After reading our posts about getting your credit card APR lowered by threatening to do a balance transfer to a lower rate credit card, Brandon got his Citibank Mastercard APR lowered from 15.74% to 1.99%. It’s an introductory rate that goes up to prime plus 4.99% after a year, but it’s definitely worth it for the time being. A factor that probably helped him was the $10,000 balance he was carrying, making his business more valuable to Citibank.

mastercard

Citing "Market Conditions" Capital One Raises Reader's APR 4.99% to 13.5%.

I have had a Capital One Mastercard for about 10 years. My interest rate has been 4.99% for as long as I can remember. I received my statement for October to find that my interest rate had jumped from 4.99% to 13.5%.

Make Credit Card Companies Your Bitch

Blueprint for Financial Prosperity reminds us that savvy consumers can take advantage of credit card companies hellbent on turning a profit. Most credit card companies will go to great lengths to keep their customers happily spending away. Use these tips to make them cater to your every financial desire:

Reclaim Unnecessary Credit Cards' Unnecessary Foreign Transaction Fees

Several major credit card companies were successfully and recently class-actioned for charging unnecessary fees for overseas transactions.

Discounts Just For Using Your Credit Card

Blueprint for Financial Prosperity reminds us that credit cards carry more discounts than we realize. Visa, MasterCard, and American Express all offer discounts for cardholders. Discover’s discounts are limited to business accounts.

IDT's Sigo Pre-Paid Mastercard Is A Huge Scam

ATM Cash Withdrawal – Domestic $1.50

If that wasn’t enough, their “Confidentiality” clause functions like a screen door on a submarine, letting a flood of IDT affiliated marketing into your home.

“Millions” Of Visa & MasterCard Accounts Breached?

Reader S. got a call this morning from Citibank. They said her card had been compromised and she needed a new card. When she asked for details, Citibank could only say that an unspecified business had their system compromised, affecting “millions” of Visa and MasterCards

Gift Cards Are The Most Popular Gift

The 2006 Deloitte report on gift cards is out, and it’s official. Gift cards are the single most popular gift this holiday season. But are they a good buy? Sort of. It seems that due to consumer pressure, and FTC pressure, stores are improving their customer service/disclosure of fees when it comes to gift cards. But that doesn’t meant there aren’t still a lot of problems. The Montgomery County, Maryland, Office of Consumer Protection which assesses dozens of cards annually, has released their 2006 report. The report evaluates 40 different gift cards, looking for things like whether or not the card can be replaced if lost or stolen, whether the cards have an expiration date, and whether fees are assessed to the card’s balance. Basically, you want to avoid the following cards:

Nokia, Cingular to Try Mastercard Test in NYC

Good news for those of you who don’t fear ID theft. Nokia, Cingular, Mastercard and Citi are testing some crap that lets you pay for things with a cell phone. The phones will use the “Mastercard Pay Pass” system that’s already installed in some stores. If you live in NYC and are accepted into the trial, you get a free phone. You need to be a Citi account holder and a Cingular user. Let us know how you like it and if your ID gets stolen. Good luck. —MEGHANN MARCO

Senator Reid Identity Theft Victim

Senate Minority Leader Harry Reid canceled his Mastercard after someone stole it and ran up over $2000 in charges.

MasterCard’s New Logo Gets Goatse

Apparently, Mastercard really is for everything else, as communicated by its new logo.

New Chase Debit Card Still Lets Vonage Screw Customer on Old Card

You would think that after Chase goes through the trouble of reissuing new Visa debit cards to replace its MasterCards, they might also take the precaution of deactivating the old card when the new one is activated. Not so, Disappointed in NYC writes. When our reader tried to cancel Vonage, they wanted to charge a cancellation fee. He refused but they still charged his old Chase Mastercard. Chase CSR said the Vonage charge went through but nothing else would.

New Debit Card, Same Balogna Baloney

We received our happy super fun awesome new Washington Mutual GOLD debit card today.

Washington Mutual Is Our Friend With Benefits (That We Couldn’t Care Less About)

We’ve just been the lucky recipient of exciting news; the PIN range our debit card belongs to has been hacked. To celebrate, Washington Mutual is “upgrading” our debit card “to gold status for free.”

UPDATE: Requiring Minimum Credit Card Purchases is a Violation

A day without ice cream is like a day without sunshine.

UPDATE: Requiring Minimum Credit Card Purchases is a Violation

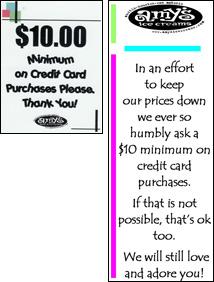

Amy’s Ice Cream has a new sign (right) that seems to say that the $10 minimum charge is suggested, not required. The sign we originally posted (left) was one a store manager had replaced the ‘official’ sign with, according to Steve.

UPDATE: Requiring Minimum Credit Card Purchases is a Violation

Our article on the minimum credit card fees charged at Amy’s Ice Cream generated quite a little uproar. Amy is pictured, left, helping award Lonnie Williams with the “Best Transition” small business award in Austin. It’s made from left-over toffee ice cream.