling you it’s replacing your credit card. If your data was among the latest set compromised, Visa and Mastercard are already alerting financial institutions so they can cancel the account number.

Shrink Ray Now Hitting Rewards Programs

We’ve seen food items, airline mile programs, and credit card limits all shrink as the economy worsens. Now it’s time for other rewards programs to become just a little less rewarding—and somewhat sneakily, too, in these two stories recently sent in by readers.

Credit Card Squeeze Is Pushing Consumers Toward Foreclosure

USAToday says that panic by the credit card industry is squeezing customers who ordinarily would be able to pay their bills — pushing them toward financial ruin and foreclosure.

Consumers: We're Mad As Hell And We're Not Going To Charge It Anymore!

Once upon a time, Peter Finch won an Oscar for telling us to go to our window, open it, and yell, “We’re mad as hell and we’re not going to take this anymore!” Now thousands and thousands of consumers are doing just that, but instead of yelling out their windows, they’re yelling at the Federal Reserve in the form of a record breaking number of public comments about some proposed credit card reforms. Not as sexy as yelling like a madman, but far, far more effective.